Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

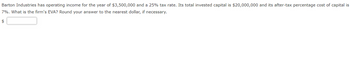

Transcribed Image Text:Barton Industries has operating income for the year of $3,500,000 and a 25% tax rate. Its total invested capital is $20,000,000 and its after-tax percentage cost of capital is

7%. What is the firm's EVA? Round your answer to the nearest dollar, if necessary.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company is considering purchasing a new piece of machinery at a cost $60,000. It is expected to generate revenues of $20,000 per year for 4 years against $3,000 of annual operating expenses. The machinery is MACRS 3-year property. The income tax rate is 25%. MARR is 10%. What is the EVA for year 3?arrow_forward8. CB Corp. is expected to generate net income of $40 million next year and will pay $20 million in after-tax interest expense next year. The company is expected to reinvest 20% of its after-tax operating earnings and will have return on capital (ROC) equal to 10% in perpetuity. If the weighted-average cost of capital for CB Corp. is 10% what is today's present value of the firm equal to? (a) $60 million. (b) $120 million. (c) $150 million. (d) $600 million.arrow_forwardPolymer Coating Enterprises has an operating income of $100,000 on revenues of $1,000,000. Average invested assets are $500,000 and the Company has an 8% cost of capital. What is the residual income?arrow_forward

- Genie Company has operating income after taxes of P50,000. It has P200,000 of equity capital, which has an after-tax weighted-average cost of 12%. Genie also has P10,000 of current liabilities (noninterest-bearing) and no long-term liabilities. What is the company's economic value added (EVA) for the period?arrow_forwardTom Inc. report a $30million of net income. its EBIT is 50millions, the flat tax rate is 25%? What was its interest expense (in million)?arrow_forwardBohr Paint Company has annual sales of $12 million per year. If there is a profit of $5000 per day with 7 days per week operation, what is the total yearly business expense? All calculations are on a before-tax basis.arrow_forward

- Thompson Trucking has $9 billion in assets, and its tax rate25%. Its basic earning power (BEP) ratio is 20%, and its returnon assets (ROA) is 5.25%. Whatis its time interest earned (TIF)ratio? Round you answer to twodecimal places.arrow_forwardLast year, Cayman Corporation had sales of $6 million, total variable costs of $2 million, and total fixed costs of $1 million. In addition, they paid $480,000 in interest to bondholders. Cayman has a 21% marginal tax rate. If Cayman's sales increase 6%, what should be the increase in operating income?arrow_forward(B) Based on the following information, how much does the company need in external funds for the upcoming fiscal year? The company has Sales $ 5,700, Costs 4,200, Current assets 3,900, Fixed assets 8,100, Current liabilities 2,200, Long-term debt 3,750, and Equity 6,050. Sales increase 15% for the upcoming fiscal year. Payout ratio is 40% and Tax rate is 34%.arrow_forward

- Your firm has total sales of $10,508. Costs are $6,062, depreciation expense is $1,188, and the interest expense is $650. The tax rate is 30 percent. Compute the firm's net profit margin. Assume there are no other expenses. Round your answer to FOUR decimal places. For example, if your answer is .2525 or 25.25%, your answer should be 0.2525.arrow_forwardCompany A unlevered value is $100 million. The tax rate is 30%. The debt cost ofcapital is 3% and the asset cost of capital is 6%.i. What is company A’s value if debt/assets is raised to 25% after aleveraged recapitalization. Assume debt is permanent.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education