Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

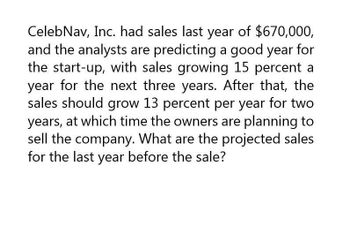

Provide correct answer. What are the projected sales sales for the last year before the sales?

Transcribed Image Text:Celeb Nav, Inc. had sales last year of $670,000,

and the analysts are predicting a good year for

the start-up, with sales growing 15 percent a

year for the next three years. After that, the

sales should grow 13 percent per year for two

years, at which time the owners are planning to

sell the company. What are the projected sales

for the last year before the sale?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Future value: CelebNav, Inc., had sales last year of $700,000, and the analysts are predicting strong future performance for the start-up, with sales growing 20 percent a year for the next three years. After that, the sales should grow 11 percent per year for two years, at which time the owners are planning to sell the company. What are the projected sales for the last year before the sale?arrow_forwardIf a company expects to increase sales by $7,000 per year over a 10-year planning horizon, what will be the cash flows at the end of every year?arrow_forwardA company is considering an investment expected to yield $70,000 after six years. If this company demands an 8% return, how much is it willing to pay for this investment today?arrow_forward

- MEINE ON The table below gives a detailed forecast of the size of the market by production volume. Assume that KMS expects to capture 10.20% of the market share in 2019 and expects that percentage will increase by 0.27% per year. KMS currently has the capacity to produce a maximum of 1,100,000 units. What production capacity will KMS require each year? When will an expansion become necessary (that is, when will production volume exceed 1,100,000 units)? Year Production Volume (000 units) Market Size KMS's market share for 2019 is KMS's market share for 2021 is KMS's market share for 2022 is 2019 KMS's market share for 2023 is 10,412 11,570 The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. KMS's market share for 2024 is 2020 10,000 units.…arrow_forwardPetry Corp. is a growing company with sales of $1.25 million this year. The firm expects to grow at an annual rate of 25 percent for the next three years, followed by a growth of 20 percent per year for the next two years. What will be Petry’s sales at the end of five years?arrow_forwardA DSL company has made an equipment investment of $40 million with the expectation that it will be recovered in 10 years. The company has a MARR based on a real rate of return of 12% per year. If inflation is 7% per year, how much must the company make each year (a) in constant-value dollars, and (b) in future dollars, to meet its expectation?arrow_forward

- Cheese & Cake Factory is looking at a project with the following forecasted sales: first-yearsales quantity of 35,000 with an annual growth rate of 5% over the next 5 years. The sales priceper unit is $40 and will grow at 3% per year. The production costs are expected to be 50% ofthe current year's sales price. The manufacturing equipment to aid this project will have a totalcost (including installation) of $1,000,000. It will be depreciated using MACRS and has aseven-year MACRS life classification. Fixed costs are $300,000 per year.The change in net operating working capital is $10,000 and will be recovered at the end of year5. Cheese & Cake Factory has a tax rate of 40%. At the end of year 5, the manufacturingequipment can be sold for $150,000 and the cost of capital for this project is 10%. What are the operating cash flow for years one and two?arrow_forwardThe table here,, gives a detailed forecast of the size of the market by production volume. Assume that KMS expects to capture 10.20% of the market share in 2022 and expects that percentage will increase by 0.23% per year. KMS currently has the capacity to produce a maximum of 1,100,000 units. What production capacity will KMS require each year? When will an expansion become necessary (that is, when will production volume exceed 1,100,000 units)? The Tax Cuts and Jobs Act of 2017 temporarily allowed 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems. KMS's market share for 2022 is Data table units. (Round to the nearest integer.) (Click on the following icon in order to copy its contents into a spreadsheet.) Year Production Volume (000 units) Market Size Market Share 2022 2023 2024 2025 2026 2027 10,000 10.20% 10,350 11,036 11,593 12,130 12,762 10.43% 10.66% 10.89% 11.12%…arrow_forwardShabbona Partners expects to have free cash flows of $38,950,000 next year, and free cash flows are expected to grow at a constant rate of 3% per year. If the firm's WACC is 9% per year, what is the value of Shabbona's operations?arrow_forward

- NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 34,000 , with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $45.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, 囲, and has a seven-year MACRS life classification. Fixed costs will be $360,000 per year. Miglietti Restaurants has a tax rate of 359 /hat is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project is 7%. What is the operating cash flow for this project in year 1 ? (Round to the nearest dollar.) Data table MACRS…arrow_forwardNPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 34,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $45.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, B, and has a seven-year MACRS life classification. Fixed costs will be $360,000 per year. Miglietti Restaurants has a tax rate of 35% What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project is 7%. What is the operating cash flow for this project in year 1? Data table (Round to the nearest dollar.) MACRS…arrow_forwardNPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 33,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $41.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,100,000. It will be depreciated using MACRS, and has a seven-year MACRS life classification. Fixed costs will be $360,000 per year. Miglietti Restaurants has a tax rate of 40%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project is 8%. MACRS Fixed Annual Expense Percentages by Recovery Class Year 3-Year…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT