Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

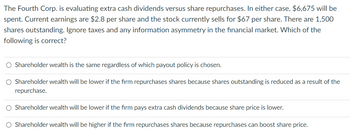

Transcribed Image Text:The Fourth Corp. is evaluating extra cash dividends versus share repurchases. In either case, $6,675 will be

spent. Current earnings are $2.8 per share and the stock currently sells for $67 per share. There are 1,500

shares outstanding. Ignore taxes and any information asymmetry in the financial market. Which of the

following is correct?

Shareholder wealth is the same regardless of which payout policy is chosen.

Shareholder wealth will be lower if the firm repurchases shares because shares outstanding is reduced as a result of the

repurchase.

O Shareholder wealth will be lower if the firm pays extra cash dividends because share price is lower.

O Shareholder wealth will be higher if the firm repurchases shares because repurchases can boost share price.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Cliff Corp (CC) has assets of $300 million including $25 million in cash. CC has 1 million share of stock outstanding and $70 million of debt. Assume capital markets are perfect. What is CC’s current debt-to-equity ratio? What is CC’s current stock price? If CC distributes $18 million in dividends, then what is the new ex- dividend share price? If instead of paying the dividend CC repurchases $18 million of stock, then what will be the new share price? What is the new debt-to-equity ratio after the payout?arrow_forwardAt the present time, Tamin Enterprises does not have any preferred stock outstanding but is looking to include preferred stock in its capital structure in the future. Tamin has found some institutional investors that are willing to purchase its preferred stock issue provided that it pays a perpetual dividend of $13 per share. If the investors pay $100.15 per share for their investment, then what is Tamin's cost of preferred stock?arrow_forwardTecumseh Inc. is analyzing the possible merger with Devonshire Inc. Savings from the merger are estimated to be a one-time after-tax benefit of $156 million. Devonshire Inc. has 5.2 million shares outstanding at a current market price of $82 per share. What is the maximum cash price per share that could be paid for Devonshire Inc.? (Omit "$" sign in your response.) Maximum cash price per share $arrow_forward

- REH Corporation's most recent dividend was $2.82 per share, its expected annual rate of dividend growth is 5%, and the required return is now 15%. A variety of proposals are being considered by management to redirect the firm's activities. Determine the impact on share price for each of the following proposed actions. a. Do nothing, which will leave the key financial variables unchanged. b. Invest in a new machine that will increase the dividend growth rate to 8% and lower the required return to 13%. c. Eliminate an unprofitable product line, which will increase the dividend growth rate to 9% and raise the required return to 17%. d. Merge with another firm, which will reduce the growth rate to 2% and raise the required return to 18%. e. Acquire a subsidiary operation from another manufacturer. The acquisition should increase the dividend growth rate to 9% and increase the required return to 17%.arrow_forwardExplain how you will manage each of these situations. Your company invests in overseas companies paying high dividends. Due to COVID-19, foreign companies have reduced their dividend payouts.arrow_forwardSunnyfax Publishing pays out all its earnings and has a share price of $37.00. In order to expand, Sunnyfax Publishing decides to cut its dividend from $3.00 to $2.00 per share and reinvest the retained funds. Once the funds are reinvested, they are expected to grow at a rate of 14%. If the reinvestment does not affect Sunnyfax's equity cost of capital, what is the expected share price as a consequence of this decision? O $45.87 $40.14 $68.81 $57.34 Suppose a ten-year, $1,000 bond with an 8.6% coupon rate and semiannual coupons is trading for $1,035.39. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? 8.08% O4.04% O 5.36% O 10.72%arrow_forward

- In a Modigliani and Miller world with no taxes, a 100% equity financed company has generated £1m cash flows this year. Consider three alternative policies: 1) pay £1m to shareholders as dividends, 2) buy back £1m worth of shares, 3) retain all cash flows. Determine which of the following statements is correct. The company's value is higher under policy 1 The company's value is higher under policy 2 Shareholders are indifferent between all three policies Shareholders are indifferent between policy 1 and policy 2, but prefer both policies to policy 3arrow_forwardd. Determine what rate of return must be earned on the net proceeds to the corporation so there will not be a dilution in earnings per share during the year of going public. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. > Answer is complete but not entirely correct. Rate of return 27.74 % e. Determine what rate of return must be earned on the proceeds to the corporation so there will be a 5 percent increase in earnings per share during the year of going public. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. > Answer is complete but not entirely correct. Rate of return 11.42%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education