Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

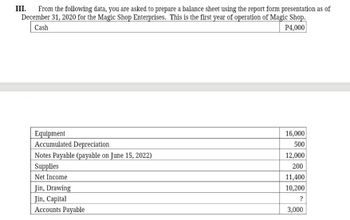

Transcribed Image Text:III. From the following data, you are asked to prepare a balance sheet using the report form presentation as of

December 31, 2020 for the Magic Shop Enterprises. This is the first year of operation of Magic Shop.

Cash

P4,000

Equipment

Accumulated Depreciation

Notes Payable (payable on June 15, 2022)

Supplies

Net Income

Jin, Drawing

Jin, Capital

Accounts Payable

16,000

500

12,000

200

11,400

10,200

?

3,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The current ratio including transaction c. is The debt ratio including transaction c is screenshots attached thank youarrow_forwardLocate Gap Inc.’s 2020 Annual Report (for fiscal year 2/2/20-1/30/21) There are 10 sections of questions. You will find the information necessary to answer the questions in “Item 8. Financial Statements and Supplementary Data,” of the report. Read through the questions carefully and answer in the space provided. What are the following amounts at 1/30/21: Total Assets : Total Liabilities: Total Owner’s Equity : At 1/30/21: What is the percentage of debt used to finance Gap? What is the percentage of owner’s equity used to finance Gap? What is the significance of these two percentages?arrow_forwardPlease, I need all work clear, in an apropiate table, showing all calculations, thank you Only typed solutionarrow_forward

- Answer the following requirements on these financial accounting questionarrow_forwardSelected financial statement information for 2018, 2019, and 2023 for End Run Corporation is presented below (amounts in millions of dollars): Accounts receivable Current assets Property, plant, and equipment (net) Total assets Current liabilities Long-term debt Sales Cost of goods sold Selling and administrative expenses Income from continuing operations Cash flow from operations Depreciation expense 2020 A. 2020 SAI B. 2020 LVGI C. 2020 TATA D. 2020 Y E. 2020 earnings manipulation probability 10508 30945 11284 68787 29417 8776 101573 92207 3931 946 4837 518 2019 3905 7438 10744 31289 6595 7223 47860 32090 3315 1063 1127 550 2018 2985 5743 10493 26213 6048 7223 33906 27772 2582 739 1863 550 For 2019 and 2020, compute the following amounts relative to Beneish's eight-factor earnings manipulation model:arrow_forwardJust Dew It Corporation reports the following balance sheet information for 2020 and 2021. Assets Current assets Cash Accounts receivable Inventory Total Total assets 2020 Net plant and equipment $240,750 $310,600 a. Current ratio b. Quick ratio c. Cash ratio d. NWC ratio e. Debt-equity ratio e. Equity multiplier f. Total debt ratio f. Long-term debt ratio $8,850 $14,200 15,750 23,000 34,650 52,200 $ 59,250 $89,400 JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets 2021 300,000 400,000 2020 times times times % times times times times Liabilities and Owners' Equity Current liabilities 2021 Accounts payable Notes payable Based on the balance sheets given for Just Dew It: a. Calculate the current ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the quick ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate the cash ratio for…arrow_forward

- Prepare the Statement of Financial Positionarrow_forwardComparative balance sheets for 2021 and 2020 and a statement of income for 2021 are given below for Metagrobolize Industries. Additional information from the accounting records of Metagrobolize also is provided. METAGROBOLIZE INDUSTRIESComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 580 $ 375 Accounts receivable 600 450 Inventory 900 525 Land 675 600 Building 900 900 Less: Accumulated depreciation (300 ) (270 ) Equipment 2,850 2,250 Less: Accumulated depreciation (525 ) (480 ) Patent 1,200 1,500 $ 6,880 $ 5,850 Liabilities Accounts payable $ 750 $ 450 Accrued liabilities 300 225 Lease liability—land 130 0 Shareholders' Equity Common stock 3,150 3,000 Paid-in capital—excess of par 750 675…arrow_forwardA comparative balance sheet for Gena Company appears below:GENA COMPANYComparative Balance SheetDec. 31, 2021 Dec. 31, 2020AssetsCash $ 34,000 $11,000Accounts receivable 21,000 13,000Inventory 35,000 17,000Prepaid expenses 6,000 9,000Long-term investments -0- 17,000Equipment 60,000 33,000Accumulated depreciation—equipment (20,000) (15,000)Total assets $136,000 $85,000Liabilities and Stockholders' EquityAccounts payable $ 17,000 $ 7,000Bonds payable 36,000 45,000Common stock 53,000 23,000Retained earnings 30,000 10,000Total liabilities and stockholders' equity $136,000 $85,000Additional information:1. Net income for the year ending December 31, 2021 was $35,000.2. Cash dividends of $15,000 were declared and paid during the year.3. Long-term investments that had a cost of $17,000 were sold for $14,000.4. Depreciation expense for the year was $5,000.InstructionsPrepare a full statement of cash flows for the year ended December 31, 2021, using the indirectmethod.arrow_forward

- Condensed balance sheet and income statement data for Jergan Corporation are presented here. Jergan CorporationBalance SheetsDecember 31 2020 2019 2018 Cash $ 30,800 $ 17,600 $ 18,700 Accounts receivable (net) 50,500 44,200 47,100 Other current assets 89,600 94,900 63,900 Investments 55,300 71,000 45,100 Plant and equipment (net) 500,500 370,000 358,500 $726,700 $597,700 $533,300 Current liabilities $85,500 $79,800 $69,400 Long-term debt 144,300 84,100 50,300 Common stock, $10 par 348,000 316,000 304,000 Retained earnings 148,900 117,800 109,600 $726,700 $597,700 $533,300 Jergan CorporationIncome StatementFor the Years Ended December 31 2020 2019 Sales revenue $738,000 $605,500 Less: Sales returns and allowances 39,100 29,900 Net sales…arrow_forwardFollowing are the current asset and current liability sections of the balance sheets for Freedom Incorporated at January 31, 2023 and 2022 (in millions): Current Assets Cash Accounts receivable Inventories Total current assets Current Liabilities Note payable Accounts payable Other accrued liabilities Total current liabilities Req A January 31, 2023 $12 8 7 $ 27 Req B and C Working capital Current ratio 4 3 $ 11 January 31, 2022 Required: a. Calculate the working capital and current ratio at each balance sheet date. b. Evaluate the firm's liquidity at each balance sheet date. c. Assume that the firm operated at a loss during the year ended January 31, 2023. How could cash have increased during the year? $ 9 11 11 $ 31 Complete this question by entering your answers in the tabs below. 1 3 01/31/2023 01/31/2022 $8 Calculate the working capital and current ratio at each balance sheet date. Note: Enter "Working capital" in millions of dollars (i.e., 10,000,000 should be entered as 10).…arrow_forwardSome selected financial statement items belonging to MNO Company are given in the table below. According to this information, which of the following is Return on Assets (ROA) in 2021? Inventory 12,500Total Assets in 2021 110,000Current Liabilities 40,000Total Assets in 2020 90,000Net Profit 12,000Shareholders' Equity 65,000 Select one:a. 0.12b. 0.10c. 0.18d. 0.13arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning