Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

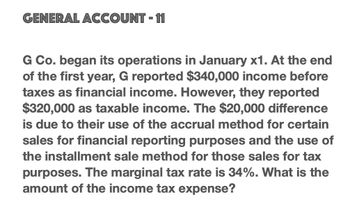

Transcribed Image Text:GENERAL ACCOUNT - 11

G Co. began its operations in January x1. At the end

of the first year, G reported $340,000 income before

taxes as financial income. However, they reported

$320,000 as taxable income. The $20,000 difference

is due to their use of the accrual method for certain

sales for financial reporting purposes and the use of

the installment sale method for those sales for tax

purposes. The marginal tax rate is 34%. What is the

amount of the income tax expense?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During the year, Madison began offering warranties on its products and has a Warranty liability for financial reporting purposes of 5,000 at the end of the year. Warranty expenses are not deductible until paid for income tax purposes. Prepare the journal entry to record Madisons income taxes at the end of the year.arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardhfgarrow_forward

- Range Rover Inc. had taxable income of $152,000 for the year. The GAAP basis of accounts receivable (net) $9,600 less than the tax basis of accounts receivable. Assuming a tax rate of 25%, record the income tax journal entry on December 31. Assume zero beginning balances in deferred tax accounts Note: faline in a journal entry ant required for the transaction select N/A as the account names and leave the Dr. and Cr. answers blank (zero) Dr. Account Name Date Dec 31 income Tax Expose Income Tax Payate Deferred Tax Asset Tocesant incomearrow_forwardDomesticarrow_forwardThe following information pertains to Ramesh Company for the current year: Book income before income taxes $ 1,06,000 Income tax expense 45,500 Income taxes due for this year 28,000 Statutory income tax rate 35% The company has one permanent difference and one temporary difference between the book and taxable income. a. Calculate the amount of temporary difference for the year and indicate whether it causes book income to be more or less than taxable income. b. Calculate the amount of permanent difference for the year and indicate whether it causes book income to be more or less than taxable income. c. Provide the journal entry to record income tax expenses for the year. d. Compute the effective tax rate (that is, income tax expense divided by book income before taxes).arrow_forward

- Hello tutor can you answer this account query?arrow_forwardFor the current year, LNS corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End Cumulative Taxable Income First $ 1,860,000 Second 2,620,000 Third 3,510,000 What are LNS’s minimum first, second, third, and fourth quarter estimated tax payments, using the annualized income method? (Enter all amounts as positive values. Leave no answer blank. Enter zero if applicable. Round "Annualization Factor" for Fourth quarter to 7 places. Round other intermediate computations and final answers to the nearest whole dollar amount.)arrow_forwardRecording Income Tax Expense Rangee Rover Inc. had taxable income of $218,500 for the year. The GAAP basis of accounts receivable (net) is $13,800 less than the tax basis of accounts receivable. Assuming a tax rate of 25%, record the income tax journal entry on December 31. Assume zero beginning balances in deferred tax accounts. • Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name Cr. Dec. 31 Income Tax Expense Deferred Tax Liability Income Tax Payable N/A To record income tax expense. > > Dr. 54,625 0 0 O 0x 13,800 * 40,825 * 0arrow_forward

- For the current year, LNS corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End First Second Third What are LNS's minimum first-, second-, third-, and fourth-quarter estimated tax payments, using the annualized income method? Note: Enter all amounts as positive values. Leave no answer blank. Enter zero if applicable. Round "Annualization Factor" for Fourth quarter to 7 places. Round other intermediate computations and final answers to the nearest whole dollar amount. Installment First quarter Second quarter Cumulative Taxable Income $ 1,000,000 1,600,000 2,400,000 Third quarter Fourth quarter Taxable Income Annualization Factor Annual Estimated Taxable Income $ $ $ $ 0 0 0 0 Tax on Estimated Taxable Income Percentage of Tax Required to be Paid Required Cumulative Payment % $ |% $ % $ % $ 0 0 0 0 Prior Cumulative Payments Required Estimated Tax Paymentarrow_forwardCalculate the balance in the company’s deferred income tax liability account at the end of each year.arrow_forwardFor the current year, LNS corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End First Second Third Installment Cumulative Taxable Income $1,000,000 1,600,000 2,400,000 What are LNS's minimum first, second, third, and fourth quarter estimated tax payments determined using the annualized income method? (Enter all amounts as positive values. Leave no answer blank. Enter zero if applicable. Round "Annualization Factor" for Fourth quarter to 7 places. Round other intermediate computations and final answers to the nearest whole dollar amount.) First quarter Second quarter Third quarter Fourth quarter Taxable Annualization Income Factor $ 1,000,000 1,000,000 1,600,000 2,400,000 Annual Est. Taxable Income $4,000,000 4 $4,000,000 2 $3,200,000 1.3300000 $3,192,000 Answer is complete but not entirely correct. Tax on Estimated Taxable Income 4 $ 1,360,000 1,360,000 1,088,000 1,088,000 $ $ X Percentage of Tax Required to be Paid 25 % 50 %…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning