Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

A 143.

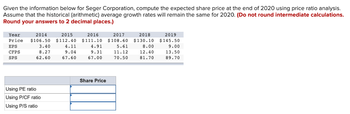

Transcribed Image Text:Given the information below for Seger Corporation, compute the expected share price at the end of 2020 using price ratio analysis.

Assume that the historical (arithmetic) average growth rates will remain the same for 2020. (Do not round intermediate calculations.

Round your answers to 2 decimal places.)

Year

2014

2015

Price $106.50 $112.40

EPS

CFPS

SPS

3.40

8.27

62.60

Using PE ratio

Using P/CF ratio

Using P/S ratio

4.11

9.04

67.60

2016

$111.10

4.91

9.31

67.00

Share Price

2017

2018

$108.60 $130.10

5.61

11.12

70.50

8.00

12.40

81.70

2019

$145.50

9.00

13.50

89.70

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $81.90 $81.90 3.20 7.67. 64.00 Using PE ratio Using P/CF ratio Using P/S ratio 2017 $ 87.80 3.91 8.56 69.00 2018 $ 86.50 4.71 8.95 68.40 Share Price 2021 2019 2020 $84.00 $ 105.50 $ 120.90 7.40 8.40 12.04 13.26 83.10 91.10 5.41 10.52 71.90arrow_forwardGiven the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $ 94.50 4.34 7.27 52.60 Using PE ratio Using P/CF ratio Using P/S ratio $ 100.40 $ $ $ 58.52 2018 $ 99.10 5.22 Answer is complete but not entirely correct. Share Price 57.90 2019 $ 97.90 6.06 10.12 60.69 316.15 249.66 X 148.12 x $ 121.50 7.00 11.80 71.60 2021 $ 136.80 13.10 78.70arrow_forwardGiven the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year 2016 2017 2018 2019 2020 2021 Price $ 94.50 $ 100.40 $ 99.10 $ 97.90 $ 121.50 $ 136.80 EPS 4.34 5.05 5.22 6.06 7.00 8.00 CFPS 7.27 8.24 8.71 10.12 11.80 13.10 SPS 52.60 58.52 57.90 60.69 71.60 78.70arrow_forward

- Given the information below for Seger Corporation, compute the expected share price at the end of 2020 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2020. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year 2014 2015 2016 2017 2018 2019 Price $ 52.10 $ 58.00 $ 56.70 $ 54.20 $ 75.70 $ 91.10 EPS 3.10 3.81 4.61 5.31 7.10 8.10 CFPS 7.37 8.32 8.77 10.22 11.86 13.14 SPS 23.70 28.70 28.10 31.60 42.80 50.80arrow_forwardBhupatbhaiarrow_forwardGiven the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 2017 $ 103.50 $ 109.40 5.30 4.59 8.02 8.84 60.10 65.10 Using PE ratio Using P/CF ratio Using P/S ratio 2018 $ 108.10 6.10 9.16 64.50 X Answer is complete but not entirely correct. $ $ $ Share Price 2019 $ 105.60 6.80 10.87 68.00 167.36 X 272.56 X 155.05 2020 $ 127.10 7.75 12.25 79.20 2021 $ 142.50 8.75 13.40 87.20arrow_forward

- Vijayarrow_forwardes Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price 2016 $ 97.60 2017 $ 103.50 2018 $ 102.20 2019 $ 99.70 2020 $ 121.20 2021 $ 136.60 EPS CFPS 2.80 8.22 3.51 4.31 5.01 7.95 8.95 9.00 9.28 11.07 12.37 13.48 SPS 52.60 57.60 57.00 60.50 71.70 79.70 Using PE ratio Using P/CF ratio Using P/S ratio Share Pricearrow_forwardGiven the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $94.50 4.34 7.27 52.60 Using PE ratio Using P/CF ratio Using P/S ratio 2017 $ 100.40 5.05 8.24 58.52 X Answer is not complete. Share Price 2018 $99.10 5.22 8.71 57.90 $ 148.40 x 2019 $97.90 6.06 10.12 60.69 2020 $ 121.50 7.00 11.80 71.60 2021 $ 136.80 8.00 13.10 78.70arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning