ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

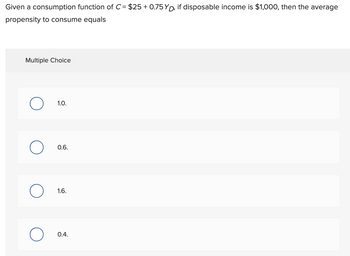

Transcribed Image Text:Given a consumption function of C= $25 +0.75 YD, if disposable income is $1,000, then the average

propensity to consume equals

Multiple Choice

1.0.

0.6.

1.6.

0.4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose a change in income of $5,100 causes a change in consumption of $2,600. What is the MPS? Multiple Choice 0.51 0.49 0.31 0.69arrow_forwardUse Lagrange multipliers to find expressions for x, and x₂ which maximise the utility function U = x/² + x1/² subject to the general budgetary constraint P₁x₁ + P₂x₂ = Marrow_forwardCourse: Introduction to Microeconomics Topic: Intertemporal Consumption DecisionsA consumer makes decision to consume in this year and next year. This year she has an income of M1 = $ 1.5 million and next year her income will be M2 = $ 2.75 million. Interest rate is 10%. Her intertemporal preferences are represented by function U(c1, c2) = c1*c2, whose intertemporal marginal rate of substitution is IMRS = c2/c1.a) Find and graph Budget Constraintb) Find and graph optimal consumption basket and indicate whether the consumer SAVES or BORROWS in the FIRST YEAR.c) Indicate whether following statement is true or false: "Any increase in interest rate will cause a decrease in consumer's welfare" Justify.d) If next year's income is maintained, how much would this year's income have to be for consumer to neither save nor borrow money at 10% interest rate?e) How much would interest rate have to be for consumer to consume exactly her initial endowment (M1 = $ 1.5 million and M2 = $ 2.75…arrow_forward

- Only Carrow_forwardSuppose that we have an economy with many identical households. There is a government that exogenously consumes some output and pays for it with lump sum taxes. Lifetime utility for a household is: U =InCt +ßlnCt+1 The household faces two within period budget constraints given by: Ct + St = Yt – Tt Ct+1 =Yt+1 -Tt+1 +(1+rt)St Use the Euler equation and intertemporal budget constraint to derive an expression for the consumption function. The government faces two within period budget constraints: (1) G_t + SG_t = T_t (2) G_(t+1) = T_(t+1) + (1 + r_t)SG_t In equilibrium, what must be true about S_t and SG_t?arrow_forwardIf the Marginal Propensity to Consume is 80%, then the Consumption Multiplier is .8 O 2 O 1.25 O 5 O 20 80 5 Parrow_forward

- If a $1000 increase in disposable income causes consumer spending to rise by $700, what is the marginal propensity to consume (MPC)? 0.60 0.50 0.85 O 0.70arrow_forwardHow does savings change with changes in y2? Provide some intuition behind this result.arrow_forwardSuppose that firm uses 3 units of labor (L) with 4 units of capital (K) in fixed proportion. Which of the following is correct? The law of diminishing MRTSLK holds and thus Lagrange multiplier method is applicable MRTSL,K is not well defined and thus Lagrange multiplier method is applicable The law of diminishing MRTSLK holds and capital and labor are perfect complements. O MRTSLK is not well defined and thus Lagrange multiplier method is not applicablearrow_forward

- Suppose that the least amount of goods and services that Roberto will consume in a year is $40,000.Roberto tends to save $0.30 of every dollar of disposable income that he makes. Use the given line to graph Roberto's consumption function for disposable income levels between $0 and $200,000. Move each endpoint to the appropriate spot on the graph.arrow_forwardU = c¹/² + Bc¹²/2 tt+1 A) Suppose that the household faces two within period budget constraints of the form: C++ 1 = Y++1 + (1+r)s Combine the two period budget constraints into one intertemporal budget constraint. B) Use the intertemporal budget constraint and this utility function to derive the Euler equation characterizing an optimal consumption plan. C) Use this Euler equation and the intertemporal budget constraint to derive a consumption function expressing cas a function of Y, Y₁+1, and rt.arrow_forwardIf Andrea’s disposable income increases from $600 to $700 and her level of personal consumption expenditures increases from $450 to $475. You may conclude that her marginal propensity to consume is: Group of answer choices 0.5 0.1 0.75 0.25arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education