FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

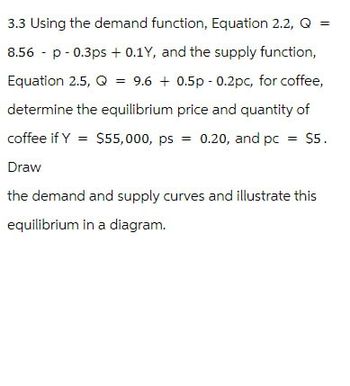

Transcribed Image Text:3.3 Using the demand function, Equation 2.2, Q =

8.56 p 0.3ps + 0.1Y, and the supply function,

Equation 2.5, Q = 9.6 +0.5p -0.2pc, for coffee,

determine the equilibrium price and quantity of

coffee if Y = $55,000, ps = 0.20, and pc = $5.

Draw

the demand and supply curves and illustrate this

equilibrium in a diagram.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Consider an economy with two types of companies, S and I. The profits of companies S always move together, but the profits of companies I move independently of each other. For both firms, there is a 70% probability that the firm's return is 30%, and a 30% probability that the return is -30%. The standard deviation of an individual company's return is closest to the value: Choose one: A.23.0% B.5.25% C.15.0% D.10.0% Only typed answerarrow_forward3. The following graph depicts a macro equilibrium. Answer the questions based on the information in the graph.(a) What is the equilibrium rate of GDP?(b) If full-employment real GDP is $1200, what problem does this economy have?(c) How large is the real GDP gap?arrow_forwardSolve the question given in imagearrow_forward

- use attachment to answer questions This question relates to Diagram 1 from the 9.4 diagrams, which shows the Security Market Line. What is the expected return on the market? Select one: a. 20% b. 10% c. 15% d. 5%arrow_forward7arrow_forwardThe effective convexity of with a high price of $100.73, a low price of $99.24, and a current price of $99.88 given a 600bps change in yield curve is closest to A. -555 B. -198 C. -33 D. Not enough informationarrow_forward

- 4arrow_forward!arrow_forwardUse the following screenshot from Bloomberg: TO 5/8 10/15/24 Govt TO 10/15/24 Govt 99-23/99-23+ 1) Yield & Spread TO Spread Price Yield YAS Wkout Settle 11/03/210 Related Functions Men Settings 0.719/0.716 3) Pricing Nov 1 I BGN @ 15:2 4) Descr 2) Graphs 10/15/24 (91282CDB4 0.00 bp VS 99-23 0.717551 Wst 10/15/2024 @ 100.00 Duration 11/03/210 3y T O 10/15/24 99-23 15:28:11 0.717551 S/A Yld 6 6 What is the ask price of this Treasury bond if its par value is $1,000 $992.34 $997.30 $995.15 $992.30arrow_forward

- 1. Consider a pure exchange economy with two goods and two consumers. Let F denote food and C denote clothing. Lacy has the utility function U(F, C) = F 1/3 C 2/3 . Roy has the utility function V (F, C) = F 2/3 C 1/3 . Each consumer has an initial endowment consisting of 9 units of F and 9 units of C. Normalize the price of F to one. Let P denote the price of C. (a) Is the initial endowment a Pareto efcient allocation of F and C between the two con sumers? Explain briefy. (b) What is each consumer’s demand for F and C as a function of P? [Hint: the wealth of each consumer is 9 + 9P.] (c) What is the price of C in a competitive equilibrium? (d) What is the allocation of F and C between the two consumers in a competitive equilibrium?arrow_forwardConsider a firm with a forward-looking P/E ratio of 4, a discount rate R=10% and ROE=5%. Suppose the price is equal to the fundamental value given by the DDM. What is the plowback ratio b of the firm? b=_ (answer a number between 0 and 1 with 2 decimals, e.g., 0.12)arrow_forward!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education