Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

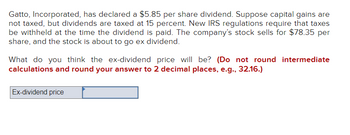

Transcribed Image Text:Gatto, Incorporated, has declared a $5.85 per share dividend. Suppose capital gains are

not taxed, but dividends are taxed at 15 percent. New IRS regulations require that taxes

be withheld at the time the dividend is paid. The company's stock sells for $78.35 per

share, and the stock is about to go ex dividend.

What do you think the ex-dividend price will be? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

Ex-dividend price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Fourth Corp. is evaluating extra cash dividends versus share repurchases. In either case, $6,675 will be spent. Current earnings are $2.8 per share and the stock currently sells for $67 per share. There are 1,500 shares outstanding. Ignore taxes and any information asymmetry in the financial market. Which of the following is correct? Group of answer choices Shareholder wealth is the same regardless of which payout policy is chosen. Shareholder wealth will be lower if the firm repurchases shares because shares outstanding is reduced as a result of the repurchase. Shareholder wealth will be lower if the firm pays extra cash dividends because share price is lower. Shareholder wealth will be higher if the firm repurchases shares because repurchases can boost share price.arrow_forward↑ You are a shareholder in a C corporation. The corporation earns $2.05 per share before taxes. Once it has paid taxes it will distribute the rest of its earnings to you as a dividend Assume the corporate tax rate is 25% and the personal tax rate on all income is 20% How much is left for you after all taxes are paid? The amount that remains is $ per share. (Round to the nearest cent.)arrow_forwardSusan Corp wants to pay dividends to their investors . On July 23, 2021, the company publicly announces that the company is going to pay the dividend to investors on record as of September 1, 2021. The dividend will be paid to investors on September 10, 2021. On what date will Susan Corp reduce retained earnings for these dividends? Group of answer choices July 23 September 1 September 10 December 31 Retained earnings is not reduced by dividends.arrow_forward

- You are a shareholder in a C corporation. The corporation earns $4 per share before taxes. Once it has paid taxes, it will distribute the rest of its earnings to you as a dividend. The corporate tax rate is 21%, and the personal tax rate on dividend income is 20%. How much is left for you after all taxes are paid? The amount that remains is $ _ per share. (Round to 2 decimals.)arrow_forwardCharleston Corporation (CC) now operates as a "regular" corporation, but it is considering a switch to S Corporation status. CC is owned by 100 stockholders who each hold 1% of the stock, and each faces a personal tax rate of 24%. The firm carns $3,000,000 per year before taxes, and since it has no need for retained earnings, it pays out all of its earnings as dividends. Assume that the corporate tax rate is 34% and the personal tax rate is 24%. How much more (or less) spendable income would each stockholder have if the firm elected S Corporation status? a. $7,752 b. $2,472 $9.732 d $5,472 & $3,000arrow_forward1) During 2022, Matador declared preferred dividends of $70,000, paid $90,000 for dividends, and received $135,000 for dividends on available-for-sale equity securities. The bookkeeper did not include any of these when calculating ICO. Determine the adjustment to ICO. Matador has a corporate tax rate of 30%.arrow_forward

- You are a shareholder in a C corporation. The corporation eams $1.74 per share before taxes. Once it has paid taxes, it will distribute the rest of its earnings to you as a dividend The corporate tax rate is 40%, and your personal tax rate on (both dividend and non-dividend) income is 30% How much is left for you after all taxes are paid? The amount that remains is Sper share (Round to the nearest cont) Grearrow_forwardVijay shiyalarrow_forwardWyatt Oil pays a regular dividend of $2.0 per share. Typically, the stock price drops by $2.20 per share when the stock goes ex-dividend. Suppose the capital gains tax rate is 24%, but investors pay different tax rates on dividends. Absent transactions cost, the highest dividend tax rate of an investor who could gain from trading to capture the dividend is closest to (%) (2 decimal places):arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education