Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Hello tutor give answer

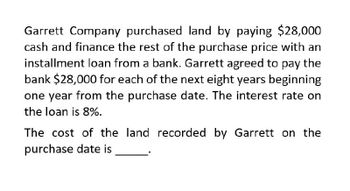

Transcribed Image Text:Garrett Company purchased land by paying $28,000

cash and finance the rest of the purchase price with an

installment loan from a bank. Garrett agreed to pay the

bank $28,000 for each of the next eight years beginning

one year from the purchase date. The interest rate on

the loan is 8%.

The cost of the land recorded by Garrett on the

purchase date is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Short Company purchased land by paying $11,000 cash on the purchase date and agreed to pay $11,000 for each of the next six years beginning one-year from the purchase date. Short's incremental borrowing rate is 7%. The land reported on the balance sheet is closest to: (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided.) Multiple Cholce $77,000. $63.432. $66,000. $43,979.arrow_forwardWe acquired a property for $10,000,000 including all fees. We financed its purchase with a $7,000,000 loan that carried an annual interest rate of 5.2%, an amortization period of 25 years and a 5-year term. NOI for year 1 was $1,200,000; year 2 was $1,300,000, and for year 3 NOI was $1,400,000. All cash flow after debt service was paid to the equity investors as distributions at the end of every year. We sold this property at the end of year 3 for $11,000,000 net of all disposition fees. Identify the pre-tax annual cash flows to the equity investors and determine the pre-tax IRR to the equity investors for this investment.arrow_forwardOn January 1, 20x9, Fairness Company sold a tract of land that was acquired years ago for P 3,000,000. Fairness received a three year non-interest bearing note for P 6,000,000 in exchange for the land, but the current market rate of interest for comparable notes is 10%. The note is payable in equal annual instalments of P 2,000,000 every December 31 starting December 31, 20x9. a. Compute for the carrying value of the note on January 1, 20x9b. Compute for the gain or loss on salec. Compute for the interest income recognized in 20x11.d. Compute for the carrying value of the note in December 31, 20x10e. Prepare all entries.arrow_forward

- ACT Company acquired an investment property with an installment price of P2,400,000. The acquisition of the property requires a down payment of 20% and a non-interest bearing note payable at the end of each year for five years. The prevailing market rate of interest for similar instrument is 12%. ACT Company transaction costs amounting to P50,000 on the property. What is the cost of acquiring the property? Use 3-decimal interest factor.arrow_forwardOn January 1, 20x9, Fairness Company sold a tract of land that was acquired years ago for P 3,000,000. Fairness received a three year 15% interest bearing note for P 6,000,000 in exchange for the land, but the current market rate of interest for comparable notes is 10%. The note is payable in equal annual instalments of P 2,000,000 every December 31 starting December 31, 20x9. a. Compute for the carrying value of the note on January 1, 20x9b. Compute for the gain or loss on salec. Compute for the interest income recognized in 20x11.d. Compute for the carrying value of the note in December 31, 20x10e. Prepare all entries.arrow_forwardPurchased land and an office building for $140,000, of which $20,000 was attributable to the fair market value of the land. A $50,000 cash down payment was made and a 5% five-year note was signed for the balance. Interest and 20% of the principal will be paid annually on this date. (Assume a 360-day year for interest computation purposes.) I need to know how to record the transaction in a general journal.arrow_forward

- On April 1, 2022 Blo Inc. receives a 6-year $60,000 note in exchange for a parcel of land. The cost of the land was $35,000. Neither the market rate nor the fair value of the land can be determined. Notes of similar risk carry a 12% imputed rate of interest. The financial year ends December 31. a. The present value of the note is $Answer b. There was a (gain or loss) Answer on the sale of the land of $Answerarrow_forwardOn April 1, 2023 Blo Inc. receives a 6-year $60,000 note in exchange for a parcel of land. The cost of the land was $35,000. Neither the market rate nor the fair value of the land can be determined. Notes of similar risk carry a 12% imputed rate of interest. The financial year ends December 31. a. The present value of the note is $________ b. There was a (gain or loss) ___________on the sale of the land of $__________arrow_forwardOn July 1, 2020, Manuel Corporation purchased machinery worth P 8,000,000. Terms: P 500,000 down payment, the balance on three equal annual payments every July 1 of each year. The cash price of the machinery is P 6,000,000. A promissory note is issued for the installment balance. Required: 1. What would be the journal entry to record the acquisition of machinery? 2. What would be the journal entries to record the amortization at December 31, 2020? 3. What is the carrying amount of machinery at December 31, 2020?arrow_forward

- On January 1, 2020, South Company acquired a building for P5,000,000. The entity paid P500,000 down and signed a noninterest bearing note for the balance which is payable in 3 equal annual installments every December 31 of each year. The prevailing interest rate for a note of this type is 12%. The present valueof an ordinary annuity of 1 for three periods is 2.4018. Required: Prepare Journal entries to record purchase of building on January 1, 2020, first installment payment on December 31, 2020 and interest for 2020.arrow_forwardHemingway Company purchases equipment by issuing a 7-year, $350,000 non-interest-bearing note, when the market rate for this type of note is 10%. Hemingway will pay off the note with equal payments to be made at the end of each year. Required: Prepare the journal entry to record Hemingway’s acquisition of the equipmarrow_forwardOn January 1 Coopers Industries bought a parcel of land for use in its operations by paying the seller $100,000 in cash and signing a 5-year, 12 percent note payable in the amount of $400,000. In connection with the purchase of the land, Coopers incurred legal fees of $19,000, a real estate agent sales commission of $25,000, surveying fees of $1,000, and an appraisal fee of $5,000. The acquisition cost of the land is O $131,000 O $150,000 O $531,000 O $550,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College