Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

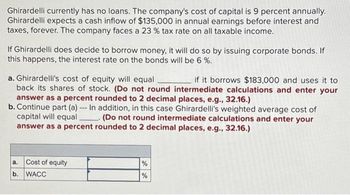

Transcribed Image Text:Ghirardelli currently has no loans. The company's cost of capital is 9 percent annually.

Ghirardelli expects a cash inflow of $135,000 in annual earnings before interest and

taxes, forever. The company faces a 23 % tax rate on all taxable income.

If Ghirardelli does decide to borrow money, it will do so by issuing corporate bonds. If

this happens, the interest rate on the bonds will be 6%.

a. Ghirardelli's cost of equity will equal

if it borrows $183,000 and uses it to

back its shares of stock. (Do not round intermediate calculations and enter your

answer as a percent rounded to 2 decimal places, e.g., 32.16.)

b. Continue part (a) -- In addition, in this case Ghirardelli's weighted average cost of

capital will equal (Do not round intermediate calculations and enter your

answer as a percent rounded to 2 decimal places, e.g., 32.16.)

a. Cost of equity

b. WACC

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Bellwood Company is financed entirely with equity. The company is considering a loan of $4.5 million. The loan will be repaid in equal principal installments over the next two years and has an interest rate of 7 percent. The company's tax rate is 24 percent. According to MM Proposition I with taxes, what would be the increase in the value of the company after the loan? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Increase in the valuearrow_forwardMeyer & Co. expects its EBIT to be $115,000 every year forever. The firm can borrow at 7 percent. The company currently has no debt, and its cost of equity is 13 percent. a. If the tax rate is 24 percent, what is the value of the firm? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What will the value be if the company borrows $255,000 and uses the proceeds to repurchase shares? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardGypco expects an EBIT of $10,000 every year forever. Gypco can borrow at 7 percent. Suppose Gypco currently has no debt and its cost of equity is 17 percent. The corporate tax rate is 35 percent. What will the value of the firm if Gypco borrows $15,000 and uses the proceeds to purchase stock?arrow_forward

- Bruce & Co. expects its EBIT to be $100,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Given the above information; a) Complete the table given below for varying levels of debt below by using a mix of the given information and using your own computations. EBIT $100,000.00 Cost of debts 11% cost of equity when unlevered 18% Tax rate 31% Debts $0 $10,000.00 $20,000.00 $30,000.00 Cost of Equity when levered Equity D/E Vu VL WACC b) Plot the results from the table into the following two graphs:i) Value of the firm vis-à-vis- Total debtii) Cost of capital of the firm vis-à-vis D/E ratio.iii) Which MM propositions have you demonstrated?arrow_forwardBruce & Co. expects its EBIT to be $100,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Given the above information; a) Complete the table given below for varying levels of debt below by using a mix of the given information and using your own computations. EBIT $100,000.00 Cost of debts 11% cost of equity when unlevered 18% Tax rate 31% Debts $0 $10,000.00 $20,000.00 $30,000.00 Cost of Equity when levered Equity D/E Vu VL WACC b) Plot the results from the table into the following two graphs:i) Value of the firm vis-à-vis- Total debtii) Cost of capital of the firm vis-à-vis D/E ratio.iii) Which MM propositions have you demonstrated? Please show the graphs.arrow_forwardCede & Co. expects its EBIT to be $83,000 every year forever. The firm can borrow at 11 percent. The firm currently has no debt, and its cost of equity is 15 percent. a. If the tax rate is 25 percent, what is the value of the firm? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What will the value be if the company borrows $144,000 and uses the proceeds to repurchase shares? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- Hunter Corporation expects an EBIT of $30,000 every year forever. The company currently has no debt and its cost of equity is 14 percent. The tax rate is 20 percent. The company is able to borrow at 8 percent. What will the value of the company be if it takes on debt equal to 60 percent of its levered value? [Note: the proceeds from issuing new debt are used to repurchase Hunter's equity.] O $251,488.1 $194,805.2 O $274,285.8 O $171,428.6arrow_forwardCompany B currently has $25 million in debt outstanding. In addition to 9.0% interest, it plans to repay 6% of the remaining balance each year. If Company B has a marginal corporate tax rate of 38%, and if the interest tax shields have the same risk as the loan, what is the present value of the interest tax shield from the debt?arrow_forwardA company expects EBIT of 200000 every year into perpetuity. The firm currently has no debt, but it can borrow at 10% per annum. The company's cost of equity is 25% and the company is subject to a corporate tax rat of 35%. If the company borrows 200,000 and uses the proceeds to repurchase equity, the value of the company would be:arrow_forward

- Please answer the following urgently : Bruce & Co. expects its EBIT to be $100,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Given the above information; a) Complete the table given below for varying levels of debt below by using a mix of the given information and using your own computations. EBIT $100,000.00 Cost of debts 11% cost of equity when unlevered 18% Tax rate 31% Debts $0 $10,000.00 $20,000.00 $30,000.00 Cost of Equity when levered Equity D/E Vu VL WACC b) Plot the results from the table into the following two graphs:i) Value of the firm vis-à-vis- Total debtii) Cost of capital of the firm vis-à-vis D/E ratio.iii) Which MM propositions have you demonstrated?arrow_forwardThe CFO of Kendrick Enterprises, is evaluating a 10-year, 7.6 percent loan with gross proceeds of $6,400,000. The interest payments on the loan will be made annually. Flotation costs are estimated to be 2.7 percent of gross proceeds and will be amortized using a straight-line schedule over the 10-year life of the loan. The company has a tax rate of 23 percent and the loan will not increase the risk of financial distress for the company. a. Calculate the net present value of the loan excluding flotation costs. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Calculate the net present value of the loan including flotation costs.arrow_forwardICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 9 years to maturity that is quoted at 107 percent of face value. The issue makes semiannual payments and has an embedded cost of 6.6 percent annually. What is the company's pretax cost of debt? If the tax rate is 24 percent, what is the aftertax cost of debt? Pretax cost of debt: __________% Aftertax cost of debt: __________%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education