FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:gle Chrome

File

Edit View

History

Bookmarks Profiles Tab

Window Help

Gbjs-Google Search

x QuickLaunchSSO :: Single Siç x

M Question 9 Chapter 3 Home X +

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe...

Chapter 3 Homework

Saved

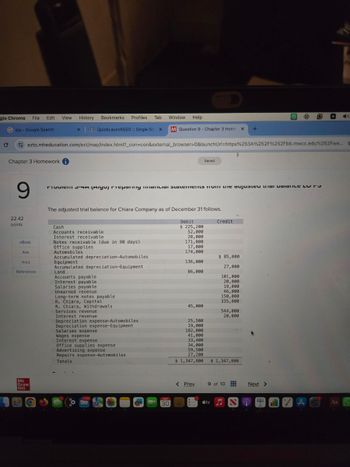

9

22.42

points

PICNICI SAM (Miyu riepany mancial Statements Home adjusted Liai valatice L

The adjusted trial balance for Chiara Company as of December 31 follows.

Cash

Debit

Credit

eBook

Ask

Print

References

Accounts receivable

Interest receivable.

Notes receivable (due in 90 days)

Office supplies

Automobiles

Accumulated depreciation-Automobiles

Equipment

Accumulated depreciation-Equipment

Land

Accounts payable

$ 225,200

52,000

20,000

171,000

17,000

174,000

$ 85,000

136,000

86,000

27,000

101,000

Interest payable

20,000

Salaries payable

19,000

Unearned revenue

46,000

Long-term notes payable

150,000

R. Chiara, Capital

335,800

R. Chiara, Withdrawals

45,000

Services revenue

Interest revenue

544,000

20,000

Depreciation expense-Automobiles

25,500

Depreciation expense-Equipment

19,000

Salaries expense

182,000

Wages expense

41,000

Interest expense

Office supplies expense

Advertising expense

Repairs expense-Automobiles

Totals

33,400

34,000

59,500

27,200

$ 1,347,800

$ 1,347,800

Mc

Graw

Hill

MAY

30

< Prev

9 of 10

Next >

tv NO

AC Aa

Transcribed Image Text:Google Chrome

File Edit View History

Gbjs- Google Search

Bookmarks

x

Profiles Tab

QuickLaunchSSO :: Single Sig

Window Help

x M Question 8- Chapter 3 Home .x

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... ☆

Chapter 3 Homework

Saved

Help

Save & Exit

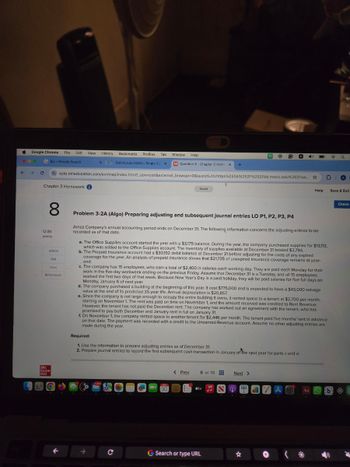

8

12.81

points

eBook

Ask

Print

References

Problem 3-2A (Algo) Preparing adjusting and subsequent journal entries LO P1, P2, P3, P4

Arnez Company's annual accounting period ends on December 31. The following information concerns the adjusting entries to be

recorded as of that date.

a. The Office Supplies account started the year with a $3,175 balance. During the year, the company purchased supplies for $13,113,

which was added to the Office Supplies account. The inventory of supplies available at December 31 totaled $2,794.

b. The Prepaid Insurance account had a $30,192 debit balance at December 31 before adjusting for the costs of any expired

coverage for the year. An analysis of prepaid insurance shows that $21,735 of unexpired Insurance coverage remains at year-

end.

c. The company has 15 employees, who earn a total of $2,400 in salaries each working day. They are paid each Monday for their

work in the five-day workweek ending on the previous Friday. Assume that December 31 is a Tuesday, and all 15 employees

worked the first two days of that week. Because New Year's Day is a paid holiday, they will be paid salaries for five full days on

Monday, January 6 of next year.

d. The company purchased a building at the beginning of this year. It cost $775,000 and is expected to have a $45,000 salvage

value at the end of its predicted 35-year life. Annual depreciation is $20,857.

e. Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $2,700 per month,

starting on November 1. The rent was paid on time on November 1, and the amount received was credited to Rent Revenue.

However, the tenant has not paid the December rent. The company has worked out an agreement with the tenant, who has

promised to pay both December and January rent in full on January 31.

f. On November 1, the company rented space to another tenant for $2,446 per month. The tenant paid five months' rent in advance

on that date. The payment was recorded with a credit to the Unearned Revenue account. Assume no other adjusting entries are

made during the year.

Required:

1. Use the information to prepare adjusting entries as of December 31.

2. Prepare journal entries to record the first subsequent cash transaction in January of the next year for parts c and e.

Graw

Hill

30

< Prev

8 of 10

Next >

⚫tv

7AO

Aa

b

←

с

G Search or type URL

☆

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I really need help with this assignment!!!arrow_forwardFile Edit View History C Bookmarks Profiles Tab Window Help Netflix 120 Inbox (X MACC10 × Accoux Accour X M Questi X QuickLxM Questi x M Questi x wiL47 X mal Exam 14 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Q Saved Mc Graw Hill Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad debts expense. Assume that Business Solutions has total revenues of $61,000 during the first three months of 2022 and that the Accounts Receivable balance on March 31, 2022, is $22,117. Required: 1a. Prepare the adjusting entry to record bad debts expense, which are estimated to be 2% of total revenues on March 31, 2022. There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31. 1b. Prepare the adjusting entry to record bad debts expense, which are estimated to be 3% of accounts receivable on March 31, 2022. There is a zero unadjusted balance in the Allowance for…arrow_forwardExamity Dashboard (click this Question 2 - Chapter 12 Home x O ezto.mheducation.com/ext/map/index.html?.con=con&external browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%25 Chapter 12 Homework a Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate comp Zachary Services Company has 61 employees, 36 of whom are assigned to Division A and 25 to Division B. Zachary incurred $364,170 of fringe benefits cost during year 2. 20 points Required Determine the amount of the fringe benefits cost to be allocated to Division A and to Division B. O Answer is complete but not entirely correct. Allocated Cost Division A s 160,420 O B $ 172,760 MacBook Airarrow_forward

- ogle Chrome File Edit View History Bookmarks Profiles My Inbox (232) - abigailof X Tab Window Help My Verify Your Email Addr 98 × G The following unadjust x iConnect - Home X M Question 4- Chapter ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... C bjs-Google Search Chapter 4 Homework 29.4 points 4 Saved New Help Save & Exit Check my The following unadjusted trial balance is for Ace Construction Company at its June 30 current fiscal year-end. The credit balance of the V. Ace, Capital account was $51,300 on June 30 of the prior year, and the owner invested $27,000 cash during the current fiscal year. ACE CONSTRUCTION COMPANY Unadjusted Trial Balance June 30 eBook Number Account Title 101 Cash Ask 126 Supplies 128 Prepaid insurance Print 167 168 eferences 201 Equipment Accumulated depreciation-Equipment Accounts payable 203 Interest payable 208 Rent payable 210 Wages payable 213 Property taxes payable 251 Long-term…arrow_forwardHome myTech Question 15 - Chapter 7 Assesme X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/kEZASSBkEPuCI4plIVu. 8 Apps G Gmail YouTube Maps GE News OR Translate Chapter 7 Assesment i Saved Help Save & Exit Submit Davenport Inc. has two divisions, Howard and Jones. Following is the income statement for the past month: 15 Howard Jones Total Sales $925, 200 $616,800 $1,542,000 Variable Costs 662,880 555,120 $1,218,000 $262,320 $ 61,680 $ 324,000 Contribution Margin Fixed Costs (allocated) Profit Margin 234,540 156,360 390,900 $ 27,780 $ (94,680) $ (66,900) What would Davenport's profit margin be if the Jones division was dropped? Multiple Choice $66,900 loss $128,580 loss Next > 7:58 PM O Prev. 15 of 25 3/23/2022 34°F Cloudyarrow_forwardGradebook / ACC 202: Manage X M Question 3 - Chapter 11 Home X to.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra days-Become a w X sp MyPath - Home Maps News mework i Required A Translate M SmartBook 2.0 M SmartBook 2.0 Ibez Company is considering a project that requires an initial investment of $72,000 and will generate net cash flows of $16,100 per year for 5 years. Ibez requires a return of 10% on its investments. The present value factor of an annuity for 5 years at 10% is 3.7908. a. Compute the net present value of the project. b. Determine whether the project should be accepted or rejected on the basis of net present value. Complete this question by entering your answers in the tabs below. Years 1-6 Net present value Required B Compute the net present value of the project. (Negative Net present value amounts should be indicated with a minus sign.) Present Value of Annuity at 10% Present Value of Net Cash…arrow_forward

- pogle Chrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (264)-abic x MACC101 Principle: x (4724) IFRS vs. G X M Chapter 6 Home X M Question 14 - Cha x iConnect - Home × M esc ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 6 Homework Saved 2 Part 1 of 2 Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Date 14.25 points March 14. March 15 July 30 October 5 October 26 Sales Purchase Sales January 1 January 10 Activities. Beginning inventory Units Acquired at Cost 260 units @$12.40= Units Sold at Retail $ 3,224 215 units @ $42.40 420 units Purchase Sales Purchase Totals 460 units @ $17.40 = @ $22.40 = 7,308 380 units @ $42.40 10,304 425 units @ $42.40 160 units 1,300 units @ $27.40 = 4,384 $ 25,220 1,020 units 1…arrow_forwardChrome File Edit View History Bookmarks Tab Profiles Window Help Inbox (240) - abigailoforiwaa X M Gmail × | QuickLaunchSSO:: Single Sig x M Question 13 - Mid-Term Exam x On December 1, Jasmin Erns Ne ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 13 Refer to Apple's financial statements in Appendix A to answer the following. Skipped Help Save & Exit 1. For the fiscal year ended September 28, 2019, what amount is credited to Income Summary to summarize its revenues earned? 2. For the fiscal year ended September 28, 2019, what amount is debited to Income Summary to summarize its expenses incurred? 3. For the fiscal year ended September 28, 2019, what is the balance of its Income Summary account before it is closed? 1. Amount credited to income summary 2. Amount debited to income summary Ask 3. Balance in income summary account Mc с $ tv MacBook Pro G Search or type URL & ☆ Aa Carrow_forwardrive - Google Drive 4 My Drive - Google Drive + Front Desk Operations 2020 - Go X akeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=D&inprogress%3false ☆ Tp ix 02 TVCC Email P My Math Lab Log In to Canvas EX Mathway | Calculus... N Netflix , Cengage Login Login 国R. Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc. Sales $165,000 $505,000 Variable costs 66,200 303,000 Contribution margin $98,800 $202,000 Fixed costs 60,800 101,000 Income from operations $38,000 $101,000 a. Compute the operating leverage for Beck Inc. and Bryant Inc. If required, round to one decimal place. Beck Inc. Bryant Inc. b. How much would income from operations increase for each company if the sales of each increased by 10%? If required, round answers to nearest whole number. Dollars Percentage Beck Inc. $4 % Bryant Inc. c. The difference in the of income from operations is due to the difference in the operating leverages. Beck Inc.'s…arrow_forward

- 線 5. %24 O Question 6- Assignment #2 Chp X YouTube + x cation.com/ext/map/index.html?_con3Dcon&external_browser-0&launchUrl-https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fm... E Chp. 12 due Jan. 26 8:00 am Saved Help Save & Exit Sub Check my w Jazelle Momba wants to visit her family in Zimbabwe in 2025, which is 8 years from now. She knows that it will cost approximately $7,600 including flight costs, on-the-ground costs, and extra spending money to stay for 4 months. If she opens an account that compounds interest at 6% semiannually, how much does she need to deposit today to cover the total cost of her visit? (Use Table 12.3.) (Round your answer to the nearest dollar.) Deposit eBook Hint Print References 6 of 10 Next > OL 10 9 a. 250 米 %6 4. 03arrow_forwardrome Edit File View History D Bookmarks Profiles Tab Window Help G bjs - Google Search C The following financial statem× | iConnect - Home X M Question 17 - Chapter 1 Home ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fbb.mwcc.edu%2 hapter 1 Homework 17 Part 4 of 5 4.84 points Saved Required information Problem 1-2A (Algo) Computing missing information using accounting knowledge LO A1 [The following information applies to the questions displayed below.] The following financial statement information is from five separate companies. Company A Company B Company C Company D Beginning of year eBook Assets Liabilities $ 36,000 29,520 $ 28,080 19,656 $ 23,040 12,441 $ 64,080 Company E $ 98,280 44,215 ? Ask Print End of year Assets 41,000 29,520 ? 74,620 Liabilities ? 20,073 13,460 35,817 113,160 89,396 Changes during the year References Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 8,608 Owner withdrawals…arrow_forward- Google Drive X 4 My Drive - Google Drive +Front Desk Operations 2020 - Go X + Assignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator=&inprogress%-false * Tp Ask 0 TVCC Email P My Math Lab Log In to Canvas X Mathway | Calculus.. N Netflix Cengage Login Login Rea Equivalent Units and Related Costs; Cost of Production Report; Entries Dover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass through the Reaction and Filling departments, emerging as finished chemicals. The balance in the account Work in Process-Filling was as follows on January 1: Work in Process-Filling Department (3,500 units, 30% completed): Direct materials (3,500 x $10.60) $37,100 Conversion (3,500 x 30% x $6.80) 7,140 $44,240 The following costs were charged to Work in Process-Filling during January: Direct materials transferred from Reaction Department: 45,200…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education