Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please solve this problem

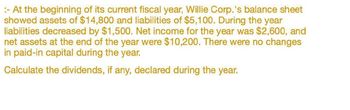

Transcribed Image Text::- At the beginning of its current fiscal year, Willie Corp.'s balance sheet

showed assets of $14,800 and liabilities of $5,100. During the year

liabilities decreased by $1,500. Net income for the year was $2,600, and

net assets at the end of the year were $10,200. There were no changes

in paid-in capital during the year.

Calculate the dividends, if any, declared during the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For the current year, Vidalia Company reported revenues of 250,000 and expenses of 225,000. At the beginning of the year, its retained earnings had a balance of 95,000. During the year, Vidalia paid 11,000 dividends to shareholders. Its contributed capital was 56,000 at the beginning of the year, and it did not issue any new stock during the year. Vidalias assets total 237,500 on December 31 of the current year. What are Vidalias total liabilities on December 31 of the current year?arrow_forwardAt the beginning of its current fiscal year, Willie Corporation' s balance sheet showed assets of $11, 100 and liabilities of $ 5,200. During the year, liabilities decreased by $800. Net income for the year was $2, 600, and net assets at the end of the year were $6,400. There were no changes in paid - in capital during the year. Required: Calculate the dividends, if any, declared during the year. Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effect.arrow_forwardAt the beginning of its current fiscal year, Willie Corp's balance sheet showed assets of $14,600 and liabilities of $5,400. During the year, liabilities decreased by $1,000. Net income for the year was $3.100, and net assets at the end of the year were $9,900. There were no changes in paid-in capital during the year. Required: Calculate the dividends, if any, declared during the year. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Stockholders' Equity Assets = Liabilities PIC RE Beginning: $ 14,600 $ 5,400 Changes: (1,000) + Ending:arrow_forward

- At the beginning of its current fiscal year, Willie Corporation's balance sheet showed assets of $12,400 and liabilities of $6,400. During the year, liabilities decreased by $1,400. Net income for the year was $3,050, and net assets at the end of the year were $6,650. There were no changes in paid-in capital during the year. Required: Calculate the dividends, if any, declared during the year. Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. Stockholders' Equity Assets Liabilities + PIC RE Beginning: Changes: $ 12,400 = $ (750) = 6,400 + (1,400) + $ 0+ $ 6,000 0+ Changes: Ending: $ 11,650 = $ 5,000 + 0+ EA $ 3,050 +Net income (2,400) Dividends 6,650arrow_forwardAt the beginning of its current fiscal year, Willie Corp.'s balance sheet showed assets of $11,900 and liabilities of $5,600. During the year, liabilities decreased by $900. Net income for the year was $3,100, and net assets at the end of the year were $7,100. There were no changes in paid-in capital during the year. Required: Calculate the dividends, if any, declared during the year.arrow_forwardAt the beginning of its current fiscal year, Willie Corporations balance sheet showed assets of $ 11, 100 and liabilities of $6,700. During the year, liabilities decreased by $700. Net income for the year was $2,700, and net assets at the end of the year were $4,700. There were no changes in paid - in capital during the year. Required:Calculate the dividends, if any, declared during the year. Indicate the financial statement effect.Note: Enter decreases with a minus sign to indicate a negative financial statement effect.\table[[, Assets, =, Liabilities,+, Stockholders' Equity], [, PIC,\table [[ + ], [ + ]], RE], [Beginning:,, 11, 100, , $, 6, 700, +, S, 0], [Changes: ,,,,, (700), +,, 0, +,], [Changes:], [Ending:,,, | =,,, | +,, 0, +,]] = Beginning: Changes: Changes: Ending: Assets = Liabilities + $ 11,100 = $ 6,700 + (700) + || 3 || Stockholders' Equity RE $ PIC 0 + 0 + 0 +arrow_forward

- Haresh Narrow_forwardCalculate dividends, if any, declared during the year from the given information: Wallace Corp balance sheet showed assets of P12,600 and liabilities of P6,300 at the beginning of its current fiscal year. During the year, liabilities decreased by P1,300. Net income for the year was P3,100, and net assets at the end of the year were P7,100. There were no changes in paid-in capital during the year.arrow_forwardNeed Answerarrow_forward

- . The following are the amounts of Care Corporation’s assets and liabilities at May 31, 2010 and its revenue and expenses for the year ended on that date, listed in alphabetical order. Care Corporation had share capital of P50,000 and accumulated profits of P87,390 on June 1, the beginning of the fiscal year. During the year, the corporation paid cash dividends of P25,000. Accounts payable P 48,320 Accounts receivable 68,840 Advertising expense 14,600 Cash 40,150 Insurance expense 12,000 Land 150,000 Miscellaneous expense 3,140 Notes payable 22,000 Prepaid insurance 2,000 Rent…arrow_forwardThe income statement for Dodson Corporation reported net income of $22,400 for the year ended December 31 before considering the following: During the year the company purchased available-for-sale securities. At year end, the fair value of the investment portfolio was $2,100 more than cost. The balance of Retained Earnings was $83,000 on January 1. . Dodson Corporation paid $9,000 in cash dividends during the year. Calculate the balance of Retained Earnings on December 31. 51,600arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning