FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:4.

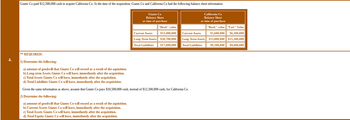

Giants Co paid $12,500,000 cash to acquire California Co. At the time of the acquisition, Giants Co and California Co had the following balance sheet information:

Giants Co

Balance Sheet

at time of purchase

"Book" value

Current Assets $13,400,000

Long-Term Assets $28,700,000

Total Liabilities $17,600,000

California Co

Balance Sheet

at time of purchase

Current Assets

Long-Term Assets

Total Liabilities

** REQUIRED:

1) Determine the following:

a) amount of goodwill that Giants Co will record as a result of the aquisition.

b) Long-term Assets Giants Co will have, immediately after the acquisition.

c) Total Assets Giants Co will have, immediately after the acquisition.

d) Total Liabilities Giants Co will have, immediately after the acquisition.

Given the same information as above, assume that Giants Co pays $10,500,000 cash, instead of $12,500,000 cash, for California Co.

2) Determine the following:

a) amount of goodwill that Giants Co will record as a result of the aquisition.

b) Current Assets Giants Co will have, immediately after the acquisition.

c) Total Assets Giants Co will have, immediately after the acquisition.

d) Total Equity Giants Co will have, immediately after the acquisition.

"Book" value "Fair" Value

$5,600,000 $6,100,000

$13,800,000 $15,300,000

$9,100,000 $9,600,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- COMPUTE FOR THE GOODWILL.arrow_forwardAcquisition Entries, Acquisition Costs, Bargain Gain Plastic Corporation is contemplating a business combination with Steel Corporation at December 31, 2021. Steel's condensed balance sheet on that date appears below: Assets Cash and receivables Inventory Equity method investments Land Buildings and equipment Patents Total assets Liabilities and Stockholders' Equity Liabilities Common stock Retained earnings Total liabilities and equity Cash and receivables Inventory Equity method investments Land Description Buildings and equipment Patents Goodwill Liabilities Required Prepare the journal entry to record the business combination of Plastic and Steel for each of the following acquisition costs and combination methods. (a) Plastic acquires Steel as a merger for $250,000 cash. Other direct cash acquisition costs are $20,000. General Journal Description Cash and receivables Inventory Equity method investments. Land Liabilities Cash Buildings and equipment Patents ÷ Description (b) Plastic…arrow_forwardGodoarrow_forward

- Use the following information for question 6 and 7: Marksman acquired 100 percent of Tribal Transit for P275,000. At the date of acquisition, Fast Transit had the following book and market values: Book Value Market Value Cash and Receivables P30,000 P30.000 Inventory 100,000 120,000 Plant Assets (net) 210,000 300,000 Current Liabilities (45,000) (45,000) Long-term Debt (115,000) (115,000) Common Stock (10,000) Retained Earnings (170,000) 6. What is the amount of the "Investment in Tribal Transit" account on Marksman's financial records at the acquisition date? 7. What amount of pre-acquisition earnings is eliminated in the acquisition date worksheet elimination?arrow_forwardHoolia Corporation acquires equipment and patents from another company for $50 million and records the acquisition as an asset acquisition. The equipment has a fair value of $19.20 million and the patents have a fair value of $28.80 million. Neither asset is nonqualifying. At what value does Hoolia record the equipment? Select one: a. $25.0 million b. $20.0 million c. $21.2 million d. $19.2 millionarrow_forwardStockton Company Adjusted Trial Balance December 31 Cash Accounts Receivable Prepaid Expenses Equipment Accumulated Depreciation Accounts Payable Notes Payable Bob Steely, Capital Bob Steely, Drawing Fees Earned Wages Expense Rent Expense Utilities Expense Depreciation Expense Miscellaneous Expense Totals Account Debit Credit No. Balances Balances 11 5,725 12 2,957 13 660 18 13,876 19 1,391 21 1,560 22 5,033 31 13,647 32 41 6,270 51 52 53 54 59 904 2,350 807 338 170 114 27,901 27,901arrow_forward

- On September 1, 2017, Winans Corporation acquired Aumont Enterprises for a cash payment of $700,000, At the time of purchase, Aumont's Balance sheet showed assets of $620,000 Liabilities of $200.000 and owners equity of $420,000, The fair value of Aumonts assets is estimated to be $800 000. Compute the amount of good will acquired by Winans. O S80 000 O $100.000 O $180 000 O All of the abovearrow_forwardNonearrow_forwardIn The Process Of the Acquisition, ABC Incorporation Paid In Cash the Following Expenses US Accounting fees 30,000 Travel expenses 10,000 Accounting fees (SEC) 10,000 SEC filing fees 20,000 Required: Prepare the journal entry to record the acquisition expensesarrow_forward

- Questions: a. How much is the Goodwill/Gain on Bargain Purchase? b. How much is the Consolidated Assets? c.arrow_forwardCASE 1 Presented below are the financial balances for the BonGiovi Company and the Terens Company as of December 31, 2017, immediately before BonGiovi acquired Terens. Also included are the fair values for Terens Company's net assets at that date (thousands of US$). Terens Compute consolidated retained earnings as a result of this acquisition. A) $1,160. Compute consolidated revenues immediately following the acquisition. BonGiovi Book Value Terens Book Value B) $1,170. 31.12.2017 31.12.2017 Fair Value 31.12.2017 C) $1,265. Cash 870 240 240 Receivables 660 600 600 D) $1,280. Inventory 1,230 420 580 Land 1,800 260 250 E) $1,650. Buildings (Net) 1,800 540 650 Equipment (net) 660 380 400 Accounts Payable (570) (240) (240) Accrued expenses (270) (60) Long term Liabilities (2,700) (1,020) (60) (1,120) Common Stock (1,980) A) $3,540. ($20par) B) $2,880. Common Stock ($5 (420) par) C) $1,170. Additional paid in (210) (180) capital D) $1,650. Retained earnings (1,170) (480) Revenue (2,880)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education