FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

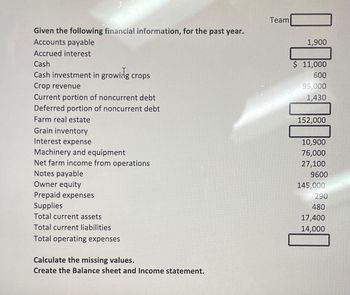

Transcribed Image Text:Given the following financial information, for the past year.

Accounts payable

Accrued interest

Cash

Cash investment in growing crops

Crop revenue

Current portion of noncurrent debt

Deferred portion of noncurrent debt

Farm real estate

Grain inventory

Interest expense

Machinery and equipment

Net farm income from operations

Notes payable

Owner equity

Prepaid expenses

Supplies

Total current assets

Total current liabilities

Total operating expenses

Calculate the missing values.

Create the Balance sheet and Income statement.

Team

1,900

$ 11,000

600

95,000

1,430

152,000

10,900

76,000

27,100

9600

145,000

290

480

17,400

14,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- Fitz Company reports the following information. Selected Annual Income Statement Data Selected Year-End Balance Sheet Data Net income $ 391,000 Accounts receivable decrease $ 27,200 Depreciation expense 44,200 Inventory decrease 46,000 Amortization expense 8,000 Prepaid expenses increase 6,400 Gain on sale of plant assets 7,100 Accounts payable decrease 8,200 Salaries payable increase 1,900 Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. Note: Amounts to be deducted should be indicated with a minus sign.arrow_forwardFitz Company reports the following information. Selected Annual Income Statement Data Net income Depreciation expense Amortization expense Gain on sale of plant assets Cash flows from operating activities Selected Year-End Balance Sheet Data $ 373,000 Accounts receivable decrease 49,400 Inventory decrease 8,300 Prepaid expenses increase 6,700 Accounts payable decrease Salaries payable increase Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Changes in current operating assets and liabilities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash $ 60,400 42,500 6,400 8,800 1,700 $arrow_forwardCash Flow RatiosSpencer Company reports the following amounts in its annual financial statements: Cash flow from operating activities $90,000 Capital expenditures $59,500* Cash flow from investing activities (68,000) Average current assets 136,000 Cash flow from financing activities (8,500) Average current liabilities 102,000 Net income 42,500 Total assets 255,000 * This amount is a cash outflowa. Compute Spencer's free cash flow.b. Compute Spencer's operating-cash-flow-to-current-liabilities ratio.c. Compute Spencer's operating-cash-flow-to-capital-expenditures ratio. Round ratios to two decimal points. a. Free cash flow Answer b. Operating-cash-flow-to-current-liabilities ratio Answer c. Operating-cash-flow-to-current-expenditures ratio Answerarrow_forward

- Cash receipts totaled $875,000 for property taxes and $292,500 from other revenue. Note: Enter debits before credits. Transaction General Journal Debit Credit 04 .arrow_forwardDays' cash on hand Financial statement data for years ending December 31 for Newton Company follow: 20Y9 20Y8 Cash (end of year) $25,500 $24,250 Short-term investments (end of year) 8,270 9,460 Operating expenses 60,135 63,780 Depreciation expense 13,225 11,400 Determine the days’ cash on hand for 20Y8 and 20Y9. Assume 365 days in a year. Round all calculations to one decimal place. Days’ Cash on Hand 20Y8: fill in the blank 1 66 days 20Y9: fill in the blank 2 daysarrow_forwardCash flow from operating activity????arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education