FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

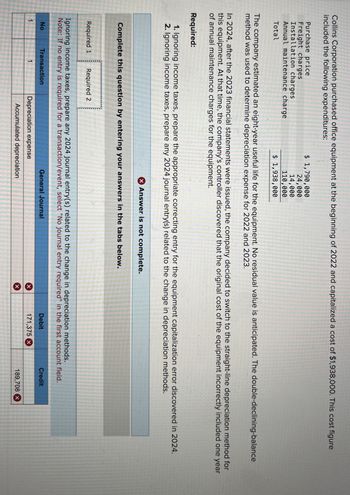

Transcribed Image Text:Collins Corporation purchased office equipment at the beginning of 2022 and capitalized a cost of $1,938,000. This cost figure

included the following expenditures:

Purchase price

Freight charges

Installation charges

Annual maintenance charge

Total

$ 1,790,000

24,000

14,000

110,000

$ 1,938,000

The company estimated an eight-year useful life for the equipment. No residual value is anticipated. The double-declining-balance

method was used to determine depreciation expense for 2022 and 2023.

In 2024, after the 2023 financial statements were issued, the company decided to switch to the straight-line depreciation method for

this equipment. At that time, the company's controller discovered that the original cost of the equipment incorrectly included one year

of annual maintenance charges for the equipment.

Required:

1. Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2024.

2. Ignoring income taxes, prepare any 2024 journal entry(s) related to the change in depreciation methods.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Ignoring income taxes, prepare any 2024 journal entry(s) related to the change in depreciation methods.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Transaction

No

1

General Journal

Depreciation expense

Accumulated depreciation

Debit

Credit

×

171,375 x

189,708 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of 2022, Robotics Incorporated acquired a manufacturing facility for $12.9 million. $9.9 million of the purchase price was allocated to the building. Depreciation for 2022 and 2023 was calculated using the straight-line method, a 25-year useful life, and a $1.9 million residual value. In 2024, the company switched to the double-declining-balance depreciation method. What is depreciation on the building for 2024?arrow_forwardCoachwhip Corporation purchased a machinery on January 1, 2022 for P5,000,000. The same had an expected useful life of 8 years. Straight line depreciation method is in place for similar items. On January 1, 2024, the asset is appraised as having a sound value of P4,500,000. On January 1, 2027, the asset had a recoverable value of P1.375.000. How much is the loss on impairment should be recognized on January 1, 2027?arrow_forwardHowarth Manufacturing Company purchased equipment on June 30, 2017, at a cost of $800,000. The residual value of the equipment was estimated to be $50,000 at the end of a five-year life. The equipment was sold on March 31, 2021, for $170,000. Howarth uses the straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service. ces Required: 1. Prepare the journal entry to record the sale. 2. Assuming that Howarth had instead used the double-declining-balance method, prepare the journal entry to record the sale. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming that Howarth had instead used the double-declining-balance method, prepare the journal entry to record the sale. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) General Journal No 1 Event 1 Cash Accumulated…arrow_forward

- Coachwhip Corporation purchased a machinery on January 1, 2022 for P5,000,00O. The same had an expected useful life of 8 years. Straight line depreciation method is in place for similar items. On January 1, 2024, the asset is appraised as having a sound value of P4,500,000. On January 1, 2027, the asset had a recoverable value of P1,375,000. How much is the loss on impairment should be recognized on January 1, 2027?arrow_forwardOman Cables Co. Purchased a machine for OR45,000 on January 1, 2020. The machine is expected to have a four - year life, with a residual value of OR5,000 at the end of four years. Using the sum - of - the years' - digits method, depreciation for 2021 would be Select one: a. 16,000 b. 12,000 C. 13,500 O d. none of the above is correctarrow_forwardNavigation Inc. acquired an equipment on January 1, 2014 at a cost of $2,200,000 including an estimated residual value of $200,000 and twenty (20) years estimated useful life. The replacement cost of the equipment is $2,400,000 on December 30, 2017. The depreciated replacement cost declined to $1,470,000 after two years. If there is a need to gross up, round off percentage to whole number and to nearest dollar. Questions: 1. What is the carrying amount of the equipment on December 31, 2020?2. What is the balance of the revaluation surplus immediately after revaluation?arrow_forward

- Tan Chin Company purchases a building for $11,300,000 on January 2, 2017. An engineer’s report shows that of the total purchase price, $11,000,000 should be allocated to the building (with a 40-year life), $150,000 to 15-year property, and $150,000 to 5-year property. No residual (salvage) value should be considered. Compute depreciation expense for 2017 using component depreciationarrow_forwardMeca Concrete purchased a mixer on January 1, 2022, at a cost of $45,000. Straight-line depreciation for 2022 and 2023 was based on an estimated eight-year life and $3,000 estimated residual value. In 2024, Meca revised its estimate and now believes the mixer will have a total service life of only six years, and that the residual value will be only $2,000. Required:Compute depreciation for 2024 and 2025.arrow_forwardIrwin, Inc., constructed a machine at a total cost of $35 million. Construction was completed at the end of 2014and the machine was placed in service at the beginning of 2015. The machine was being depreciated over a10-year life using the sum-of-the-years’-digits method. The residual value is expected to be $2 million. At thebeginning of 2018, Irwin decided to change to the straight-line method. Ignoring income taxes, what journalentry(s) should Irwin record relating to the machine for 2018?arrow_forward

- Culver Automotive purchased equipment on October 1, 2024, at a total cost of $182,000. The machine has an estimated useful life of eight years or 100,000 hours, and an estimated residual value of $42,000. During 2024 and 2025, the machinery was used 6,300 and 14,700 hours, respectively. Calculate depreciation expense at December 31, 2024 and December 31, 2025, under the following depreciation methods: (Round answers to 0 decimal places, e.g. 5,275. and Round Depreciation cost per unit to 1 decimal places, e.g. 527.5) Straight-line depreciation Units-of-production depreciation Double diminishing-balance depreciation $ LA $ LA 2024 $ LA $ LA 2025arrow_forwardAt the beginning of 2022, Robotics Incorporated acquired a manufacturing facility for $12.9 million. $9.9 million of the purchase price was allocated to the building. Depreciation for 2022 and 2023 was calculated using the straight-line method, a 25-year useful life, and a $1.9 million residual value. In 2024, the company switched to the double-declining-balance depreciation method. What is depreciation on the building for 2024?arrow_forwardCoachwhip Corporation purchased a machinery on January 1, 2022 for P5,000,000. The same had an expected useful life of 8 years. Straight line depreciation method is in place for similar items. On January 1, 2024, the asset is appraised as having a sound value of P4,500,000. On January 1, 2027, the asset had a recoverable value of P1,375,000. The amount of revaluation surplus on January 1, 2024 is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education