Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

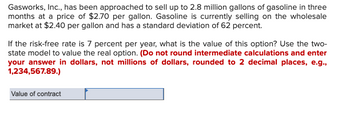

Transcribed Image Text:Gasworks, Inc., has been approached to sell up to 2.8 million gallons of gasoline in three

months at a price of $2.70 per gallon. Gasoline is currently selling on the wholesale

market at $2.40 per gallon and has a standard deviation of 62 percent.

If the risk-free rate is 7 percent per year, what is the value of this option? Use the two-

state model to value the real option. (Do not round intermediate calculations and enter

your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g.,

1,234,567.89.)

Value of contract

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- YOU ARE A FINANCIAL ANALYST FOR A COMPANY THAT IS CONSIDERING A NEW PROJECT. IF THE PROJECT IS ACCEPTED, IT WILL USE A FRACTION OF A STORAGE FACILITY THAT THE COMPANY ALREADY OWNS BUT CURRENTLY DOES NOT USE. THE PROJECT IS EXPECTED TO LAST 10 YEARS, AND THE ANNUAL DISCOUNT RATE IS 10% (COMPOUNDED ANNUALLY). YOU RESEARCH THE POSSIBILITIES, AND FIND THAT THE ENTIRE STORAGE FACILITY CAN BE SOLD FOR €100,000 AND A SMALLER (BUT BIG ENOUGH) FACILITY CAN BE ACQUIRED FOR €40,000. THE BOOK VALUE OF THE EXISTING FACILITY IS €60,000, AND BOTH THE EXISITING AND THE NEW FACILITIES (IF IT IS ACQUIRED) WOULD BE DEPRECIATED STRAIGHT LINE OVER 10 YEARS (DOWN TO A ZERO BOOK VALUE). THE CORPORATE TAX RATE IS 40%. DISCUSS WHAT IS THE OPPORTUNITY COST OF USING THE EXISTING STORAGE CAPACITY?arrow_forwardSuppose that your company is planning to sell 1.25 million litres of fuel in two years. Thecurrent price of fuel is £1.60 per litre. a) Suppose there is a two-year heating oil futures contract available. The futuresprice is £1.63 per litre. How many contracts would you need to fully eliminate yourrisk exposure over the next two years? How many contracts would you need ifyour optimal hedging ratio was 0.75? What position in these contracts would youtake today? Explain. b) Evaluate the outcomes of your hedging strategy if the price of fuel in two years is(1) £1.72 per litre, and (2) £1.58 per litre. In each case assume the heating oilfutures price to be equal to that of the fuel. Comment on your results.arrow_forwardA company that manufactures clear PVC pipe is investigating two production options with the following cash flow estimates. The chief operating officer (COO) has asked you to determine if the batch option would ever have a lower annual worth than the continuous flow system using interest rates over a range of 5% to 15% for the batch option, but only 15% for the continuousflow system. The batch process can be used anywhere from 3 to 10 years. (Note: The continuous flow process was previously determined to have its lowest cost over a 5-year life cycle.)arrow_forward

- a. Use the Black-Scholes formula to find the value of the following call option. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) i. Time to expiration 1 year. ii. Standard deviation 40% per year. iii. Exercise price $84. iv. Stock price $84. v. Interest rate 4% (effective annual yield). b. Now recalculate the value of this call option, but use the following parameter values. Each change should be considered independently. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) i. Time to expiration 2 years. ii. Standard deviation 50% per year. iii. Exercise price $94. iv. Stock price $94. v. Interest rate 6%. c. In which case did increasing the value of the input not increase your calculation of option value? a. Call option value b-i. Call option value when time to expiration is 2 years. b-ii. Call option value when standard deviation is 50% per year. b-iii. Call option value when exercise price is $60. b-iv. b-v. C…arrow_forwardIvy's Ice Cream is looking at an opportunity that would require an investment of $900,000 today. The investment will provide cash flows of $250,000 in the first year, $400,000 in the second year, and $600,000 in the third year. If the interest rate is 8%, what is the NPV of this investment opportunity? Should Ivy's Ice Cream move forward with this investment based on the NPV? (Round your answer to the nearest whole dollar.)arrow_forwardOn May 25, 2018 you purchased an option which will allow you to sell a commercial building on August 14, 2022 for $42 million. Your current estimate of the value of the commercial building is $38 million. The annual volatility for the change in the commercial building’s value is 57% and the risk-free rate is 6%. What type of option is this? Calculate the value of the option to sell the commercial building. Please show work in excel and equations/questions used.arrow_forward

- Melbourne Capital Ltd considers selling European call options on ANZ Bank Ltd for $1.50 per option. The current market price is $17.70 on 28th September 2020, the exercise price is $20, and the maturity of each call option is 6 months. (i) Under what circumstances does the investor make a profit? (ii) Under what circumstances will the option be exercised? (iii) How many call options should the investor sell to raise a total capital of $1,260,000?arrow_forward4arrow_forwardThe price of a European CALL option is $8.00 and a European PUT is $10.00. The expiration date is 1 year and has an exercise price k=$60.00, the share price of the underlying asset is quoted today at $60.00. The risk-free rate is 10% per year. Propose a strategy that generates arbitrage and a profit.arrow_forward

- A UK oil trader, Teresa, is considering purchasing oil on the spot market for speculative purposes. The current spot price is $18 a barrel. However, she expects the price to decline to $16 a barrel in one month's time. If she bought on the spot market today, she would hold the oil for one month at a cost of £0.002 a barrel for the month, after which she could sell the oil on the spot market. The current US dollar exchange rate is $1.50/£. If she expects the exchange rate to be $1.30/£1 in one month's time, what is her expected gain/loss on the oil deal? A. £0.306 gain per barrel B. £0.027 gain per barrel C. £1.540 loss per barrel D. £6.202 loss per barrelarrow_forwardAs a major maker/manufacturer of premium leather hand luggage, you are concerned that leather prices may move beyond their current level of $30/pound when you are ready for production. Therefore, you enter into the appropriate option contract. The strike price is fixed at the current spot price at an options price of $5.00 per option. What is the position you take and your profit or loss, if eight months later, leather is selling at the spot market for $38.50? Olong futures, $7.50 Oshort futures, -$4.00 Olong call, $3.50 Olong call, -$5.00 O long futures, $5.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education