Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:**Educational Content on Required Return and the Security Market Line (SML)**

---

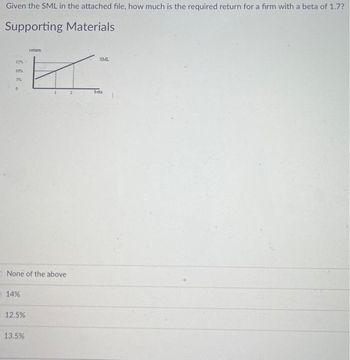

**Given the SML in the attached file, how much is the required return for a firm with a beta of 1.7?**

### Supporting Materials

#### Graph Explanation:

- **Title:** (Not labeled)

- **X-Axis:** Beta (β)

- **Y-Axis:** Return (%)

- **Graph Details:**

- The graph illustrates the Security Market Line (SML), which depicts the relationship between beta (risk) and the expected return.

- The line is upward sloping, indicating higher returns for higher risk (beta).

- Key Points:

- At beta = 0, return is 5%.

- At beta = 1, return is 10%.

- At beta = 2, return is 15%.

#### Multiple Choice Options:

- None of the above

- 14%

- 12.5%

- 13.5%

**Analysis:**

To find the required return for a firm with a beta of 1.7, draw a line upward from the 1.7 mark on the x-axis until it intersects with the SML, then extend horizontally to the y-axis to determine the return percentage.

**Conclusion:**

Based on the position of beta and the SML slope in the graph, the required return would be a value close to 13.5%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 5arrow_forwardi need the answer quicklyarrow_forwardA Beta 1.10 Market Capitalization = 122.548B Book Value of Debt = 93.21B Bond Price = 103.10 Interest Rate = 2.75% Maturity = 20 years Therefore - PV = -1,031.00; FV = 1,000; PMT = 27.50; N = 20; CPT I = 2.55% Tax rate 21% Current One Year Treasury Bill Rate (Risk-free Rate) = 5% Market Return: Estimated at 8% Step 1 Calculate the WACC for Deere and Company (DE) given: Step 2 Step 3 Step 4 Search What are the weightings for Equity and Debt? What is the Cost of Equity? What is the After-Tax Cost of Debt? What is the WACC?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education