Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is profit

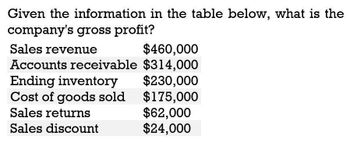

Transcribed Image Text:Given the information in the table below, what is the

company's gross profit?

Sales revenue

$460,000

Accounts receivable $314,000

Ending inventory

$230,000

Cost of goods sold

$175,000

Sales returns

$62,000

Sales discount

$24,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardThe following is select account information for Sunrise Motors. Sales: $256,400; Sales Returns and Allowances: $34,890; COGS: $120,470; Sales Discounts: $44,760. Given this information, what is the Gross Profit Margin Ratio for Sunrise Motors? (Round to the nearest whole percentage.)arrow_forwardThe following is select account information for August Sundries. Sales: $850,360; Sales Returns and Allowances: $148,550; COGS: $300,840; Operating Expenses: $45,770; Sales Discounts: $231,820. If August Sundries uses a multi-step income statement format, what is their gross margin?arrow_forward

- Kulsrud Company would like to estimate the current inventory level. Using the gross profit method and the following information, estimate the current inventory level for Kulsrud Company. Goods available for sale 100,000 Net sales 150,000 Normal gross profit as a percent of sales 40%arrow_forwardLast year, Nikkola Company had net sales of 2,299,500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average inventory. 2. Calculate the inventory turnover ratio. 3. Calculate the inventory turnover in days. 4. CONCEPTUAL CONNECTION Based on these ratios, does Nikkola appear to be performing well or poorly?arrow_forwardCost of goods sold and related items The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 20Y8: Estimated returns of current year sales 11,600 Inventory, May 1, 20Y7 380,000 Inventory, April 30, 20Y8 415,000 Purchases 3,800,000 Purchases returns and allowances 150,000 Purchases discounts 80,000 Sales 5,850,000 Freight in 16,600 a. Prepare the Cost of goods sold section of the income statement for the year ended April 30, 20Y8, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended April 30, 20Y8. c. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forward

- Given the information below, what is the gross profit? Sales revenue Accounts receivable Ending inventory Cost of goods sold Sales returns Multiple Choice $76,000 $197,000 $79,000 $106,000 $ 345,000 60,000 118,000 239,000 30,000arrow_forwardDetermining Gross Profit During the current year, merchandise is sold for $11,750,000. The cost of the goods sold is $7,050,000. a. What is the amount of the gross profit?$ b. Compute the gross profit percentage (gross profit divided by sales). Round to the nearest whole number. % c. When will the income statement report net income?arrow_forwardDetermining Gross Profit During the current year, merchandise is sold for $821,000. The cost of merchandise sold sold is $599,330. a. What is the amount of the gross profit?$ b. Compute the gross profit percentage (gross profit divided by sales). Round to the nearest whole number.% c. When will the income statement necessarily report a net income?arrow_forward

- What is Gross Profit?arrow_forwardDetermining Gross Profit During the current year, merchandise is sold for $45,870,000. The cost of the merchandise sold is $33,026,400. a. What is the amount of the gross profit? 12,843,600 b. Compute the gross profit percentage (gross profit divided by sales). % c. When will the income statement necessarily report a net income?arrow_forwardDetermining gross profit During the current year, merchandise is sold for $8, 100,000. The cost ofthe goods sold is $4,698,000. a. What is the amount of the gross profit?b. Compute the gross profit percentage (gross profit divided by sales).c. Will the income statement always report a operating income? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,