Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

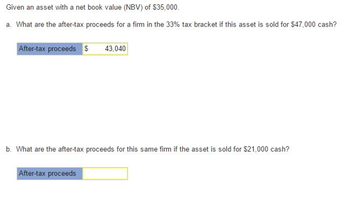

Transcribed Image Text:Given an asset with a net book value (NBV) of $35,000.

a. What are the after-tax proceeds for a firm in the 33% tax bracket if this asset is sold for $47,000 cash?

After-tax proceeds $ 43,040

b. What are the after-tax proceeds for this same firm if the asset is sold for $21,000 cash?

After-tax proceeds

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- am. 111.arrow_forwardAssume a firm has EBAT of $590,000, and no amortization. It is in a 40 percent tax bracket. a. Compute its cash flow. $ 354,000 b. Assume it has $590,000 in amortization. Recompute its cash flow. $ 590,000 c. How large a cash flow benefit did the amortization provide? $T] Cash flow Cash flow Benefit in cash flowarrow_forwardPlease give me answer accountingarrow_forward

- Suppose you sell a fixed asset for $109,000 when its book value is $129,000. If your company’s marginal tax rate is 21 percent, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)? (Enter your answer as a whole number.)arrow_forwardI need answer of this question general accountingarrow_forwardSuppose you sell a fixed asset...accounting questionsarrow_forward

- Suppose you sell a fixed asset for $125,000 when it's book value is $139,000. If your company's marginal tax rate is 30%, what will be the effect on cash flows of this sale (i.e., what will be the after-tax free cash flow of this sale)? a. $9,800 b. $14,000 c. $111,300 d. $129,200arrow_forwardSuppose you sell a fixed asset for $85,000 when it's book value is $100,000. If your company's marginal tax rate is 21%, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)? Multiple Choice A. $67,150 B. $100,000 C. $88,150 D. $15,000arrow_forwardPlease give solution for this accounting questionarrow_forward

- Suppose you sell a fixed asset for $312,000 when its book value is $102,000. If your company’s marginal tax rate is 35 percent, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)?arrow_forward?arrow_forwardA corporation with a 27% combined income tax rate is considering the following investment in research equipment. Prepare an after-tax cash flow table assuming MACRS depreciation. (a) What is the before-tax rate of return? (b) What is the after-tax rate of return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning