Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

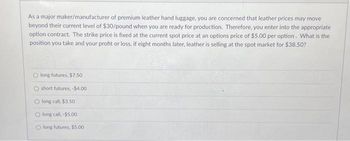

Transcribed Image Text:As a major maker/manufacturer of premium leather hand luggage, you are concerned that leather prices may move

beyond their current level of $30/pound when you are ready for production. Therefore, you enter into the appropriate

option contract. The strike price is fixed at the current spot price at an options price of $5.00 per option. What is the

position you take and your profit or loss, if eight months later, leather is selling at the spot market for $38.50?

Olong futures, $7.50

Oshort futures, -$4.00

Olong call, $3.50

Olong call, -$5.00

O long futures, $5.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- as a soybean buyer, you are concerned about soy prices. Currently, they are at $60 per bushel .Therefore, you enter into the appropriate futures contract at the current spot price. What is your profit or loss, if six months later, soybean is selling at the spot market for 51 bushell? why?arrow_forwardCompany XYZ makes widgets. They will have 500 widgets to sell in 6 months. The current price is $60 per widget. The company's cost to create each widget is $40. The company decides to insure its position. The company has the following two options to hedge its risks: enter into a forward contract with a forward price of $61.80 buy a 6 -month $60-strike European put option for a premium of $5.25 The risk-free rate is 6% convertible semiannually. For what range of prices in 6 months would profit for option (1) be greater than the profit for option (2)? A. 56.39 to oo B. 0 to 67.05 C. 67.05 to oo D. 0 to 67.21 E. 67.21 to ooarrow_forward(1) A trader signs a Forward contract on April 30 for the delivery of 500 gallons of oil on October 31. The risk-free rate is 5.00% on April 30 and the current price of oil is $30 per gallon. Each gallon of storage costs $0.03 per day.a. What will be the fair forward price on April 30?b. If the spot price of oil is $45 per gallon on July 31, what profit or loss would the trader incur if they close out (cash settle) their position?arrow_forward

- Suppose a Japanese company, Matsushita, has to sell Can$ 50 m sometime during the next 6 months, and would like to lock in a minimum ¥ value. The price of a put option with a strike price of K = ¥ 230/$ is ¥ 4/$ What is the actual amount that they receive if the spot rate at the end of 3 months is ¥ 245/$?Since ST >K, the options are worthless and Matsushita can do better by selling at the market rate of ¥ 245/$, rather than the exercise price of ¥ 230/$. Thus, their total receipts will be O¥4/$ O¥ 234 / $ O¥241/$ O¥ 230 / $arrow_forwardA holder of a 90-day bill with 40 days left to maturity and a face value of $ 100, 000 chooses to sell it into the market. If bills maturing in 40 days are currently yielding 1.75% per annum, what price will be obtained? (Assume there are 365 days in a year, and answers must be rounded to two decimal places) $ Please only use a plain number as your answer and don't insert a comma. For example, if you get 1000, please use 1000, and don't use 1,000.arrow_forwardSuppose a Japanese company, Matsushita, has to sell Can$ 50 m sometime during the next 6 months, and would like to lock in a minimum ¥ value. The price of a put option with a strike price of K = ¥ 230/$ is ¥ 4/$ What is the actual amount that they receive if the spot rate at the end of 3 months is 245/$?Since ST >K, the options are worthless and Matsushita can do better by selling at the market rate of ¥ 245/$, rather than the exercise price of ¥ 230/$. Thus, their total receipts will be CV234/$ C¥230 / $ C¥241/$ C¥4/$arrow_forward

- You are the buyer for a cereal company and you must buy 80,000 bushels of corn next month. The futures contracts on corn are based on 5,000 bushels and are currently quoted at 415′0 cents per bushel for delivery next month. If you want to hedge your cost, you should _____ contracts at a cost of _____ per contract.arrow_forwardLet’s assume we are a heating oil delivery service company that sells 80,000 gallons of heating oil every month its clients. The firm wants to hedge its position buy entering into a contract to buy its heating oil at the end of each month for the following month. The firm has decided it only needs to hedge for the next 5 months as the demand for heating oil significantly falls off after that. What would be the swap price of the 80,000 gallons of heating oil at the end of each month for the next 5-months if the following information is true? (Risk-free rate is provided per annum with continuous compounding) Month Forward Price Risk-Free Rate 1 $ 2.999 1.50% 2 $ 3.009 1.50% 3 $ 3.039 1.60% 4 $ 3.075 1.75% 5 $ 3.105 1.75%arrow_forwardYou are trying to decide between two mobile phone carriers. Carrier A requires you to pay $210 for the phone and then monthly charges of $60 for 24 months. Carrier B wants you to pay $100 for the phone and monthly charges of $74 for 12 months. Assume you will keep replacing the phone after your contract expires. Your cost of capital is 4.2% APR, compounded monthly. Based on cost alone, which carrier should you choose? The EAA for plan A is __arrow_forward

- You are trying to decide between two mobile phone carriers. Carrier A requires you to pay $200 for the phone and then monthly charges of $58 for 24 months. Carrier B wants you to pay $115 for the phone and monthly charges of $68 for 12 months. Assume you will keep replacing the phone after your contract expires. Your cost of capital is 3.7% APR, compounded monthly. Based on cost alone, which carrier should you choose? The EAA for plan A is $ (Round to the nearest cent.)arrow_forwardYou are trying to decide between two mobile phone carriers. Carrier A requires you to pay$185 for the phone and then monthly charges of $54 for 24 months. Carrier B wants you to pay $105 for the phone and monthly charges of $68 for 12 months. Assume you will keep replacing the phone after your contract expires. Your cost of capital is 3.9%APR, compounded monthly. Based on cost alone, which carrier should you choose? The EAA for plan A isThe EAA for plan B isThe EAA for plan C isarrow_forwardConsider a producer who is in the business of producing Cocoa for future sale. At the time of 0 (i.e., present time), we have S(O) = $1652, F(0) = $1675. The firm is expecting to sell the Cocoa in 2 months, while the delivery date of the futures contract is 3 months away. Assume that the price of Cocoa in two months is unpredictable, but we know that the future price in two months will be $8 higher than the spot price of Cocoa in two months (i.e., F(t) = S(t) + $8). Question 18. Without hedging, what is the firm's net profit at date t (i.e., in two months)? A) $23 B) $8 C) $31 D) $15arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education