FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

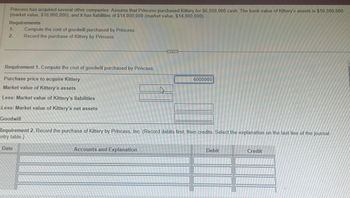

Transcribed Image Text:Princess has acquired several other companies. Assume that Princess purchased Kittery for $6,000,000 cash. The book value of Kittery's assets is $16,000,000

(market value, $18,000,000), and it has liabilities of $14,000,000 (market value, $14,000,000).

Requirements

1.

2.

Compute the cost of goodwill purchased by Princess.

Record the purchase of Kittery by Princess.

Requirement 1. Compute the cost of goodwill purchased by Princess.

Purchase price to acquire Kittery

Market value of Kittery's assets

Less: Market value of Kittery's liabilities

Less: Market value of Kittery's net assets

Goodwill

Date

4

Requirement 2. Record the purchase of Kittery by Princess, Inc. (Record debits first, then credits. Select the explanation on the last line of the journal

entry table.)

Accounts and Explanation

6000000

10

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Columbia recently acquired all of Mercury's net assets in a business acquisition. The cash purchase price was $22,000,000. Mercury's assests and liabilites had the following costs and appraised values: Current assets Land, building and equipment Current liabilites Mortgage payable How much goodwill will rewult from this transaction? Cost Basis $ 6,000,000 $ 14,000,000 Appraised Value $ 6,000,000 $23,000,000 $4,000,000 $4,000,000 $ 10,000,000 $10,000,000arrow_forwardMainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash. The book values and fair values of Iceberg's assets and liabilities were as follows: Current assets Property, plant, and equipment Other assets Current liabilities Long-term liabilities Required: 1. Calculate the amount paid for goodwill. 2. Determine the financial statement effects of the acquisition. Required 1 Required 2 Complete this question by entering your answers in the tabs below. Book Value $ 11,400,000 20,200,000 3,400,000 7,800,000 13,200,000 Assets Determine the financial statement effects of the acquisition. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answer in millions rounded to 1 decimal place. (i.e. 5,500,000 should be entered as 5.5). Accounts Payable Accounts Receivable Accumulated Depreciation Advertising Expense Fair Value $ 14,400,000 26,200,000 4,400,000 7,800,000 12,200,000 Balance Sheet Liabilities…arrow_forwardPainted Desert has acquired several companies. Assume that Painted Desert purchased Oak Tree Unlimited for $14,000,000 cash. The book value of Oak Tree Unlimited's assets is $14,000,000 (fair value, $15,000,000), and it has liabilities of $13,000,000 (fair value, $13,000,000). Requirements 1. Compute the cost of goodwill purchased by Painted Desert. 2. Record the purchase of Oak Tree Unlimited by Painted Desert. Requirement 1. Compute the cost of goodwill purchased by Painted Desert. Purchase price to acquire Oak Tree Unlimited Fair value of Oak Tree Unlimited's assets Less: Fair value of Oak Tree Unlimited's liabilities Less: Fair value of Oak Tree Unlimited's net assets Goodwill Requirement 2. Record the purchase of Oak Tree Unlimited by Painted Desert. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit…arrow_forward

- Determine correct value of goodwillarrow_forwardMeasuring and recording goodwill Princeton has acquired several other companies. Assume that Princeton purchased Kelleher for $9,000,000 cash. The book value of Kelleher’s assets is $19,000,000 (market value, $20,000,000), and it has liabilities of $12,000,000 (market value, $12,000,000). Requirements Compute the cost of the good-will purchased by Princeton. Record the purchase of Kelleher by Princeton.arrow_forwardHoyle Company owns a manufacturing plant with a fair value of $4,600,000, a recorded cost of $8,500,000, and accumulated depreciation of $3,650,000. Patterson Company owns a warehouse with a fair value of $4,400,000, a recorded cost of $6,900,000, and accumulated depreciation of $2,800,000. Hoyle and Patterson exchange assets, with Hoyle also receiving cash of $200,000 from Patterson. The exchange is considered to have commercial substance. Required: Record the exchange on the books of: Hoyle Pattersonarrow_forward

- Dynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items: Patent with 4 remaining years of legal life Goodwill Dynamo's financial condition just prior to the acquisition of these assets is shown in Required B. Required a. Compute the annual amortization expense for these items. b. Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model. Complete this question by entering your answers in the tabs below. Required A Required B Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model. (In the Cash Flo operating activities, FA for financing activities, or IA for investing activity. Leave the cell blank if there is no effect. Enter any decreases to accoun all cells will require entry.) Event Acquisition Amortization Cash + 86,400 + + + Balance Sheet Assets Patent + Goodwill $…arrow_forwardCompany X purchased Company Y for $4,000,000. The net assets of the company purchased were valued at $3,800,000. What asset will be on Company X's balance sheet for $200,000? Goodwill Amortization Not enough info Equipmentarrow_forward2. Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $840,000. The estimated market values of the purchased assets are building, $487,500; land, $302,250; land improvements, $58,500; and four vehicles, $126,750. 4. Compared to straight-line depreciation, does accelerated depreciation result in payment of less total taxes over the asset’s life?arrow_forward

- Required Information [The following information applies to the questions displayed below] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $830,000. The estimated market values of the purchased assets are building, $467,500, land, $243,100; land improvements, $56,100; and four vehicles, $168,300. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Required 3 Allocate the lump-sum purchase price to the separate assets purchased. Required 1A Required 18 Required 2 Allocation of total cost Building…arrow_forwardFirst Company purchased Second Company for $19,000,000 cash. At the time of purchase, Second Company's assets had a market value of $28,000,000 and the liabilities had a market value of $13,000,000. At the time of the purchase, Second Company's assets had a book value of $15,000,000, and the liabilities had a book value of $9,000,000. What amount of goodwill is recorded?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education