FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

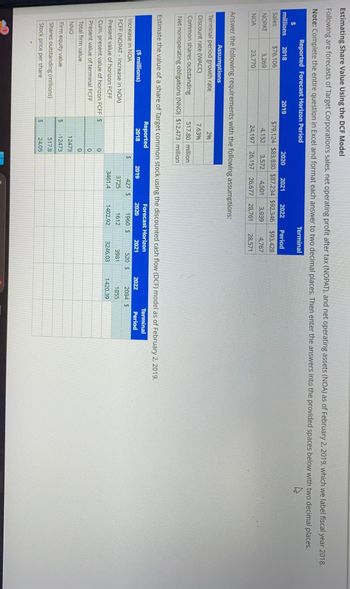

Transcribed Image Text:Estimating Share Value Using the DCF Model

Following are forecasts of Target Corporation's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2, 2019, which we label fiscal year 2018.

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places.

Reported Forecast Horizon Period

$

millions 2018

Terminal

2019

2020 2021 2022

$79,124 $83,830 $87,234 $92,346

Period

$93,428

4,767

Sales

$76,106

NOPAT

3,269

NOA

23,770

4,152 3,572 4,501 3,939

24,197 26,157 26,677 28,761 28,571

Answer the following requirements with the following assumptions:

Assumptions

Terminal period growth rate

2%

Discount rate (WACC)

7.63%

Common shares outstanding

517.80 million

Net nonoperating obligations (NNO) $12,473 million

Estimate the value of a share of Target common stock using the discounted cash flow (DCF) model as of February 2, 2019.

($ millions)

Increase in NOA

Reported

2018

$

LA

Forecast Horizon

Terminal

2019

2020

2021

2022

Period

427 $

FCFF (NOPAT - Increase in NOA)

Present value of horizon FCFF

3725

1960 $

1612

520 $

3981

2084 $

1855

3461.4

1402.92

3246.03

1420.39

Cum. present value of horizon FCFF $

0

Present value of terminal FCFF

0

Total firm value

NNO

0

12473

Firm equity value

$

-12473

Shares outstanding (millions)

Stock price per share

LA

517.8

24.05

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What does this mean for a company?arrow_forwardEstimating Share Value Using the DCF ModelAssume following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of January 29, 2011. Reported Horizon Period (In millions) 2011 2012 2013 2014 2015 Terminal Period Sales $ 3,750 $ 4,500 $ 5,400 $ 6,480 $ 7,776 $ 7,853 NOPAT 464 539 654 794 982 960 NOA 1,320 1,602 1,933 2,332 2,791 2,802 Answer the following requirements assuming a discount rate (WACC) of 13.3%, a terminal period growth rate of 1%, common shares outstanding of 86.2 million, and net nonoperating obligations (NNO) of $(261) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations).(a) Estimate the value of a share of Abercrombie & Fitch common stock using the discounted cash flow (DCF) model as of January 29, 2011. Rounding instructions: Round answers to the nearest whole number unless noted otherwise. Use your rounded answers for…arrow_forwardEstimating Share Value Using the ROPI Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Forecast Horizon Period Colgate Palmolive (CL) Reported $ millions 2018 2019 2020 2021 2022 Sales $13,990 $14,409 $14,842 $15,287 $15,746 NOPAT 2,463 2,536 2,612 2,690 2,771 NOA 5,253 5,411 5,574 5,740 5,913 a. Forecast the terminal period values for Sales, NOPAT, and NOA, assuming a 1% terminal period growth rate. Note: Round answers to the nearest dollar. Terminal period sales 2$ 15,903 Terminal period NOPAT $ 2,799 Terminal period NOA 2$ 5,972 b. Estimate the value of a share of Colgate-Palmolive common stock using the residual operating income (ROPI) model. Assume a discount rate (WACC) of 5.70%, common shares outstanding of 862.9 million, net nonoperating obligations (NNO) of $5,076 million, and noncontrolling interest (NCI) from the balance sheet of $269 million. Note: Round answers to two decimal places. $ 0 c. Colgate-Palmolive stock…arrow_forward

- am. 116.arrow_forwardGiven the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $ 87.90 4.64 8.17 69.00 Using PE ratio Using P/CF ratio Using P/S ratio 2017 2018 $93.80 $ 92.50 5.35 6.15 8.96 9.25 74.00 73.40 Share Price 2019 $90.00 6.85 11.02 76.90 2020 2021 $111.50 $ 126.90 7.90 12.34 88.10 8.90 13.46 96.10arrow_forwardRefine Assumptions for PPE ForecastFollowing are the income statement and balance sheet for Medtronic PLC. Consolidated Statement of Income ($ millions) For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expenses 2,330 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 198 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit (loss) 6,268 Other nonoperating income, net (373) Interest expense 1,444 Income (loss) before income taxes 5,197 Income tax provision 547 Net income (loss) 4,650 Net (income) loss attributable to noncontrolling interests (19) Net income (loss) attributable to Medtronic $ 4,631 Consolidated Balance Sheet ($ millions) April 26, 2019 Current assets Cash and cash equivalents $ 4,393 Investments 5,455 Accounts receivable, less…arrow_forward

- Use the Ulta annual report to calculate profit margin, total debt ratio, and cash ratio for the year ending in 2021.arrow_forwardEstimating Share Value Using the DCF Model Following are forecasts of sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of December 31, 2018, for Humana. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Reported Forecast Horizon Period Terminal $ millions Sales NOPAT NOA 2021 2022 2020 2018 2019 $57,472 $58,326 $59,192 $60,072 $60,964 3,179 3,218 3,140 3,052 3,102 4,844 4,657 4,718 4,781 4,592 Period $61,568 3,244 4,887 Answer the following requirements with the following assumptions: Assumptions Terminal period growth rate 1% Discount rate (WACC) 7.8% Common shares outstanding 135.60 million Net nonoperating obligations (NNO) $(5,569) million Noncontrolling interest $0 million NNO is negative because Humana's nonoperating assets exceed its nonoperating liabilities. (a) Estimate the value of a share of Humana's common stock using the…arrow_forwardCalculate the Return on Shareholder equity % ratio for Urban Outfitters for both 2018 and 2019. Be sure to report in percentages & round your answer to 2 decimal place.arrow_forward

- es Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price 2016 $ 97.60 2017 $ 103.50 2018 $ 102.20 2019 $ 99.70 2020 $ 121.20 2021 $ 136.60 EPS CFPS 2.80 8.22 3.51 4.31 5.01 7.95 8.95 9.00 9.28 11.07 12.37 13.48 SPS 52.60 57.60 57.00 60.50 71.70 79.70 Using PE ratio Using P/CF ratio Using P/S ratio Share Pricearrow_forwardAbbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 13% in 2022 and all assets and liabilities increase correspondingly. Income Statement Sales Costs, including interest Net income $ 6,800 4,900 $ 1,900 2021 Balance Sheet, Year-End 2020 Net assets $ 5,916 $ 5,500 Total $ 5,916 $ 5,500 Debt Equity Total 2021 $ 2,516 3,400 $ 5,916 2020 $ 2,433 3,067 $ 5,500 a. If the payout ratio is set at 60% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? b. If the payout ratio is set at 60% and the firm maintains a fixed debt ratio but issues no equity, what is the maximum possible growth rate for Archimedes? Note: For all requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. a. Maximum possible growth rate b. Maximum possible growth rate % %arrow_forwardFor XYZ Corporation, the book value per share at the end of 2021 Is 31.46, ROI is .1, and earnings per share for 2022 (at the end of the year) are 4.57. What is the value of residual earnings per share for 2022? O2.38 1.42 O 3.57 O 1.13arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education