Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN: 9781305080577

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

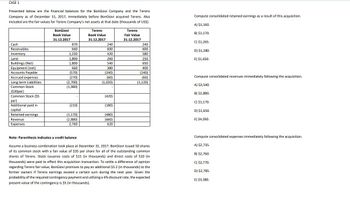

Transcribed Image Text:CASE 1

Presented below are the financial balances for the BonGiovi Company and the Terens

Company as of December 31, 2017, immediately before BonGiovi acquired Terens. Also

included are the fair values for Terens Company's net assets at that date (thousands of US$).

Terens

Compute consolidated retained earnings as a result of this acquisition.

A) $1,160.

Compute consolidated revenues immediately following the acquisition.

BonGiovi

Book Value

Terens

Book Value

B) $1,170.

31.12.2017

31.12.2017

Fair Value

31.12.2017

C) $1,265.

Cash

870

240

240

Receivables

660

600

600

D) $1,280.

Inventory

1,230

420

580

Land

1,800

260

250

E) $1,650.

Buildings (Net)

1,800

540

650

Equipment (net)

660

380

400

Accounts Payable

(570)

(240)

(240)

Accrued expenses

(270)

(60)

Long term Liabilities

(2,700)

(1,020)

(60)

(1,120)

Common Stock

(1,980)

A) $3,540.

($20par)

B) $2,880.

Common Stock ($5

(420)

par)

C) $1,170.

Additional paid in

(210)

(180)

capital

D) $1,650.

Retained earnings

(1,170)

(480)

Revenue

(2,880)

(660)

E) $4,050.

Expenses

2,760

620

Note: Parenthesis indicates a credit balance

Assume a business combination took place at December 31, 2017. BonGiovi issued 50 shares

of its common stock with a fair value of $35 per share for all of the outstanding common

shares of Terens. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in

thousands) were paid to effect this acquisition transaction. To settle a difference of opinion

regarding Terens fair value, BonGiovi promises to pay an additional $5.2 (in thousands) to the

former owners if Terens earnings exceed a certain sum during the next year. Given the

probability of the required contingency payment and utilizing a 4% discount rate, the expected

present value of the contingency is $5 (in thousands).

Compute consolidated expenses immediately following the acquisition.

A) $2,735.

B) $2,760.

C) $2,770.

D) $2,785.

E) $3,380.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ☐ Compute the investment to be recorded at the date of acquisition. A) $1,750. B) $1,755. C) $1,725. CASE 1 Presented below are the financial balances for the BonGiovi Company and the Terens Company as of December 31, 2017, immediately before BonGiovi acquired Terens. Also included are the fair values for Terens Company's net assets at that date (thousands of US$). D) $1,760. E) $1,765. Compute consolidated inventory immediately following the acquisition. BonGiovi Book Value 31.12.2017 Terens Book Value 31.12.2017 Terens Fair Value 31.12.2017 Cash 870 240 240 A) $1,650. Receivables 660 600 600 Inventory 1,230 420 580 B) $1,810. Land 1,800 260 250 C) $1,230. Buildings (Net) 1,800 540 650 Equipment (net) 660 380 400 Accounts Payable (570) (240) (240) Accrued expenses (270) (60) (60) D) $580. E) $1,830. Long term Liabilities (2,700) (1,020) (1,120) Common Stock (1,980) ($20par) Common Stock ($5 (420) par) Additional paid in (210) (180) capital B) $1,800. Retained earnings (1,170) (480)…arrow_forwardCASE 1 Presented below are the financial balances for the BonGiovi Company and the Terens Company as of December 31, 2017, immediately before BonGiovi acquired Terens. Also included are the fair values for Terens Company's net assets at that date (thousands of US$). Compute the consolidated cash upon completion of the acquisition. BonGiovi Book Value Terens Book Value 31.12.2017 31.12.2017 Terens Fair Value 31.12.2017 Cash 870 240 240 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (Net) 1,800 540 650 Equipment (net) 660 380 400 Accounts Payable (570) (240) (240) A) $1,350. Accrued expenses (270) Long term Liabilities (2,700) (60) (1,020) (60) (1,120) B) $1,110. Common Stock (1,980) ($20par) C) $1,080. Common Stock ($5 (420) par) D) $1,085. Additional paid in (210) (180) E) $ 635. capital Retained earnings (1,170) (480) Revenue (2,880) (660) Expenses 2,760 620 Note: Parenthesis indicates a credit balance Assume a business combination took place at December…arrow_forwardPresented below are the financial balances for the BonGiovi Company and the TerensCompany as of December 31, 2017, immediately before BonGiovi acquired Terens. Also included are the fair values for Terens Company's net assets at that date (thousands of US$). BonGiovi BV31.12.2017 Terens BV 31.12.2017 Terens FV 31.12.2017Cash 870 240 240Receivables 660 600 600Inventory 1,230 420 580Land 1,800 260 250Buildings (Net) 1,800…arrow_forward

- REQUIRED 1. Prepare a consolidated balance sheet for Pen Corporation and Subsidiary at December 31, 2011. 2. Compute consolidated net income for 2012 assuming that Pen Corporation reported separate income of $680,000 and Sut Company reported net income of $360,000. (Separate incomes do not include income from the investment in Sut.)arrow_forward1. What is the Consolidated Net Income for 2020? 2. What is the Consolidated Net Income for 2021?arrow_forwardOn January 1, 2012, Aspen Company acquired 80 percent of Birch Company's outstanding voting stock for $438,000. Birch reported a $457,500 book value and the fair value of the noncontrolling interest was $109,500 on that date. Also, on January 1, 2013, Birch acquired 80 percent of Cedar Company for $200,000 when Cedar had a $205,000 book value and the 20 percent noncontrolling interest was valued at $50,000. In each acquisition, the subsidiary's excess acquisition-date fair over book value was assigned to a trade name with a 30-year life. These companies report the following financial information. Investment income figures are not included. Sales: Aspen Company Birch Company Cedar Company Expenses: Aspen Company Birch Company Cedar Company Dividends declared: Aspen Company Birch Company Cedar Company 2012 $ 632,500 261,250 Not available $ 542,500 200,000 Not available $15,000 8,000 Not available 2013 2014 $747,500 327,250 $822,500 416,900 185,900 292,600 $522,500 $750,000 261,000…arrow_forward

- On December 18, 2017, Stephanie Corporation acquired 100 percent of a Swiss company for 4.0 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 CHF 1. On December 18, 2017, the book and fair values of the subsidiary's assets and liabilities were: Cash Inventory Property, plant & equipment Notes payable Stephanie prepares consolidated financial statements on December 31, 2017. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. a. CHF a. Determine the translation adjustment to be reported on Stephanie's December 31, 2017, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary's functional currency. What is the economic relevance of this translation adjustment? b. Determine the remeasurement gain or loss to be reported in Stephanie's 2017 consolidated net income, assuming that the U.S. dollar…arrow_forwardAlford Company and its 80 percent–owned subsidiary, Knight, have the following income statements for 2018:Additional Information for 2018• Intra-entity inventory transfers during the year amounted to $90,000. All intra-entity transfers were downstream from Alford to Knight.• Intra-entity gross profits in inventory at January 1 were $6,000, but at December 31 they are $9,000.• Annual excess amortization expense resulting from the acquisition is $11,000.• Knight paid dividends totaling $20,000.• The noncontrolling interest’s share of the subsidiary’s income is $9,800.• During the year, consolidated inventory rose by $11,000 while accounts receivable and accounts payable declined by $8,000 and $6,000, respectively.Using either the direct or indirect method, compute net cash flows from operating activities during the period for the business combination.arrow_forwardPritano Company acquired all the net assets of Succo Company on December 31, 2013, for $2,234,440 cash. The balance sheet of Succo Company immediately prior to the acquisition showed: Book value Fair value Current assets $ 962,320 $962,320 Plant and equipment 1,186,440 1,337,450 Total $2,148,760 $2,299,770 Liabilities $191,390 $214,050 Common stock 471,160 Other contributed capital 584,100 Retained earnings 902,110 Total $2,148,760 As part of the negotiations, Pritano agreed to pay the stockholders of Succo $385,210 cash if the post-combination earnings of Pritano averaged $2,234,440 or more per year over the next two years. The estimated fair value of the contingent consideration was $148,740 on the date of the acquisition. (a) Prepare the journal entry on the books of Pritano to record the acquisition on December 31, 2013. (If no entry is required, select…arrow_forward

- The balance sheet of the proprietorship of Jacob as of June 30, 2018 showed the following assets andliabilities:Cash P 40,000Accounts Receivable 53,600Inventory 88,000Equipment 65,600Accounts Payable 63,520The cash balance included a 200- share certificate of BW Resources common at acquisition cost of P 1,600; the current market quotation is 70 per share. Of the accounts receivable, an estimated 5% is considered to be doubtful of collection. Certain inventory items, booked at a cost of P22,960, are currently worth P16,000. Depreciation has not been recorded; the equipment, acquired two years ago, has a remaining useful life of about eight more years. Prepaid expense of P 12,800 and accrued expense of P 6,120 have not been properly recognized. Emily and Bert will join Jacob in a partnership. Jacob will invest the net assets of his business, after effecting the appropriate adjustments, and he will be allowed credit for goodwill equal to 10% of his initial capital credit. Emily and Bert…arrow_forwardjituarrow_forwardsub parts to be solved a) Liala Ltd acquired all the issued shares of Jordan Ltd on 1 January 2015. The following transactions occurred between the two entities: On 1 June 2016, Liala Ltd sold inventory to Jordan Ltd for $12,000, this inventory previously costed Liala Ltd $10,000. By 30 June 2016, Jordan Ltd had sold 20% of this inventory to other entities for $3,000. The other 80% was all sold to external entities by 30 June 2017 for $13,000. During the 2016–17 period, Jordan Ltd sold inventory to Liala Ltd for $6,000, this being at cost plus 20% mark-up. Of this inventory, 20 % remained on hand in Liala Ltd at 30 June 2017. The tax rate is 30%. b) On 1 July 2016, Liala ltd sold an item of plant to Jordan Ltd Ltd for $150,000 when its carrying value in Liala Ltd book was $200,000 (costs $300,000, accumulated depreciation $100,000). This plant has a remaining useful life of five (5) years form the date of sale. The group measures its property plants and equipment using a costs…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub