Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

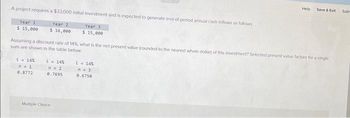

Transcribed Image Text:A project requires a $33,000 initial investment and is expected to generate end-of-period annual cash inflows as follows

Year 1

Year 2

$ 15,000 $ 16,000

i = 14%

n=1

0.8772

{ = 14%

n = 2

0.7695

Year 3

$ 15,000

Assuming a discount rate of 14%, what is the net present value (rounded to the nearest whole dollar) of this investment? Selected present value factors for a single

sum are shown in the table below.

Multiple Choice

Help

{= 14%

n=3

0.6750

Save & Exit

Subr

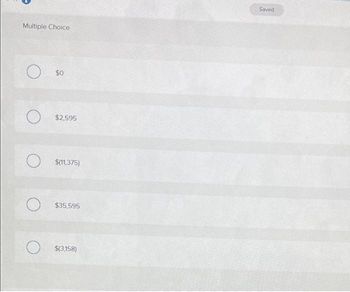

Transcribed Image Text:Multiple Choice

O

O

O

O

$0

$2,595

$(11,375)

$35,595

$(3,158)

Saved

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are evaluating an investment project, which has a cost of $161,000 today and is expected to provide after-tax annual cash flows of $20,000 for seven years. In order to compute the MIRR, you are modifying the cash flows. Assuming the cost of capital is 9.1 percent, what is the terminal cash flow of the modified cash flows? Question 12 options: $173,074 $176,474 $178,474 $180,974 $182,874 $184,574arrow_forwardA project requires a $41,000 initial investment and is expected to generate end-of-period annual cash inflows of $18,500 for each of three years. Assuming a discount rate of 13%, what is the net present value of this investment? Selected present value factors for a single sum are shown in the table below: - 138 í = 138 n=2 1-13% n=3 n 1 0.8850 0.7831 0.6931arrow_forwardMyca Corporation has a project with the following cash flows. What is the value of1. the cash flows today assuming an annual interest rate of 10 percent? Year Cash Flow 1 $1,820 2 2,300 3 2,640 4 2,650arrow_forward

- A project requires a $42,000 initial investment and is expected to generate end-of-period annual cash inflows as follows: Year 1 Year 2 $ 16,800 $ 10,400 i = 12% n = 4 0.8929 Assuming a discount rate of 12%, what is the net present value (rounded to the nearest whole dollar) of this investment? Selected present value factors for a single sum are shown in the table below: i = 12% n = 2 0.7972 Multiple Choice $0 $30,240 $(12,104) $33,826 Year 3 $ 14,800 $(8,174) Total $ 42,000 i = 12% n = 3 0.7118arrow_forwardProject L requires an initial outlay at t = 0 of $72,917, its expected cash inflows are $13,000 per year for 9 years, and its WACC is 14%. What is the project's IRR? Round your answer to two decimal places. %arrow_forwardHarrow_forward

- An investment project provides cash inflows of $740 per year for 9 years. What is the project payback period if the initial cost is $1,480? A. 2.00 years B. 2.02 years C. 1.90 years D. 1.94 years E. 2.04 years What is the project payback period if the initial cost is $4,958? A. 6.70 years B. 6.77 years C. 6.37 years D. 6.83 years E. 6.50 years What is the project payback period if the initial cost is $7,400? A. 3.01 years B. Never C. 4.95 years D. 5.25 years E. 1.35 yearsarrow_forward3) Consider the following two projects: Net Cash Flow Each Period Initial Outlay 1 2 3 4 Project A $4,000,000 $2,003,000 $2,003,000 $2,003,000 $2,003,000 Project B $4,000,000 0 0 0 $11,000,000 Calculate the net present value of each of the above projects, assuming a 14 percent discount rate. What is the internal rate of return for each of the above projects? Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above. If 14 percent is the required rate of return, and these projects are independent, what decision should be made? If 14 percent is the required rate of return, and the projects are mutually exclusive, what decision should be made?arrow_forwardunc.3arrow_forward

- Compute the payback statistic for Project A if the appropriate cost of capital is 7 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: −$2,300 $870 $870 $780 $560 $360arrow_forwardAnnual cash inflows that will arise from two competing investment projects are given below: Investment A $ 3,000 4,000 5,000 6,000 $ 18,000 Year 1 2 3 4 The discount rate is 10% Click here to view Exhibit 148 1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables Required: Compute the present value of the cash inflows for each investment Year 1234 S S Investment B $6,000 5,000 4,000 3,000 $18,000 Present Value of Cash Flows Investment A 300 300 $ Investment Barrow_forwardA new project will have an intial cost of $14,000. Cash flows from the project are expected to be $-4,000, $6,000, $8,000, and $12,000 over the next 4 years, respectively. Assuming a discount rate of 12%, what is the project's IRR? Question 5 options: 12.61% 13.14% 13.66% 13.93% 13.40%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education