Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

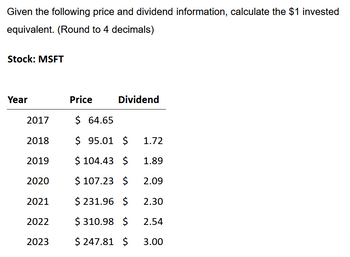

Transcribed Image Text:Given the following price and dividend information, calculate the $1 invested

equivalent. (Round to 4 decimals)

Stock: MSFT

Year

Price

Dividend

2017

$ 64.65

2018

$ 95.01 $ 1.72

2019

$ 104.43 $ 1.89

2020

$107.23 $ 2.09

2021

$231.96 $ 2.30

2022

$310.98 $ 2.54

2023

$ 247.81 $ 3.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- if a dividend in 2018 was $1.11 per share and in 2019 dividend was $1.15 per share What is the dividend growth rate? Select one: a. 1% b. 1.5 % c. 2% d. 3.6%arrow_forwardOn the basis of this information, calculate as many liquidity, activity, leverage, profitzit and common stock measures as you can. (Note: Assume the current market price of the common stock is $75 per share.arrow_forwardPerferred Stock Rate of Return. What is the normal rate of return on a peretual perferred stock with a $100.00 par value, A stated dividend of 10% of par, and a current market price of (a) $61.00 (b) $90.00 (c) $100.00, and (d) $138.00arrow_forward

- Suppose the following financial information is available for Walgreens. (in millions) Average common stockholders' equity Dividends declared for common stockholders Dividends declared for preferred stockholders Net income 2022 $9,200.0 460 0 1,840 2021 2022 8,600.0 387 0 2,150 Calculate the payout ratio and return on common stockholders' equity for 2022 and 2021. (Round answers to 1 decimal place, eg 12.5%) 2021arrow_forwardBelow is the history of the dividend payments for the HMST firm. What is your best estimate for the firm's cost of equity on December 3, 2021, if on that day the stock sells for $40? Date Paid 12/1/2017 12/1/2018 12/1/2019 12/1/2020 12/1/2021 $3.68 Dividend $3.5 $3.95 $4.29 $5.32 31.00% 19.73% 18.70% 23.11% 26.07%arrow_forwardThe following returns reflect annual returns to ABC's stock and the S&P 500. 2017 2018 2019 2020 1.10 0.98 1.19 ABC 1.25 .11 -.11 .033 -.055 S&P 500 .1 What is the beta for ABC's stock. Please round to the nearest 100th (ex. X.XX) -.1 .05 -.05arrow_forward

- You bought a stock on 1 January 2018 for $135.5 and below are the year-end price data and annual dividends for the stock: Date Closing Price Annual Dividend 31 December 2017 135.5 3.6 31 December 2018 138.2 3.65 31 December 2019 136.8 3.5 31 December 2020 140.7 3.7 What is the standard deviation of returns on this stock over the 2018-2020 period? 0.0173 0.0005 0.0009 0.0212 O 0.0303arrow_forwardXYZ's stock price and dividend history are as follows: Beginning-of-Year Dividend paid at Price $ 102 122 92 102 Year 2018 2019 2020 2021 Year-End $4 Arithmetic average rate of return Geometric average rate of return 4 An investor buys three shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all four remaining shares at the beginning of 2021. 4 4 a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations.) Dollar-weighted rate of return b. What is the dollar-weighted rate of return? (Hint: Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. If your calculator cannot calculate internal rate of return, you will have to use trial i and error.) (Round your answer to 4…arrow_forwardThe following information is provided for Apolis Inc. Total common stockholders' equity on Dec. 31, 2020 $302,000 Total common stockholders' equity on Dec. 31, 2019 $288,000 Sales, 2020 $165,000 Total assets $605,000 Common shares outstanding, 2020 Dividends declared and paid, 2020 Market price per share, Dec. 31, 2020 If the payout ratio is .20, what is the return on equity? Select one: O O O a. 0.10 b. 0.09 c. 0.08 d. 0.07 « Previous 50,000 $6,000 $21 Save Answersarrow_forward

- The following is a collection of analyst forecasts of the eamings per share of WPB Corp, for Q3 2021. Calculate the EPS If the reported EPS for WPB Corp. is $26.0O, how should the stock price react? $23.10 $29.45 $37.15 $14.95 $32.99 F $25.60 $19.85 H. $33.35arrow_forwardShare commom stock dividend is $1.00 , g=5.4 and required return is 11.4%, What is the stock price?arrow_forwardBased on the given data, what is the returns for Company JFC? Company Dec. 30, 2020 Dec. 29, 2019 Dividends Returns (%) AC 395.00 301.00 5.00 JFC 88.90 55.00 2.50 O a. 66.18% Ob. 19.19% Oc. 32.89% d. 26.80%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education