FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

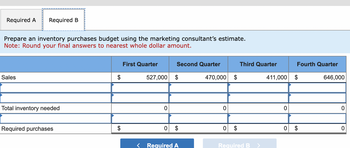

Transcribed Image Text:Required A Required B

Prepare an inventory purchases budget using the marketing consultant's estimate.

Note: Round your final answers to nearest whole dollar amount.

Sales

Total inventory needed

Required purchases

$

A

First Quarter

527,000 $

0

Second Quarter

0

Required A

470,000 $

0

0

$

Third Quarter

Required B >

411,000 $

0

Fourth Quarter

0

646,000

0

0

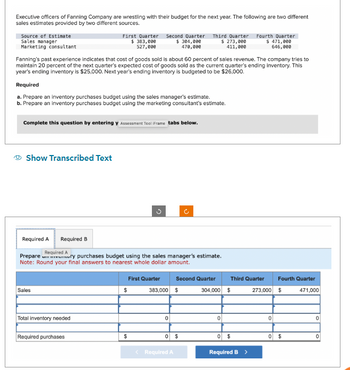

Transcribed Image Text:Executive officers of Fanning Company are wrestling with their budget for the next year. The following are two different

sales estimates provided by two different sources.

Source of Estimate

Sales manager

Marketing consultant

Fanning's past experience indicates that cost of goods sold is about 60 percent of sales revenue. The company tries to

maintain 20 percent of the next quarter's expected cost of goods sold as the current quarter's ending inventory. This

year's ending inventory is $25,000. Next year's ending inventory is budgeted to be $26,000.

Required

a. Prepare an inventory purchases budget using the sales manager's estimate.

b. Prepare an inventory purchases budget using the marketing consultant's estimate.

Complete this question by entering y Assessment Tool iFrame tabs below.

Show Transcribed Text

First Quarter Second Quarter

$ 383,000

$ 304,000

527,000

470,000

Sales

Required A Required B

Required A

Prepare y purchases budget using the sales manager's estimate.

Note: Round your final answers to nearest whole dollar amount.

Total inventory needed

Required purchases

$

$

First Quarter

383,000 $

0

0

Third Quarter Fourth Quarter

$ 273,000

$ 471,000

411,000

646,000

Required A

Second Quarter

$

304,000 $

0

Third Quarter

0 $

Required B

>

273,000

0

0

Fourth Quarter

471,000

$

$

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- T1o T12 T18 28 30 T36 TAO 18 16 20 22 24 126 32 34 38 To 2 91 Baab Corporation is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year: Beginning Balance Ending Balance 14,000 $ 27,000 $ 62,000 $ 22,000 9,000 77,000 Raw materials Work in process 24 $ Finished Goods The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year: kh Raw materials were purchased, $315,000. Raw materials were requisitioned for use in production, $307,000 ($281,000 direct and $26,000 indirect). The following employee costs were incurred: direct labor, $377,000; indirect labor, $96,000; and administrative salaries, $172,000. Selling costs, $147,000. Factory utility costs, $10,000. Depreciation for…arrow_forward20 TB MC Qu. 10-71 Thomas Enterprises... Thomas Enterprises purchased 58,300 pounds (cost = $378,950) of direct material to be used in the manufacture of the company's sole product. According to the production specifications, each completed unit requires five pounds of direct material at a standard cost of $6.80 per pound. Direct materials consumed by the end of the period totaled 55,800 pounds in the manufacture of 11,400 finished units. 5 Dints еВook An examination of Thomas' payroll records revealed that the company worked 23,100 labor hours (cost = $272,580) during the period, and specifications called for each completed unit requiring two hours of labor at a standard cost of $12.40 per hour. Use the information to compute the following variances. Print References Thomas' direct-labor rate variance was: Multiple Choice $13,860 F.arrow_forwardngage X * Cengag X Cengage X Cengage x MindTap x MindTar x G module x S ACC202 x v.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Show Me How Capital and Revenue Expenditures On August 5, GTS Co. paid $3,280 to repair the transmission on one of its delivery vans. In addition, GTS paid $57 to install a GPS system in its van. Journalize the entries for the transmission. If an amount box does not require an entry, leave it blank. August 5 Journalize the entry for GPS system expenditures. If an amount box does not require an entry, leave it blank. 88 August 5 Check My Work Previous 6:34 PM 11/27/2021 55°Farrow_forward

- Please do not give solution in image format thankuarrow_forwardThe balance sheet of Cattleman's Steakhouse shows assets of $104,400 and liabilities of $30,000. The fair value of the assets is $112.500 and the fair value of its liabilities is $30,000. Longhorn paid Cattleman's $140,000 to acquire all of its assets and liabilities. Longhorn-should record goodwill on this purchase of: Muitiple Choice $27,500. $41.100. $98,600.arrow_forward9q-5arrow_forward

- Determine the NPV, IRR, and MIRR for project X.arrow_forwardDete for Utuyox735, a large merchandiser, is below Sales are budgeted at $307,000 for November, $327,000 for December, and $227,000 for January . Collections are expected to be 60% in the month of sale and 40% in the month following the sale The cost of goods sold is 75% of sales . Utuyoz735 desires to have an ending merchandise Inventory at the end of each month equal to 90% of the next month's cost of goods soid. Payment for merchandise is made in the month flowing the purchase Other monthly expenses to be paid in cash are $22,800. Monthly depreciation is $29,500 . Ignore taxes. . (D#38127) Annet Cash Balance Sheet October 31 Accounts receivable. Merchandise inventory Property, plant and equipment, net of $624,000 accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity Q) What are the accounts payable for Utuyoz735 at the end of December? Multiple Choice F 35,000 85,500…arrow_forwardM Question 6- QUIZ- CH 18-C X Project 6 x .mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%252Fw... 18 es Saved Help Save Exercises 18-41 (Algo) Allocation of Central Costs; Profit Centers [LO 18-3] Woodland Hotels Incorporated operates four resorts in the heavily wooded areas of northern California. The resorts are named after the predominant trees at the resort: Pine Valley, Oak Glen, Mimosa, and Birch Glen. Woodland allocates its central office costs to each of the four resorts according to the annual revenue the resort generates. For the current year, the central office costs (000s omitted) were as follows: Front office personnel (desk, clerks, etc.) Administrative and executive salaries Interest on resort purchase Advertising Housekeeping Depreciation on reservations computer Room maintenance Carpet-cleaning contract Contract to repaint rooms $ 12,100 5,700 4,700 600 3,700 80 1,210 50 570 $ 28,710 Revenue (000s) Square…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education