ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

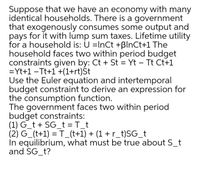

Transcribed Image Text:Suppose that we have an economy with many

identical households. There is a government

that exogenously consumes some output and

pays for it with lump sum taxes. Lifetime utility

for a household is: U =InCt +ßlnCt+1 The

household faces two within period budget

constraints given by: Ct + St = Yt – Tt Ct+1

=Yt+1 -Tt+1 +(1+rt)St

Use the Euler equation and intertemporal

budget constraint to derive an expression for

the consumption function.

The government faces two within period

budget constraints:

(1) G_t + SG_t = T_t

(2) G_(t+1) = T_(t+1) + (1 + r_t)SG_t

In equilibrium, what must be true about S_t

and SG_t?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 1 For the utility function U = (Qx0.5+Qy0.5)² and the budget 133 = 8Qx + 10Qy find the CHANGE in optimal consumption of Y if the price of X increases by a factor of 1.1. Please enter your response as a positive number with 1 decimal and 5/4 rounding (e.g. 1.15 1.2, 1.14 = 1.1).arrow_forwardfor small change in xarrow_forwardAnn's utility function is U = q1q2/(q1 + q2). Solve for her optimal values of q1 and q2 as a function of p1, p2 and Y.arrow_forward

- The utility function of a certain consumer is U =(x1,x2)= x11/3 x22/3 , x 1and x 2 is the consumption of two kinds of goods, and the consumer's income is 100. The current prices of the two kinds of goods are P 1 =1 and P 2=2 respectively, ask: 1. If the price of the first commodity increases from 1 to 2, and other factors remain unchanged, what is the total effect of the price increase on the consumption of the first commodity? According to the Slutsky decomposition principle, what are the income effect and substitution effect? 2. Calculate the amount of income compensation that changes the price of the first commodity from 1 to 2, keeping the original effect unchangedarrow_forwardSuppose that there are T periods to maximize over. Show that the intertemporal budget constraint is Ct+2 Yt+2 Yt+1 (1+r) (1+r)² (1 + r)² Ct + Ct+1 (1 + r) + 2+...+ Ct+T+1 (1+r)² \ T = Yt + + +...+ Yt+T+1 (1+r)arrow_forwardConsider a consumer who can borrow or lend freely at an interest rate of 100% per period of time (think of the period as being, say, 30 years, a bit like with a mortgage). So r = 1.0, or 100%. The consumer's two-period utility function is: U = In(ct) + (1/2)In(Ct+1) The consumer earn Y=100 each period, so Y₁=100 and Yt+1 also equals 100. If this consumer is behaving optimally, trying to maximize her lifetime utility subject to the IBC, what's her consumption in period t?arrow_forward

- Laffer curve In the 1980s, president Reagan based his tax and spending policies on supply side eonomics. The idea behind supply side economics is the marginal tax rate is so high it discourages work. Cutting the tax rate would end up increasing tax revenue. We develop a simple model of this idea to determine the restrictions on the utility function required to generate a Laffer curve. Let T denote the tax rate, w is the real wage rate and n the labor supply. The tax revenue is T=wnT where wn is labor income, which is the tax base. For convinience assume w is constant. There is no reason for this assumption to be true, but we impose it to focus on the restrictions on the utility function to generate the Laffer curve. As the tax rate T increases, workers substitute towards leisure and away from consumption. Hence as T rises, wn falls and tax revenues falls for high enough tax rates. Let U,V satisfy the standard assumptions. The model is static and households are endowed with one unit of…arrow_forwardEren’s two main hobbies are taking vacations overseas (V) and eating expensive meals (M). His utility function is given as: U(V,M) = V^2MLast year, the average price of taking a vacation overseas was US$200 and the average price of an expensive meal is $50. However, due to supply problems in Onions, the average price of an expensive meal rose to $75. The average price of a vacation did not change. His income, which is $1500, did not change. Suppose that the Department of Welfare wants to know how much should be given to Eren to offset his change un utility due to the price increase of an expensive meal. Calculate the compensative variation (CV).arrow_forwardThe one-period model with quasi-linear utility predicts that a decrease in marginal income tax rates could increase tax collection if:Group of answer choices Substitution effects dominate income effects so that the percent change in taxes is greater than the percent change in GDP Substitution effects dominate income effects so that the percent change in taxes is less than the percent change in GDP Income effect dominate substitution effects so that the percent change in taxes is less than the percent change in GDP Income effects dominate substitution effects so that the percent change in taxes is greater than the percent change in GDParrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education