FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

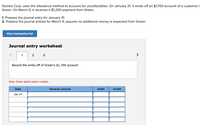

Transcribed Image Text:Gomez Corp. uses the allowance method to account for uncollectibles. On January 31, it wrote off an $1,700 account of a customer,

Green. On March 9, it receives a $1,200 payment from Green.

1. Prepare the journal entry for January 31

2. Prepare the journal entries for March 9; assume no additional money is expected from Green.

View transaction list

Journal entry worksheet

1

2 3

>

Record the write-off of Green's $1,700 account

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Jan 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Discount Mart utilizes the allowance method of accounting for uncollectible receivables. On December 12 the company receives a $590 check from Chad Thomas in settlement Thomas's $1,210 outstanding accounts receivable. Due to Thomas's failing health he is closing his company and is expecting to make no further payments to Discount Mart. Journalize this declaration. If an amount box does not require an entry, leave it blank. Dec. 12arrow_forwardKitchen Equipment Company uses the allowance method to account for uncollectibles. On October 31, It wrote off a $1,200 account of a customer, Gwen Rowe. On December 9, It recelved an $800 payment from Rowe. a. Make the appropriate entry for October 31. View transaction list Journal entry worksheet 1 Record the entry to write off $1,200-due from Gwen Rowe. Note: Enter debits before credits. Date General Journal Debit Credit October 31 Record entry Clear entry View general journalarrow_forwardJournalize the following transactions using the allowance method of accounting for uncollectible receivables. April 1 Sold merchandise on account to Jim Dobbs, $7,500. The cost of the merchandise is $6,300. If an amount box does not require an entry, leave it blank. April 1 April 1 June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. If an amount box does not require an entry, leave it blank. June 10 Oct. 11 Reinstated the account of Jim Dobbs and received $5,000 cash in full payment. If an amount box does not require an entry, leave it blank. Oct. 11 Oct. 11arrow_forward

- please help me with thesearrow_forwardOn August 2, Jun Co. receives a $7,300, 90-day, 12% note from customer Ryan Albany as payment on his $7,300 account. 1. Compute the maturity date for the above note. multiple choice October 29 October 30 October 31 November 1 November 2 2. Prepare Jun’s journal entry for August 2. 1 Record receipt of note on account.arrow_forwardUsing the direct write-off method of accounting for uncollectible receivables. Transactions: 1 Sold merchandise on account to Jim Dobbs, $6,600. The cost of the merchandise is $2,640. April June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs for and received cash in full payment. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to nearest dollar amount.arrow_forward

- Using the allowance method of accounting for uncollectible receivables. Transactions: April 1 Sold merchandise on account to Jim Dobbs, $7,200. The cost of the merchandise is $5,400. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Alan Albertson 122 Accounts Receivable-Jim Dobbs 123 Accounts Receivable-John Groves 124 Accounts Receivable-Jan Lehn 125 Accounts Receivable-Jacob Marley 126 Accounts Receivable-Mr.Potts 127 Accounts Receivable-Chad Thomas 128 Accounts Receivable-Andrew Warren 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Inventory 145 Supplies…arrow_forwardExercises Prepare entries for recognizing accounts receivable. E8.1 (LO 1), AP On January 6, Jacob Co. sells merchandise on account to Harley Inc. for $9,200, terms 1/10, n/30. On January 16, Harley pays the amount due. Instructions Prepare the entries on Jacob Co.'s books to record the sale and related collection. (Omit cost of goods sold entries.) Journalize entries related to accounts receivable.arrow_forwardJournalize the following transactions, using the direct write-off method of accounting for uncollectible receivables. Question Content Area Mar. 17: Received $3,240 from Shawn McNeely and wrote off the remainder owed of $5,020 as uncollectible. If an amount box does not require an entry, leave it blank. Date Account Debit Credit Mar. 17 - Select - - Select - - Select - - Select - - Select - - Select - Question Content Area July 29: Reinstated the account of Shawn McNeely and received $5,020 cash in full payment. If an amount box does not require an entry, leave it blank. Date Account Debit Credit July 29 - Select - - Select - - Select - - Select - July 29 - Select - - Select - - Select - - Select -arrow_forward

- nkt.1arrow_forward5. Jack's lawn care used the direct write-off method for accounting for uncollectible accounts. The company writes off $500 on Jane Doe's account. The journal entry to record this will include a debit of $500 to which account?arrow_forwardJeter Company uses the allowance method to account for uncollectible receivables. On April 2, Jeter Company wrote off a $820 account receivable from customer J. Maters. On May 12, Jeter Company unexpectedly received full payment from Maters on the previously written off account. Jeter Company records an adjusting entry for bad debts expense of $14,100 on May 31. 9. Journalize Jeter Company's write-off of the uncollectible receivable. 10. Journalize Jeter Company's collection of the previously written off receivable. 11. Journalize Jeter Company's adjustment for bad debts expense. 9. Journalize Jeter Company's write-off of the uncollectible receivable. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Date Apr. 2 Accounts and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education