Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

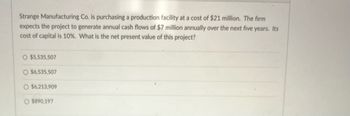

Transcribed Image Text:Strange Manufacturing Co. is purchasing a production facility at a cost of $21 million. The firm

expects the project to generate annual cash flows of $7 million annually over the next five years. Its

cost of capital is 10%. What is the net present value of this project?

O $5,535,507

O $6,535,507

O $6,213,909

O $890,197

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Blink of an Eye Company is evaluating a 5-year project that will provide cash flows of $35,700, $62,070, $62,450, $60,260, and $43,300, respectively. The project has an initial cost of $158,080 and the required return is 8.3 percent. What is the project's NPV?arrow_forwardA project’s initial cost is 13 million. The company expects a net cashflow of 10 million in year one, but the net cashflow is expected to decrease 1 million each year for the next years. If the company’s MARR is 12%, using NPW/NFW analysis is the project profitable in the first 5 years?arrow_forwardJamaica Corp. is adding a new assembly line at a cost of $6 million. The firm expects the project to generate cash flows of $1 million, $1 million, $3 million, and $4 million over the next four years. Its cost of capital is 16 percent. What is the MIRR on this project, and should the company add the new assembly line? 18.25 percent, no O 18.25 percent, yes O 21 percent, no O 21 percent, yes none of these G13arrow_forward

- You are required to investigate the following project: The initial Investment at n=0 is $100,000. The project life is 10 years. Estimated annual operating cost : 34,000. The required minimum return on the investment :14%. The salvage value 8,000. What is the minimum annual revenues that should be generated to make the project worthwhile? 97842 52758 81921 45716 O O O Oarrow_forwardWinview Clinic is evaluating a project that costs $52,125 and has expected net cash inflows of $12,000 per year for eight years. The first inflow occurs one year after the cost outflows, and the project has a cost of capital of 12%. b. What is the project's NPV? Its IRR? Its MIRR?arrow_forwardA project will produce an operating cash flow of $14,600 a year for 7 years. The initial fixed asset investment in the project will be $48,900. The net aftertax salvage value is estimated at $12,000 and will be received during the last year of the project's life. What is the net present value of the project if the required rate of return is 12 percent? Group of answer choices $22,627.54 $23,159.04 $34,627.54 $39,070.26 $41,040.83 please please solve it with a finance calculator and show your work, I know the answer but looking for some easy way to slove it by a finance calculatorarrow_forward

- BNN Corporation is currently evaluating a project that requires an initial investment of $1,000,000 with a hurdle rate of 5%. Below are the expected Cash inflow for the next five years of the project Year Cash Inflows 1 $100,000 2 200,000 3 300,000 4 400,000 5 200,000 How long will it take for BNN Corporation to recover its initial investment?arrow_forwardThe development requires investments of $100,000 today, $300,000 in 1 year from today and $200,000 in 2 years from today. Net returns for the project are expected to be $90,000 at the end of year over the next 15 years. If the company requires a rate of return of 12% compounded annually-find the NPV of the project.arrow_forwardA project requires an initial investment of $60 million and will then generate the same cash flow every year for 9 years. The project has an internal rate of return of 17% and a cost of capital of 10%. A. Compute the project's NPV (in $ million)? Round one deciamal place.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education