Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

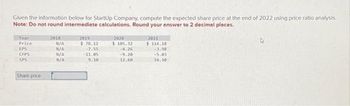

Transcribed Image Text:Given the information below for StartUp Company, compute the expected share price at the end of 2022 using price ratio analysis.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Year

Price

EPS

CFPS

SPS

Share price

2018

N/A

N/A

N/A

N/A

2019

$78.12

-7.55

-11.05

9.10

2020

$ 105.32

4.26

-9.20

12.60

2021

$114.18

-3.90

-5.01

16.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- XYZ's stock price and dividend history are as follows: Beginning-of-Year Dividend paid at Price $ 102 122 92 102 Year 2018 2019 2020 2021 Year-End $4 Arithmetic average rate of return Geometric average rate of return 4 An investor buys three shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all four remaining shares at the beginning of 2021. 4 4 a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations.) Dollar-weighted rate of return b. What is the dollar-weighted rate of return? (Hint: Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. If your calculator cannot calculate internal rate of return, you will have to use trial i and error.) (Round your answer to 4…arrow_forward1. Spark has paid the following dividends during 2021-2022: Date 9 April 2021 1 October 2021 8 April 2022 7 October 2022 The price of Spark shares at the start of 2021, 2022, and 2023 are Date 5 January 2021 5 January 2022 4 January 2023 (a) What is the HPR for 2021? What is the HPR for 2022? Dividend 12.5c 12.5c 12.5c 12.5c Price 4.80 4.49 5.34arrow_forwardEstimating Share Value Using the ROPI Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Forecast Horizon Period Colgate Palmolive (CL) Reported $ millions 2018 2019 2020 2021 2022 Sales $13,990 $14,409 $14,842 $15,287 $15,746 NOPAT 2,463 2,536 2,612 2,690 2,771 NOA 5,253 5,411 5,574 5,740 5,913 a. Forecast the terminal period values for Sales, NOPAT, and NOA, assuming a 1% terminal period growth rate. Note: Round answers to the nearest dollar. Terminal period sales 2$ 15,903 Terminal period NOPAT $ 2,799 Terminal period NOA 2$ 5,972 b. Estimate the value of a share of Colgate-Palmolive common stock using the residual operating income (ROPI) model. Assume a discount rate (WACC) of 5.70%, common shares outstanding of 862.9 million, net nonoperating obligations (NNO) of $5,076 million, and noncontrolling interest (NCI) from the balance sheet of $269 million. Note: Round answers to two decimal places. $ 0 c. Colgate-Palmolive stock…arrow_forward

- Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $ 87.90 4.64 8.17 69.00 Using PE ratio Using P/CF ratio Using P/S ratio 2017 2018 $93.80 $ 92.50 5.35 6.15 8.96 9.25 74.00 73.40 Share Price 2019 $90.00 6.85 11.02 76.90 2020 2021 $111.50 $ 126.90 7.90 12.34 88.10 8.90 13.46 96.10arrow_forwardFrom the given information determine the beta coefficients of shares of company P & Q: 2020 2021 2022 Company P 12.50% 13.25% 9.80% Company Q 14% 13.50% 12.80% Market 1.58 & 1.55 1.43 & 1.16 1.02 & 0.39 1.83 & 0.67 13% 12% 10%arrow_forwardes Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price 2016 $ 97.60 2017 $ 103.50 2018 $ 102.20 2019 $ 99.70 2020 $ 121.20 2021 $ 136.60 EPS CFPS 2.80 8.22 3.51 4.31 5.01 7.95 8.95 9.00 9.28 11.07 12.37 13.48 SPS 52.60 57.60 57.00 60.50 71.70 79.70 Using PE ratio Using P/CF ratio Using P/S ratio Share Pricearrow_forward

- XYZ's stock price and dividend history are as follows: Year Beginning-of-Year Price Dividend Paid at Year-End 2019 $ 155 2020 185 2021 145 2022 155 Arithmetic average rate of return Geometric average rate of return An investor buys three shares of XYZ at the beginning of 2019, buys another two shares at the beginning of 2020, sells one share at the beginning of 2021, and sells all four remaining shares at the beginning of 2022. $ 3 3 3 Required: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations.) % % Dollar-weighted rate of return wwww 3 % b. What is the dollar-weighted rat of return? (Hint. Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2019, to January 1, 2022. If your calculator cannot calculate IRR, you will have to use trial and error or a spreadsheet…arrow_forwardFor XYZ Corporation, the book value per share at the end of 2021 Is 31.46, ROI is .1, and earnings per share for 2022 (at the end of the year) are 4.57. What is the value of residual earnings per share for 2022? O2.38 1.42 O 3.57 O 1.13arrow_forwardAnalyze the annual reports of Flour Mills of Fiji (2020), RB Patel Ltd (2020) and Paradise Beverages Ltd (2019) from South Pacific Stock Exchange (SPSE) and answer the following questions. assuming dividend will grow 3% for Flour Mills of Fiji, 6% for RB Patel Ltd and 9% for Paradise Beverages constantly for the companies on their respective base year. Calculate the Earnings Per Share (EPS) and the Market Capitalization for each of the companies.arrow_forward

- See Table 2.5 LOADING... showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco's costs and expenses had been the same fraction of revenues in 2016-2019 as they were in 2015. What would Mydeco's EPS have been each year in this case? Calculate the new EPS for 2016-2019 below: (Round dollar amounts and number of shares to one decimal place. Round percentage amount and the EPS to two decimal places.)arrow_forwardQuestions The table shows the value of the FTSE 100 share index over 6-month periods for 2 years. Value (£) 7,147 7,455 7,692 7,668 7,154 Month January 2017 July 2017 January 2018 July 2018 January 2019 If the value of shares held in the FTSE 100 was £2,450 in July 2017, what would it be in July 2018? O O 0 £2 O £2,553 O £2,560 £2,478 £2,505 £2,520 Next »arrow_forwardXYZ's stock price and dividend history are as follows: Year Beginning-of-Year Price 2019 2020 2021 2022 $88 108 78 88 Dividend Paid at Year-End $4 An investor buys three shares of XYZ at the beginning of 2019, buys another two shares at the beginning of 2020, sells one share at the beginning of 2021, and sells all four remaining shares at the beginning of 2022 Arithmetic average rate of return Geometric average rate of return Required: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations.) Dollar-weighted rate of return 4 4 4 % % b. What is the dollar-weighted rate of return? (Hint Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2019, to January 1, 2022. If your calculator cannot calculate IRR, you will have to use trial and error or a spreadsheet program.) (Round your…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education