Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Need typed answer only.Please give answer within 45 minutes

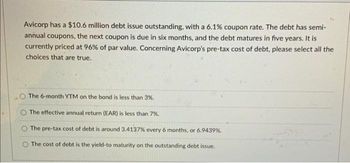

Transcribed Image Text:Avicorp has a $10.6 million debt issue outstanding, with a 6.1% coupon rate. The debt has semi-

annual coupons, the next coupon is due in six months, and the debt matures in five years. It is

currently priced at 96% of par value. Concerning Avicorp's pre-tax cost of debt, please select all the

choices that are true.

The 6-month YTM on the bond is less than 3%.

The effective annual return (EAR) is less than 7%.

The pre-tax cost of debt is around 3.4137% every 6 months, or 6.9439%.

The cost of debt is the yield-to maturity on the outstanding debt issue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please do the required and bonus either way and please all the tables to be copy and pasted to a word document so I can editarrow_forwardCan someone help who knows how to use Excel?? Thank you. Mainly need help with the formulas and how to write them. Help with d. i. and k.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- PLEASE ANSWER ASAP!!arrow_forwardChrome File Edit View History Bookmarks Tab Profiles Window Help Inbox (240) - abigailoforiwaa X M Gmail × | QuickLaunchSSO:: Single Sig x M Question 13 - Mid-Term Exam x On December 1, Jasmin Erns Ne ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 13 Refer to Apple's financial statements in Appendix A to answer the following. Skipped Help Save & Exit 1. For the fiscal year ended September 28, 2019, what amount is credited to Income Summary to summarize its revenues earned? 2. For the fiscal year ended September 28, 2019, what amount is debited to Income Summary to summarize its expenses incurred? 3. For the fiscal year ended September 28, 2019, what is the balance of its Income Summary account before it is closed? 1. Amount credited to income summary 2. Amount debited to income summary Ask 3. Balance in income summary account Mc с $ tv MacBook Pro G Search or type URL & ☆ Aa Carrow_forwardCan I get help plz and can you email me I have 2 more questions if possible gutierrezfj48@yahoo.comarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardI have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Please answer this simple questionarrow_forwardA man gets an inyoice for $460 with terms 3/10, 1/15, n/30. How much would he pay 8 days after the invoice dáte? (Round to the nearest cent as needed) The net amount due is $ CoC-oalalala Help Me Solve This Calculator Get More Help - Clear All Check Answer Pearson 2:43 PM P Type here to search 75°F 9/10/2021 DELL prt se home Insert delete backspace 6. 8 9. R Y U D F\ K V pg up alt ctrlarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education