FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

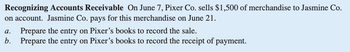

Transcribed Image Text:Recognizing Accounts Receivable On June 7, Pixer Co. sells $1,500 of merchandise to Jasmine Co.

on account. Jasmine Co. pays for this merchandise on June 21.

a. Prepare the entry on Pixer's books to record the sale.

b. Prepare the entry on Pixer's books to record the receipt of payment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Greenleaf Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the cash payments journal. June 3 Issued Check Number 380 to Skipp Corporation to buy office supplies for $375. June 5 Purchased merchandise for $4,600 on credit from Buck Company, terms n/15. June 20 Issued Check Number 381 for $4,600 to Buck Company to pay for the June 5 purchase. June 23 Paid salary of $6,200 to T. Bourne by issuing Check Number 382. June 26 Issued Check Number 383 for $5,750 to pay off a note payable to UT Bank.arrow_forwardOn February 3, Smart Company sold merchandise in the amount of $2,400 to Truman Company, with credit terms of 1/10, n/30. The cost of the items sold is $1,65O. Smart uses the perpetualinventory system and the gross method. Truman pays the invoice on February 8, and takes the appropriate discount. The journal entry that Smart makes on February 8 is: Multiple Choice Cash 1,650 Accounts receivable 1,650 Cash 2,400 Accounts receivable 2,400 Cash 2,320 Sales discounts pe here to search 5:00 PM 6% 3/7/2022arrow_forwardOn December 1, Macy Company sold merchandise with a selling price of $10,000 on account to Mrs. Jorgensen, with terms 1/10, n/30. On December 3, Mrs. Jorgensen returned merchandise with a selling price of $400. Mrs. Jorgensen paid the amount due on December 9. What journal entry did Macy Company prepare on December 9 assuming the gross method is used? A) Debit Cash for $9,504, debit Sales Discounts for $96, and credit Accounts Receivable - Mrs. Jorgensen for $9,600. B) Debit Sales Revenue for $9,504, debit Sales Discounts for $96, and credit Accounts Receivable - Mrs. Jorgensen for $9,600. C) Debit Sales Revenue for $9,600, credit Sales Discount for $96 and credit Cash for $9,504. D) Debit Cash for $9,504 and credit Accounts Receivable - Mrs. Jorgensen for $9,504.arrow_forward

- Can I have B answered immediately please?arrow_forwardUsing the allowance method of accounting for uncollectible receivables. Transactions: April 1 Sold merchandise on account to Jim Dobbs, $8,500. The cost of the merchandise is $3,400. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to nearest dollar amount. Chart of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Alan Albertson 122 Accounts Receivable-Jim Dobbs 123 Accounts Receivable-John Groves 124 Accounts Receivable-Jan Lehn 125 Accounts Receivable-Jacob Marley 126 Accounts Receivable-Mr.Potts 127 Accounts Receivable-Chad Thomas 128 Accounts Receivable-Andrew Warren 129 Allowance for…arrow_forwardNeed Answerarrow_forward

- On May 10, Blossom Company sold merchandise for $4,500 and accepted the customer's Best Business Bank MasterCard. At the end of the day, the Best Business Bank MasterCard receipts were deposited in the company's bank account. Best Business Bank charges a 3.4% service charge for credit card sales. Prepare the entry on Blossom Company's books to record the sale of merchandise. (Omit cost of goods sold entries.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts.) Date Account Titles and Explanation May 10 Accounts Receivable Sales Revenue Service Charge Expense eTextbook and Media: Debit 4500 I Credit 4500arrow_forwardOn May 10, Blossom Company sold merchandise for $11,600 and accepted the customer's America Bank MasterCard. America Bank charges a 4% service charge for credit card sales. Prepare the entry on Blossom Company's books to record the sale of merchandise. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date May 10 eTextbook and Media List of Accounts Save for Later Account Titles Debit Credit Attempts: 0 of 3 used Submit Answerarrow_forwardEntries for Uncollectible Receivables, using Allowance Method Journalize the following transactions in the accounts of Sedona Interiors Company, a Restaurant Supply Company that uses the allowance method of accounting for uncollectible receivables: May 1. Sold merchandise on account to Beijing Palace Co., $18,900. The cost of the merchandise sold was $11,200. Aug. 30. Received $8,000 from Beijing Palace Co. and wrote off the remainder owed on the sale of May 1 as uncollectible. Dec. 8. Reinstated the account of Beijing Palace Co. that had been written off on August 30 and received $10,900 cash in full payment. For a compound transaction, if an amount box does not require an entry, leave it blank. May 1-sale May 1-cost Aug. 30 Dec. 8-reinstate Dec. 8-collection. 10 0 0000 0000 0 00arrow_forward

- On April 7, Rainforest Co. sold merchandise in the amount of $4,200 to Stellar Co. with credit terms 1/10, n/30. the cost of the items sold is $2,900. Stellar pays the invoice on April 14. The journal entry Rainforest Co. makes on April 14 is: Accounts Payable Cash Cash Accounts Receivable Cash Sales Discount Accounts Receivable Cash Accounts Receivable Cash Sales Discount Accounts Receivable 77 4,200 4,200 4,158 42 2,900 4,120 29 4,200 4,200 4,200 2,900 4,149arrow_forwardVail Company recorded the following transactions during November. Date General Journal Debit Credit November 5 Accounts Receivable-Ski Shop 4,948 Sales 4,948 November 10 Accounts Receivable-Welcome Incorporated Sales 1,758 1,758 November 13 Accounts Receivable-Zia Company Sales 1,031 1,031 November 21 Sales Returns and Allowances 266 Accounts Receivable-Zia Company 266 November 30 Accounts Receivable-Ski Shop 3,665 Sales 3,665 1. Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. 2. Prepare a schedule of accounts receivable. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. General Ledger Accounts Receivable Ending Balance 0 0 Sales Ending Balance Sales Returns and Allowances Ending Balance 0 Accounts Receivable Subsidiary Ledger Ski Shop Ending Balance 0 0 Zia…arrow_forwardStar Company uses a purchases journal to record all purchases on account, including merchandise purchases. The company purchases merchandise and office supplies on a frequent basis. On November 12, Star Company purchased merchandise on account from Moon Company for $6,500, terms 2/10, n/30. How would this transaction be recorded in the purchases journal of Star Company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education