Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

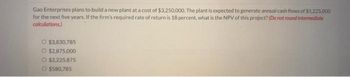

Transcribed Image Text:Gao Enterprises plans to build a new plant at a cost of $3,250,000. The plant is expected to generate annual cash flows of $1,225,000

for the next five years. If the firm's required rate of return is 18 percent, what is the NPV of this project? (Do not round intermediate

calculations.)

O $3,830,785

O $2,875,000

O $2,225,875

$580,785

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- te.7arrow_forwardA project requires a $33,000 initial investment and is expected to generate end-of-period annual cash inflows as follows Year 1 Year 2 $ 15,000 $ 16,000 i = 14% n=1 0.8772 { = 14% n = 2 0.7695 Year 3 $ 15,000 Assuming a discount rate of 14%, what is the net present value (rounded to the nearest whole dollar) of this investment? Selected present value factors for a single sum are shown in the table below. Multiple Choice Help {= 14% n=3 0.6750 Save & Exit Subrarrow_forwardF1arrow_forward

- A project requires a $41,000 initial investment and is expected to generate end-of-period annual cash inflows of $18,500 for each of three years. Assuming a discount rate of 13%, what is the net present value of this investment? Selected present value factors for a single sum are shown in the table below: - 138 í = 138 n=2 1-13% n=3 n 1 0.8850 0.7831 0.6931arrow_forwardStrange Manufacturing Co. is purchasing a production facility at a cost of $21 million. The firm expects the project to generate annual cash flows of $7 million annually over the next five years. Its cost of capital is 10%. What is the net present value of this project? O $5,535,507 O $6,535,507 O $6,213,909 O $890,197arrow_forwardam.401.arrow_forward

- A project requires a $3 million investment in net working capital (NWC) today, and will be fully recovered in 10 years. What is the PV of the NWC cash flows if r = 0.12 per annum? Enter answer in millions of dollars, rounded to the nearest thousandth (3rd digit), as in "1.123" million.arrow_forwardA project has annual cash flows of $6,000 for the next 10 years and then $9,000 each year for the following 10 years. The IRR of this 20-year project is 13.21%. If the firm's WACC is 12%, what is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. 69arrow_forwardNormal Manufacturing Co. is purchasing a production facility at a cost of $22.5 million. The firm expects the project to generate annual cash flows of $7 million over the next five years. What is the internal rate of return on this project? (Round the finall answer to the nearest percent.) 20% 18% O 17% O 19%arrow_forward

- 1. What is the profitability index of a project that costs $90,000 and returns $30,000 annually for 8 years if the opportunity cost of capital is 9.6%? a.0.64 b.0.80 c.1.76 d.1.05 e.1.26 2. King Corporation is planning a 15-year project with an initial investment of $2,013,000. The project will have $563,000 cash inflows per year in years 1-2; $166,000 cash inflows in years 3-10, and $57,000 cash inflows in years 11-15. Determine the project's internal rate of return (IRR). Using financial calculator a.6.87% b.5.72% c.4.58% d.10.30% e.8.24%arrow_forwardSnowflake Resorts is considering investing in a project that has a net investment of $240,000. This project will return positive net cash flows annually for the next 5 years of $80,000 per year. Snowflake Resorts requires a 12% return on all of its investments. The payback period of this investment is ________ years 5 3 4 2 The net present value of this project is $65,355 $48,384 $85,652 $57,635 The profitability index of this project is 2016 5924 7350 3852 When projects have scale differences, only the Net Present Value method will rank the projects correctly True False Fees paid to investment bankers and lawyers for issuing securities are called Component costs Issuance costs Security costs Licensing costs Purposes for considering a capital project may include which of the following Cost reductions Growth projects Government required projects All of the above When the weighted average cost of capital for a project is considered on an after tax…arrow_forwardA project that costs $2,300 to install will provide annual cash flows of $730 for each of the next 5 years. a. Calculate the NPV if the opportunity cost of capital is 12%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV b. Is this project worth pursuing? Yes O No c. What is the project's internal rate of return IRR? (Do not round intermediate calculations. Round your answer to 2 decimal places.) %24arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education