FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I need this question financial accounting

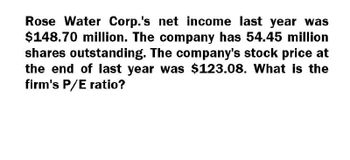

Transcribed Image Text:Rose Water Corp.'s net income last year was

$148.70 million. The company has 54.45 million

shares outstanding. The company's stock price at

the end of last year was $123.08. What is the

firm's P/E ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rutland Corp's stock price at the end of last year was $30.25 and its earnings per share for the year were $2.45. What was its P/E ratio?arrow_forwardSong Corp's stock price at the end of last year was $28.75 and its earnings per share for the year were $1.30. What was its P/E ratio? a. 27.64 b. 22.12 c. 17.69 d. 23.00 e. 18.80arrow_forwardRand Corp's stock price at the end of last year was $40.00, and its book value per share was $24.50. What was its Market/Book ratio?arrow_forward

- Ames, Inc., has a current stock price of $58. For the past year, the company had a net income of $8,400,000, total equity of $25,300,000, sales of $52,800,000, and 4.6 million shares of stock outstanding. a. What are earnings per share (EPS)? b. What is the Price-earnings ratio? c. What is the Price sales ratio? d. What is Book value per share?arrow_forwardRiggins Trucking, Inc. has a current stock price of $41. For the past year, the company had a net income of $5,150,000, total equity of $21,580,000, sales of $39,000,000, and 4.1 million shares of stock outstanding. What is the price-sales ratio? What do market ratios measure? Want detailed answerarrow_forwardWhat is the price sales ratio?arrow_forward

- Pfizer, Inc. (PFE) has earnings per share of $2.09 and a P/E ratio of 11.02. What is the stock price?arrow_forwardZero Corp's total common equity at the end of last year was $430,000 and its net income was $70,000. What was its ROE?arrow_forwardLast year Justine Corp. had sales of P315,000 and a net income of P17,382 and its year-end assets were P210,000. Justine's total-debt-to-total-assets ratio was 42.5%. Based on the Du Pont equation, what was Justine's return on equity (ROE)?arrow_forward

- General Accountingarrow_forwardNational Company's net income last year was P75,000. The company paid preferred dividends of P12,000 and its average common stockholders' equity was P480,000. The company's return on common stockholders' equity for the year was closest to:arrow_forwardReagan Corp has net income of $843,800 for the year. Their share price is $13.54 and they have 311,890 outstanding. What is the firm's price-earnings ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education