Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Accounting.....

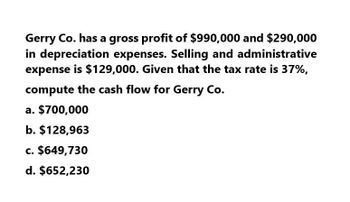

Transcribed Image Text:Gerry Co. has a gross profit of $990,000 and $290,000

in depreciation expenses. Selling and administrative

expense is $129,000. Given that the tax rate is 37%,

compute the cash flow for Gerry Co.

a. $700,000

b. $128,963

c. $649,730

d. $652,230

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Fancial account give me answer.....arrow_forwardBenson, Inc., has sales of $44830, costs of $14,370, depreciatior and interest expense of $2,390. The tax rate if 23 percent. What is the operating cash flow, or OCF?arrow_forwardGraff, Incorporated, has sales of $41,680, costs of $13,560, depreciation expense of $2,910, and interest expense of $2,120. The tax rate is 24 percent. What is the operating cash flow, or OCF? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Operating cash flow $ 17,548arrow_forward

- Helparrow_forwardThe Rogers Corporation has a gross profit of $704,000 and $343,000 in depreciation expense. The Evans Corporation also has $704,000 in gross profit, with $47,300 in depreciation expense. Selling and administrative expense is $191,000 for each company. a. Given that the tax rate is 40 percent, compute the cash flow for both companies Cash Flow Rogers= Cash Flow Evans= b. Calculate the difference in cash flow between the two firmsarrow_forwardDuring the year, Pharr Corporation had sales of $459,000. Costs were $388,000 and depreciation expense was $102,800. In addition, the company had an interest expense of $79.250 and a tax rate of 21 percent. What is the operating cash flow for the year? Ignore any tax loss carry-forward provisions. Multiple Choice $72,733 $77,768 O $15,071arrow_forward

- Answer? ? General Accounting questionarrow_forwardWhat is the net income of pinakin inc.?arrow_forwardThe Rogers Corporation has a gross profit of $770,000 and $297,000 in depreciation expense. The Evans Corporation also has $770,000 in gross profit, with $45,500 in depreciation expense. Selling and administrative expense is $252,000 for each company. a. Given that the tax rate is 40 percent, compute the cash flow for both companiesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning