FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

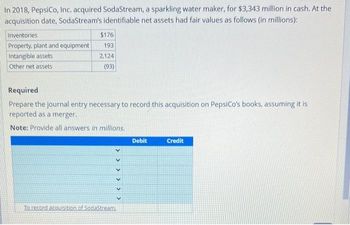

Transcribed Image Text:In 2018, PepsiCo, Inc. acquired SodaStream, a sparkling water maker, for $3,343 million in cash. At the

acquisition date, SodaStream's identifiable net assets had fair values as follows (in millions):

Inventories

$176

Property, plant and equipment

193

Intangible assets

2,124

Other net assets

(93)

Required

Prepare the journal entry necessary to record this acquisition on PepsiCo's books, assuming it is

reported as a merger.

Note: Provide all answers in millions.

To record acquisition of SodaStream.

くくくくくく

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Inventory Sales Investment income Cost of goods sold Operating expenses $ 620,000 $ Barone 420,000 1,240,000 1,040,000 not given 620,000 290,000 520,000 360,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $80,000 that was unrecorded on its accounting records and had a four-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $142,000 to Allister for $204,000. Of this amount, 10 percent remains unsold in Allister's warehouse at year- end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021: Inventory Sales Cost of goods sold Operating expenses Net income attributable to…arrow_forwardRR Records Inc. acquired all of DD Studios’ voting shares on January 1, 20x1, for P280,000. RR’s balance sheet immediately after the combination contained the following balances: (see image 1) DD’s balance sheet at acquisition contained the following balances: (see image 2) On the date of combination, the inventory held by DD had a fair value of P170,000, and its buildings and recording equipment had a value of P375, 000. Goodwill reported by DD resulted from a purchase of SS Enterprises in 20x1. SS was liquidated and its assets and liabilities were brought onto DD’s books. Compute the balance of Investment in DD Stock to be reported in the consolidated balance sheet immediately after the acquisition.arrow_forward1. The amount of goodwill (gain from a bargain purchase) resulting from the business combination is 2. On the date of acquisition, the NCI to appear in the consolidated statement of financial position is:arrow_forward

- Please Compute the Goodwill on the Acquisition Data. That is all of the Information that is needed for the question Also Please make sure it is correctarrow_forwardAcquisition Entries, Acquisition Costs, Bargain Gain Plastic Corporation is contemplating a business combination with Steel Corporation at December 31, 2021. Steel's condensed balance sheet on that date appears below: Assets Cash and receivables Inventory Equity method investments Land Buildings and equipment Patents Total assets Liabilities and Stockholders' Equity Liabilities Common stock Retained earnings Total liabilities and equity Cash and receivables Inventory Equity method investments Land Description Buildings and equipment Patents Goodwill Liabilities Required Prepare the journal entry to record the business combination of Plastic and Steel for each of the following acquisition costs and combination methods. (a) Plastic acquires Steel as a merger for $250,000 cash. Other direct cash acquisition costs are $20,000. General Journal Description Cash and receivables Inventory Equity method investments. Land Liabilities Cash Buildings and equipment Patents ÷ Description (b) Plastic…arrow_forwardPlease do not give image formatarrow_forward

- In The Process Of the Acquisition, ABC Incorporation Paid In Cash the Following Expenses US Accounting fees 30,000 Travel expenses 10,000 Accounting fees (SEC) 10,000 SEC filing fees 20,000 Required: Prepare the journal entry to record the acquisition expensesarrow_forwardQuestions: a. How much is the Goodwill/Gain on Bargain Purchase? b. How much is the Consolidated Assets? c.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education