Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please need answer the general accounting question not use

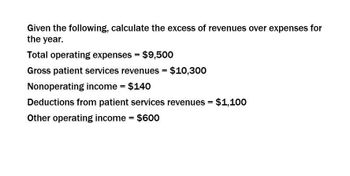

Transcribed Image Text:Given the following, calculate the excess of revenues over expenses for

the year.

Total operating expenses = $9,500

Gross patient services revenues = $10,300

Nonoperating income = $140

Deductions from patient services revenues = $1,100

Other operating income = $600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate FTE/AOB for the following results: If last year ratio was 4.82 – How does this year’s data compare? Inpatient Revenue $175,314,276 Inpatient Days 25,200 Outpatient Revenue $123,009,100 Productive labor hours 922,332 ( well explain all point of question and type the answer).arrow_forwardsarrow_forwardJefferson Memorial Hospital is an investment center as a division of Hospitals United. During the past year, Jefferson reported an after-tax income of $7 million. Total interest expense was $3,200,000, and the hospital tax rate was 30%. Total assets totaled $70 million, and non-interest-bearing current liabilities were $22,800,000. The required rate of return established by Jefferson is equal to 18% of invested capital. What is the residual income of Jefferson Memorial Hospital?arrow_forward

- Stay Handy company is a large company providing door to door delivery service forgroceries and other daily need items. In the most recent year, company had 60 millionmembers, through which provided it a revenue of $33,347 in the most recent year. Thedetails relating to Costs and expenses for the year were as follows:ParticularsCost of revenueSelling, general, and administrative expensesDepreciation and amortizationAmount (S in millions)§14 958S§7 9948,150Form the total cost of revenue 30% was fixed and the selling, general and administrativeexpenses are fixed to the extent of 70% to the number of members. How manymemberships does the company need to break-even? (All interim calculations and finalanswers should be rounded off to one decimal place)arrow_forwardPlease help me with show all calculation thankuarrow_forwardA company uses charging rates to allocate service department costs to the using departments. The accountant compiled the following information on one of the service departments: If Department K plans to use 1,350 hours of the service departments service in the coming year, how much of the service departments cost is allocated to Department K? a. 3,375 b. 27,300 c. 26,325 d. 23,950arrow_forward

- The accounts for this income year show the following:Income ($)Sales (excluding GST) 240,000Expenses ($)Cost of goods sold 130,000Interest on capital paid to Richard and Tracy 8,000Salary to Alice 25,000Superannuation to Alice 6,000Lease payments on car (excluding GST) 7,000Other deductible operating expenses (excluding GST) 14,000The leased car was used 80% of the time for business and 20% of the time for private purposes.Required:With reference to the facts above:A.Calculate the net income of the partnership.B.Show the allocation of net income to each of the three partners.C.You must refer to relevant legislation and/or case law in your answer.arrow_forwardGeneral accountingarrow_forwardConsider the following Information for the business Harry's Vintage Records. Actuals from the year ended 31st December 2021; Total Sales Revenue Total Fixed Costs $380,000 $90,000 0.20 Contribution Margin Ratio Calculate Harry's profit or loss in 2021 Select one: O a. (13,000) O b. 11,000 c. 12,000 d. (14,000)arrow_forward

- 6A. During the current year, Sokowski Manufacturing earned income of $489,887 from total sales of $5,104,801 and average capital assets of $10,251,147. What is the sales margin? Round to the nearest hundredth, two decimal places and submit the answer in a percentage.arrow_forwardsuppose you sell 8,000 of the 3 pack lenses described in question 3 above in one year. You cost on each 3 pack is $29.95 and you sell them for $59.95. if your operating expenses for the year total $144.080, what are your Net Income and Net profif margin percentage?arrow_forwardConsider the following information: Service Revenue for the year = $81,000. Of this amount, $70,500 is collected during the year and $10,500 is expected to be collected next year. Salaries Expense for the year = $41,000. Of this amount, $35,500 is paid during the year and $5,500 is expected to be paid next year. Advertising Expense for the year = $10,500. All of this amount is paid during the year. Supplies Expense for the year = $4,500. No supplies were purchased during the year. Utilities Expense for the year = $13,000. Of this amount, $11,500 is paid during the year and $1,500 is expected to be paid next year. Cash collected in advance from customers for services to be provided next year (Unearned Revenue) = $2,500.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning