FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

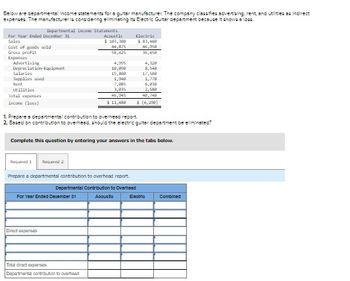

Transcribed Image Text:Below are departmental income statements for a guitar manufacturer. The company classifies advertising, rent, and utilities as indirect

expenses. The manufacturer is considering ellminsting its Electric Guitar department because it shows a loss.

For Year Ended December 31

Sales

Cost of goods sold

Gross profit

Expenses

Advertising

Depreciation Equipment

Salaries

Supplies used

Rent

Utilities

Total expenses

Income (loss)

Departmental Income Statements

Required 1 Required 2

Acoustic

$ 183,300

44,875

58,425

For Year Ended December 31

Direct expenses

4,995

10,000

19,00

1,948

7,895

3,835

46,945

$ 11,488

Total direct expenses

Departmental contribution to overhead

Electric

1. Prepares departmental contribution to overhead report

2. Based on contribution to overhead, should the electric guitar department be eliminated?

Complete this question by entering your answers in the tabs below.

Prepare a departmental contribution to overhead report.

Departmental Contribution to Overhead

Acousto

$ 83,400

46,958

36,458

8,540

17,588

1,778

6,038

2,580

48,748

$ (4,200)

Electric

Combined

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4. Undertake a sensitivity analysis assessing the impact of operating leverage on net income based on the following two what-if scenarios for both the divisions. (Use appropriate formula and format the cells as 'currency'): a) Conservative scenario: What would be the projected net income (loss) if sales decrease by 40% in the fourth quarter? b) Optimistic scenario: What would be the projected net income (loss) if sales increase by 40% in the fourth quarter? 5. Assume that you are in the position of Cost Accountant in Fitness Fast Inc. Management seeks clarification from you on the notable differences in breakeven units between the two divisions, despite both divisions reporting identical total sales and net income for the period. Additionally, They are keen to understand the reasons behind the substantial disparities in the comparative data of the sensitivity analysis for the two divisions. Explain the reasons for such differences to management. (Write your answer in the Explanation…arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Below are departmental income statements for a guitar manufacturer. The company classifies advertising, rent, and utilities as indirect expenses. The manufacturer is considering eliminating its Electric Guitar department because it shows a loss. Departmental Income Statements For Year Ended December 31 Sales Cost of goods sold Gross profit Expenses Advertising Depreciation-Equipment Salaries Supplies used Rent Utilities Total expenses Income (loss) Required 1 Required 2 Acoustic $ 102,100 44,975 57,125 For Year Ended December 31 Gross profit Direct expenses 15,015 10,100 20,100 1. Prepare a departmental contribution to overhead report. 2. Based on contribution to overhead, should the electric guitar department be eliminated? Prepare a departmental contribution to overhead report. 1,960 7,065 2,995 47,235 $ 9,890 Complete this question by entering your answers in the tabs below. Total direct expenses Departmental contribution to overhead Departmental Contribution to Overhead $ Acoustic…arrow_forwarddo not give solution in imagearrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education