College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

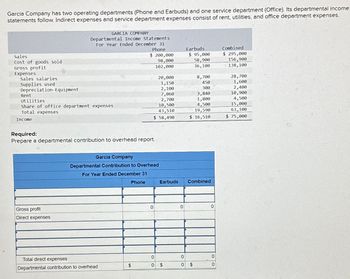

Transcribed Image Text:Garcia Company has two operating departments (Phone and Earbuds) and one service department (Office). Its departmental income

statements follow. Indirect expenses and service department expenses consist of rent, utilities, and office department expenses.

GARCIA COMPANY

Departmental Income Statements

For Year Ended December 31

Sales

Cost of goods sold

Gross profit

Expenses

Sales salaries

Supplies used

Depreciation-Equipment

Rent

Utilities

Share of office department expenses

Total expenses

Income

Phone

Earbuds

Combined

$ 200,000

98,000

$ 95,000

$ 295,000

58,900

102,000

36,100

156,900

138,100

20,000

8,700

28,700

1,150

450

1,600

2,100

300

2,400

7,060

3,840

10,900

2,700

1,800

4,500

10,500

4,500

43,510

19,590

$ 58,490

$ 16,510

15,000

63,100

$ 75,000

Required:

Prepare a departmental contribution to overhead report.

Garcia Company

Departmental Contribution to Overhead

For Year Ended December 31

Gross profit

Direct expenses

Phone

Earbuds

Combined

0

0

0

Total direct expenses

0

0

0

Departmental contribution to overhead

$

0 $

0

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- COMPUTING OPERATING INCOME The sales, cost of goods sold, and total operating expenses of departments A and B of Ash Company are as follows: Compute the departmental operating income for each department.arrow_forwardINCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT AND OPERATING INCOME Thomas and Hill Distributors has divided its business into two departments: commercial sales and industrial sales. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental gross profit and total operating income. 2. Calculate departmental gross profit percentages.arrow_forwardINCOME STATEMENT WITH DEPART MENTAL DIRECT OPERATING MARGIN AND TOTAL OPERATING INCOME Durwood Thomas operates the business Thomas Security that sells security equipment for commercial property and residential homes. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental direct operating margin and total operating income. 2. Calculate departmental direct operating margin percentages.arrow_forward

- Williams Company began operations in January 2019 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. WILLIAMS COMPANYDepartmental Income StatementsFor Year Ended December 31, 2019 Clock Mirror Combined Sales $ 175,000 $ 77,500 $ 252,500 Cost of goods sold 85,750 48,050 133,800 Gross profit 89,250 29,450 118,700 Direct expenses Sales salaries 20,450 7,000 27,450 Advertising 1,290 725 2,015 Store supplies used 1,125 625 1,750 Depreciation—Equipment 1,590 525 2,115 Total direct expenses 24,455 8,875 33,330 Allocated expenses Rent expense 7,020 3,780 10,800 Utilities expense 5,525 2,975 8,500 Share of office department expenses 10,500 4,500 15,000 Total allocated expenses 23,045 11,255 34,300 Total expenses…arrow_forwardPlease help with this accounting questionarrow_forwardWilliams Company began operations in January 2019 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. WILLIAMS COMPANYDepartmental Income StatementsFor Year Ended December 31, 2019 Clock Mirror Combined Sales $ 135,000 $ 57,500 $ 192,500 Cost of goods sold 66,150 35,650 101,800 Gross profit 68,850 21,850 90,700 Direct expenses Sales salaries 20,050 7,000 27,050 Advertising 1,210 525 1,735 Store supplies used 925 425 1,350 Depreciation—Equipment 1,510 325 1,835 Total direct expenses 23,695 8,275 31,970 Allocated expenses Rent expense 7,020 3,780 10,800 Utilities expense 2,925 1,575 4,500 Share of office department expenses 10,500 4,500 15,000 Total allocated expenses 20,445 9,855 30,300 Total expenses…arrow_forward

- The comparative statements of Bonita Company are presented here. Net sales Bonita Company Income Statements For the Years Ended December 31 Cost of goods sold Gross profit Selling and administrative expenses Income from operations Other expenses and losses Interest expense Income before income taxes Income tax expense Net income 2022 $1,811,500 1,008,900 802,600 518,600 284,000 17,800 266,200 80,152 $ 186,048 2021 $1,752,200 982,000 770,200 472,800 297,400 13,800 283,600 76,400 $207,200arrow_forwardWilliams Company began operations in January 2019 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. WILLIAMS COMPANYDepartmental Income StatementsFor Year Ended December 31, 2019 Clock Mirror Combined Sales $ 170,000 $ 95,000 $ 265,000 Cost of goods sold 83,300 58,900 142,200 Gross profit 86,700 36,100 122,800 Direct expenses Sales salaries 22,000 7,000 29,000 Advertising 1,700 500 2,200 Store supplies used 1,000 300 1,300 Depreciation—Equipment 1,700 400 2,100 Total direct expenses 26,400 8,200 34,600 Allocated expenses Rent expense 7,030 3,780 10,810 Utilities expense 2,800 2,500 5,300 Share of office department expenses 11,000 10,500 21,500 Total allocated expenses 20,830 16,780 37,610 Total expenses…arrow_forwardWilliams Company began operations in January 2019 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. WILLIAMS COMPANYDepartmental Income StatementsFor Year Ended December 31, 2019 Clock Mirror Combined Sales $160,000 $70,000 $230,000 Cost of goods sold $78,400 $43,400 $121,800 Gross profit 81,600 26,600 108,200 Direct expenses Sales salaries 20,300 7,000 27,300 Advertising 1,260 650 1,910 Store supplies used 1,050 550 1,600 Depreciation—Equipment 1,560 450 2,010 Total direct expenses 24,170 8,650 32,820 Allocated expenses Rent expense 7,020 3,780 10,800 Utilities expense 2,600 1,400 7,000 Share of office department expenses 10,500 4,500 15,000 Total allocated expenses 20,120 9,680 32,800 Total…arrow_forward

- Service department charges In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of 64,560, and the Purchasing Department had expenses of 40,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: A. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. B. Using the cost driver information in (A), determine the annual amount of payroll and purchasing costs allocated to the Residential, Commercial, and Government Contract divisions from payroll and purchasing services. C. Why does the Residential Division have a larger support department allocation than the other two divisions, even though its sales are lower?arrow_forwardThe following data were summarized from the accounting records for Ruiz Industries Inc. for the year ended November 30, 20Y8: Prepare divisional income statements for Ruiz Industries Inc.arrow_forwardMULTIPLE-STEP INCOME STATEMENT Use the following information to prepare a multiple-step income statement, including the revenue section and the cost of goods sold section, for Sauter Office Supplies for the year ended December 31,20--.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning