Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

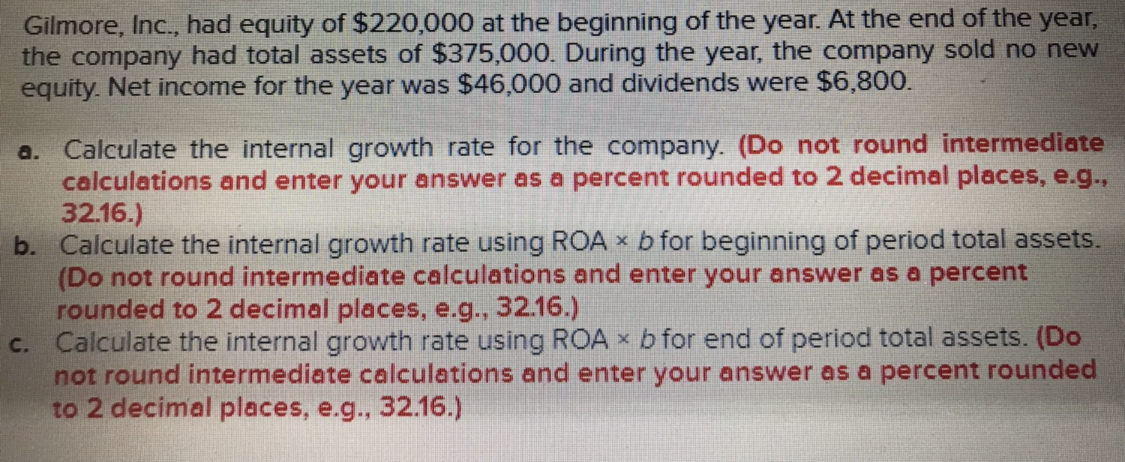

Transcribed Image Text:Gilmore, Inc., had equity of $220,000 at the beginning of the year. At the end of the year

the company had total assets of $375,000. During the year, the company sold no new

equity. Net income for the year was $46,000 and dividends were $6,800.

a. Calculate the internal growth rate for the company. (Do not round intermediate

b. Calculate the internal growth rate using ROA x b for beginning of period total assets.

c. Calculate the internal growth rate using ROA x b for end of period total assets. (Do

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

(Do not round intermediate calculations and enter your answer as a percent

rounded to 2 decimal places, e.g., 32.16.)

not round intermediate calculations and enter your answer as a percent rounded

to 2 decimal places, e.g., 32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Similar questions

- Last year Vaughn Corp. had sales of $315,000 and a net income of $17,832, and its year-end assets were $210,000. The firm's total-debt-to-total-assets ratio was 72.5%. Based on the DuPont equation, what was Vaughn's ROE? Select the correct answer. a. 31.11% b. 30.88% c. 30.19% d. 30.42% e. 30.65%arrow_forwardSwiss Group reports net income of $35,000 for the year. At the beginning of the year, Swiss Group had $160,000 in assets. By the end of the year, assets had grown to $210,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 14% return on assets? Complete this question by entering your answers in the tabs below. Return on Assets Group Perform What is Swiss Group's return on assets for the current year? Numerator: 1 1 Denominator: = Return on assetsarrow_forwardAt the beginning of its current fiscal year, Willie Corporation's balance sheet showed assets of $12,400 and liabilities of $6,400. During the year, liabilities decreased by $1,400. Net income for the year was $3,050, and net assets at the end of the year were $6,650. There were no changes in paid-in capital during the year. Required: Calculate the dividends, if any, declared during the year. Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. Stockholders' Equity Assets Liabilities + PIC RE Beginning: Changes: $ 12,400 = $ (750) = 6,400 + (1,400) + $ 0+ $ 6,000 0+ Changes: Ending: $ 11,650 = $ 5,000 + 0+ EA $ 3,050 +Net income (2,400) Dividends 6,650arrow_forward

- In its first five years of operations, Monster Hats reports the following net income and dividends (the first year is a net loss). Required: Calculate the balance of Retained Earnings at the end of each year. Note: Negative amounts should be indicated with a minus sign. Year 1 2 3 4 5 Net Income (Loss) for the Year $ Dividends for the Year (44,000) $ 59,000 93,000 130,000 155,000 0 0 23,000 23,000 36,000 € Ending Retained Earnings 95 Harrow_forward2 For the most recent year, Camargo, Inc., had sales of $562,000, cost of goods sold of $248,050, depreciation expense of $63,900, and additions of retained earnings of $76,300. The firm currently has 23,500 shares of common stock outstanding and the previous year's dividends per share were $1.45. Assuming a 22% income tax rate, what was the times interest earned ratio? (DO NOT round intermediate calculations and round your answer 10 2 decimal places, e.g., 32016 Times interest earned: ? timesarrow_forwardPresented below are three different transactions related to materiality. Explain whether you would classify these transactions as material. a. Blair Co. has reported a positive trend in earnings over the last 3 years. In the current year, it reduces its bad debt allowance to ensure another positive earnings year. The impact of this adjustment is equal to 3% of net income. b. Hindi Co. has an unusual gain of $3.1 million on the sale of plant assets and a $3.3 million loss on the sale of investments. It decides to net the gain and loss because the net effect is considered immaterial. Hindi Co.’s income for the current year was $10 million. c. Damon Co. expenses all capital equipment under $2,500 on the basis that it is immaterial. The company has followed this practice for a number of years.arrow_forward

- Last year Harrington Inc. had sales of $325,000 and a net income of $19,000, and its year- end assets were $250,000. The firm's total-debt-to-total-capital ratio was 47.5%. The firm finances using only debt and common equity, and its total assets equal total invested capital. Based on the DuPont equation, what was the ROE? Do not round your intermediate calculations. O 14.48% 13.03% O 14.91% O 17.08% 11.29%arrow_forwardFirm has the following revenues. Forecast the firm's year 4 revenue using the average annual growth rate. Year 1: $17,864. Year 2: $17,149. Year 3: $19,359.arrow_forwardGardial & Son has an ROA of 11%, a 5% profit margin, and a return on equity equal to 16%. What is the company's total assets turnover? What is the firm's equity multiplier? Do not round intermediate calculations. Round your answers to two decimal places. Total assets turnover: Equity multiplier:arrow_forward

- Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Ending Balance Balance Assets 138,000 334,000 572,000 806,000 398,000 246,000 $ 2,494,000 Cash 131,000 482,000 489,000 788,000 435,000 254, 000 $ 2,579,000 Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity 389,000 1,025,000 1,080,000 $ 2,494,000 341,000 1,025,000 1,213,000 $ 2,579,000 Total liabilities and stockholders' equity Joel de Paris, Inc. Income Statement $ 5,049,000 4,241,160 807,840 Sales Operating expenses Net operating income Interest and taxes: $ 125,000 202,000 Interest expense Тах expense 327,000 Net income 480,840arrow_forwardWildwoods, Inc. earned $1.50 per share five years ago. Its earnings this year were $3.20. What was the growth rate in earnings per share (EPS) over the 5-year period? show workarrow_forwardDo not use ai don'tarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education