Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

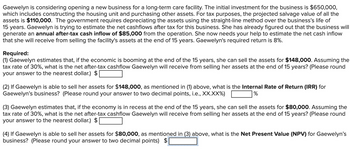

Transcribed Image Text:Gaewelyn is considering opening a new business for a long-term care facility. The initial investment for the business is $650,000,

which includes constructing the housing unit and purchasing other assets. For tax purposes, the projected salvage value of all the

assets is $110,000. The government requires depreciating the assets using the straight-line method over the business's life of

15 years. Gaewelyn is trying to estimate the net cashflows after tax for this business. She has already figured out that the business will

generate an annual after-tax cash inflow of $85,000 from the operation. She now needs your help to estimate the net cash inflow

that she will receive from selling the facility's assets at the end of 15 years. Gaewelyn's required return is 8%.

Required:

(1) Gaewelyn estimates that, if the economic is booming at the end of the 15 years, she can sell the assets for $148,000. Assuming the

tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please round

your answer to the nearest dollar.) $

(2) If Gaewelyn is able to sell her assets for $148,000, as mentioned in (1) above, what is the Internal Rate of Return (IRR) for

Gaewelyn's business? (Please round your answer to two decimal points, i.e., XX.XX%)

%

(3) Gaewelyn estimates that, if the economy is in recess at the end of the 15 years, she can sell the assets for $80,000. Assuming the

tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please round

your answer to the nearest dollar.) $

(4) If Gaewelyn is able to sell her assets for $80,000, as mentioned in (3) above, what is the Net Present Value (NPV) for Gaewelyn's

business? (Please round your answer to two decimal points) $[

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- DataPoint Engineering is considering the purchase of a new piece of equipment for $200,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $100,000 in nondepreciable working capital. $25,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Need help with subpart D-1, previously asked question and was a-c were answered. Year Amount 1 $ 173,000 2 152,000 3 108,000 4 103,000 5 89,000 6 71,000 The tax rate is 25 percent. The cost of capital must be computed based on the following: Cost(aftertax) Weights Debt Kd 5.50 % 30 % Preferred stock Kp 9.20 10…arrow_forwardAcompany is evaluating the addition of equipment to its presentoperations. They need to purchase equipment for $160,000. The five year MACRS GDS Recovery Method is appropriate forthe investment and the total tax rate (federal plus state) is 40%. Gross revenue is expected to be $30,000/year while maintenance costs are expected to be $5,000/year. It is expected that the operation will be shut down at the end of the fourth year with a salvage value of $20,000.1-Prepare a table showing your development of the ATCF's.arrow_forwardAcompany is evaluating the addition of equipment to its presentoperations. They need to purchase equipment for $160,000. The five year MACRS GDS Recovery Method is appropriate forthe investment and the total tax rate (federal plus state) is 40%. Gross revenue is expected to be $30,000/year while maintenance costs are expected to be $5,000/year. It is expected that the operation will be shut down at the end of the fourth year with a salvage value of $20,000. 2-Draw a BTCFDarrow_forward

- Galleon Industries is building a temporary manufacturing plant which will be completely removed after 5 years. The required initial cash outlays at Time 0 are as follows. Land --- $500,000New building --- 2,000,000Equipment --- 3,000,000 Galleon uses straight-line depreciation for tax purposes and will depreciate the building over 10 years and the equipment over 5 years. Galleon's effective tax rate is 40%. Revenues from the new plant are estimated at $1.5 million annually and cash expenses are estimated at $300,000 annually. At the end of the fifth year, the assumed sales values of the land and building are $700,000 and $800,000, respectively. The equipment will be removed at a cost of $80,000 and sold for $200,000. Galleon's net cash flow for period 5 would be a. $2,612,000.b. $1,040,000.c. $1,200,000d. $2,660,000.arrow_forwardAs a member of UA Corporation's financial staff, you must estimate the Year 1 cash flow for a proposed project with the following data. Under the new tax law, the equipment used in the project is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0. What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number. Sales revenues, each year $45,500 Other operating costs $22,522 Interest expense $4,000 Tax rate 25.0%arrow_forwardEmma's Bakery plans to purchase a new oven for its store. The oven has an estimated useful life of 4 years. The estimated pretax cash flows for the oven are as shown in the table that follows, with no anticipated change in working capital. Emma's Bakery has a 10% after-tax required rate of return and a 30% income tax rate. Assume depreciation is calculated on a straight-line basis for tax purposes using the initial investment in the oven and its estimated terminal disposal value. Assume all cash flows occur at year-end except for initial investment amounts. E (Click the icon to view the estimated cash flows for the oven.) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. Data Table i Requirements А В D E 1 Relevant Cash Flows at End of Each Year 1. Calculate (a) net present value, (b) payback period, and (c) internal rate of return. 2. Calculate accrual accounting rate of return based on…arrow_forward

- A Company is considering a proposal of installing a drying equipment. The equipment would involve a Cash outlay of 6,00,000 and net Working Capital of 80,000. The expected life of the project is 5 years without any salvage value. Assume that the company is allowed to charge depreciation on straight-line basis for Income-tax purpose. The estimated before-tax cash inflows are given below: Year Before-tax Cash inflows ('000) 1 2 3 4 5 240 275 210 180 160 The applicable Income-tax rate to the Company is 35%. If the Company's opportunity Cost of Capital is 12%, calculate the equipment's discounted payback period, payback period, net present value and internal rate of return. The PV factors at 12%, 14% and 15% are: Year 1 2 3 4 5 PV factor at 12% 0.8929 0.7972 0.7118 0.6355 0.5674 PV factor at 14% 0.8772 0.7695 0.6750 0.5921 0.5194 PV factor at 15% 0.8696 0.7561 0.6575 0.5718 0.4972 10-22arrow_forwardCeltic Inc. is considering a 16-year project that will generate before tax cash flow of $18,000 peryear for 16 years. The project requires a machine that costs $96,000. The CCA rate is 20% andthe salvage value is $9,600. Celtic has cash of $66,000 and needs to borrow the balance at 6%interest rate to purchase the machine. Celtic is required to repay $10,000 at year 4 and theremaining balance at year 16. The corporate tax rate is 30%.If the weighted average cost of capital is 11% and the machine is the only asset in the assetclass, calculate the NPV of the project using the WACC approach.arrow_forwardJohnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $32,000 and will be depreciated straight- line over 3 years. It will be sold for scrap metal after 5 years for $8,000. The grill will have no effect on revenues but will save Johnny's $16,000 in energy expenses. The tax rate is 30%. Required: a. What are the operating cash flows in each year? b. What are the total cash flows in each year? c. Assuming the discount rate is 12%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? Complete this question by entering your answers in the tabs below. Required A Required B Required C What are the operating cash flows in each year? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year 1 2 3 Operating Cash Flowsarrow_forward

- Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $19,000 and will be depreciated straight-line over 7 years to a salvage value of zero. The grill will have no effect on revenues, but will save Johnny's $20,000 in energy expenses. The tax rate is 31 percent. What are the operating cash flows in years 1 to 7? Enter your answer below. Numberarrow_forwardThe Kings Inn Resort purchased three delivery carts 5 years ago. The delivery carts initially cost $60,000 and are depreciated on a straight line basis over 10 years. The effective tax rate for the company is 40%. Part A: What is the net cash flow if they sell the used carts for $36,000? Part B: What are the net cash flows if they sell the used carts for $30,000? Part C: What is the net cash flow if they sell the used carts for $25,000arrow_forwardBAS Companies would like to construct and operate a new gaming facility. In addition to the capital expenditures on the facility, management estimates that the project will require an investment today of $175,000 in net working capital. The firm will recover the investment in net working capital fifteen years from today, when management anticipates closing the facility. The discount rate for this type of cash flow is 8% per year. Calculate the present value of the cost of working capital for the ice skating rink.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education