Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

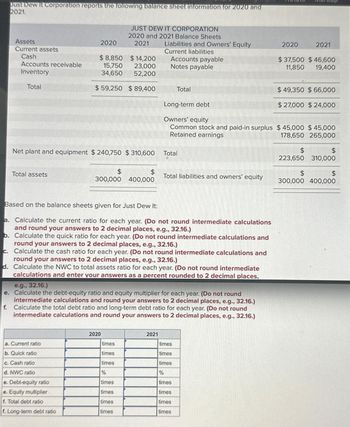

Transcribed Image Text:Just Dew It Corporation reports the following balance sheet information for 2020 and

2021.

Assets

Current assets

Cash

Accounts receivable

Inventory

Total

Total assets

2020

Net plant and equipment $240,750 $310,600

a. Current ratio

b. Quick ratio

c. Cash ratio

d. NWC ratio

e. Debt-equity ratio

e. Equity multiplier

f. Total debt ratio

f. Long-term debt ratio

$8,850 $14,200

15,750 23,000

34,650 52,200

$ 59,250 $89,400

JUST DEW IT CORPORATION

2020 and 2021 Balance Sheets

2021

300,000 400,000

2020

times

times

times

%

times

times

times

times

Liabilities and Owners' Equity

Current liabilities

2021

Accounts payable

Notes payable

Based on the balance sheets given for Just Dew It:

a. Calculate the current ratio for each year. (Do not round intermediate calculations

and round your answers to 2 decimal places, e.g., 32.16.)

b. Calculate the quick ratio for each year. (Do not round intermediate calculations and

round your answers to 2 decimal places, e.g., 32.16.)

c. Calculate the cash ratio for each year. (Do not round intermediate calculations and

round your answers to 2 decimal places, e.g., 32.16.)

d. Calculate the NWC to total assets ratio for each year. (Do not round intermediate

calculations and enter your answers as a percent rounded to 2 decimal places,

e.g., 32.16.)

e. Calculate the debt-equity ratio and equity multiplier for each year. (Do not round

intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)

Calculate the total debt ratio and long-term debt ratio for each year. (Do not round

intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)

f.

Total

Total

Total liabilities and owners' equity

times

times

times

%

times

times

times

times

2020

Long-term debt

Owners' equity

Common stock and paid-in surplus $ 45,000 $ 45,000

Retained earnings

178,650 265,000

2021

$37,500 $46,600

11,850 19,400

$ 49,350 $ 66,000

$ 27,000 $24,000

$

223,650 310,000

$

$

300,000 400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Given the data in the following table, accounts receivable in 2023 was…arrow_forwardSome recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forwardRequired: Compute the following ratios for 2020: 1. Current Ratio 2. Quick Ratio 3. Receivable Turnover 4. Average Collection Period 5. Inventory Turnover 6. Average Sales Period 7. Working Capital 8. Debt Ratio 9. Equity Ratio 10. Debt to Equity Ratio 11. Time Interest Earned 12. Gross Profit Ratio 13. Operating Profit Margin 14. Net Profit Margin 15. Return on Assetsarrow_forward

- Calculate the dividend payout ratio.arrow_forwardExamine the selected data over the 5-year period as shown in the table below for Dumbledore Ltd. Item Sales Cost of sales EBIT Interest NPAT Current assets Total assets current liabilities Total liabilities Equity Gross margin Interest coverage Current ratio 2021 $m 286.41 180.03 51.18 37.07 35.13 43.85 226.18 55.99 98.99 127.19 0.37 1.38 0.78 Year 2020 $m 280.80 166.69 51.08 33.70 35.10 43.20 221.75 53.58 91.66 130.09 0.41 1.52 0.81 2019 $m 275.29 154.35 50.98 30.64 35.06 42.56 217.40 51.27 84.87 132.53 0.44 1.66 0.89 2018 $m 269.89 142.91 50.88 27.85 35.03 41.93 213.13 49.06 78.58 134.56 0.47 1.83 U.OJ 2017 $m 264.60 134.19 49.88 25.32 34.51 41.31 206.93 47.40 74.48 132.44 0.49 1.97 0.87 2016 $m 252.00 126.00 48.90 24.00 34.00 40.70 200.90 45.80 70.60 130.30 0.50 2.04 0.89arrow_forwardFor Financial year 2021: Current ratio = Current assets / Current liabilities = 43.133 / 29.613 = 1.46 (2.d.p) Debt-to-equity = Total liabilities / Total equity = (29.613 + 25.382) / 47.069 = 1.17 (2.d.p) Return on total assets = Net profit / Average total assets = (-11.195) / 101.964 = -0.11 (2.d.p) Profit margin ratio = Net profit / Net sales = (-11.195) / 81.79 = -0.14 (2.d.p) Debt-to-asset = Total liabilities / Total assets = (29.613 + 25.382) / 101.964 = 0.54 (2.d.p) Cash flow on total assets = Net cash flow from operating activities / Average total assets = 4.717 / 101.964 = 0.05 (2.d.p) For Financial year 2022: Current ratio = Current assets / Current liabilities = 49.476 / 32.754 = 1.51 (2.d.p) Debt-to-equity = Total liabilities / Total equity = (32.754 + 27.625) / 46.732 = 1.29 (2.d.p) Return on total assets = Net profit / Average total assets = (-0.336) / 107.111 = -0.003 (3.d.p) Profit margin ratio = Net profit / Net sales = (-0.336) / 115.56 = -0.003 (3.d.p) Debt-to-asset…arrow_forward

- Return on Assets Calculate the company's return on assets for 2020 and compare the result to the industry average.arrow_forwardUsing the fiscal year end 2019 annual report for General Mills, Inc. and the figures from the 2017 annual report as noted below, calculate the financial ratios for 2019 and 2018 indicated using the EXCEL template provided: Gross profit percentage Return on sales Asset turnover Return on assets Return on common stockholders’ equity Current ratio Quick ratio Operating-cash-flow-to-current-liabilities ratio Accounts receivable turnover Average collection period Inventory turnover Days’ sales in inventory Debt-to-equity ratio Times-interest-earned ratio Operating-cash-flow-to-capital-expenditures ratio Earnings per share Price-earnings ratio Dividend yield Dividend payout ratio Total assets 2017 = $21,812.6 Total stockholders’ equity 2017 = $4,327.9 Total current liabilities 2017 = $5,330.8 Accounts receivable 2017 = $1,430.1 Inventory 2017 = $1,483.6 Year-end closing stock price May 2019 = $50.93 Year-end closing stock price May 2018 = $39.37 Perform a comparative analysis of the…arrow_forwardHello! look at the attached images and answee the following points: (a) Calculate ratios for the year ended 31 December 2021 (showing your workings) for Primrose Plc, equivalent to those provided above. Return on year-end capital employed Net asset turnover Gross profit margin Net profit margin Current ratio Closing inventory holding period Trade receivables’ collection period viii. Trade payables’ payment period Dividend yield Dividend cover (b) Analyse the financial performance and position of Primrose Plc for the year ended 31 December 2021 compared to 31 December 2020. (c) Explain the uses and the general limitations of ratio analysis. Thank you a lot!arrow_forward

- Problem 17-2A (Algo) Ratios, common-size statements, and trend percer [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity 2021 $546,242 328,838 217,404 77,566 49,162 126,728 90,676 16,866 $ 73,810 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income KORBIN COMPANY Comparative Balance Sheets December 31 2020 $ 418,466 263,634 2021 % 154,832 57,748 36,825 94,573 60, 259 12,353 $ 47,906 % $61,141 0 113,547…arrow_forwardGIVE THE COMPARATIVE BALANCE SHEET HORIZONTAL AND VERTICAL ANALYSIS FROM THE GIVEN BALANCE SHEET BELOW JOLLIBEE BALANCE SHEET ASSETS ITEM 2016 2017 2018 2019 2020 Cash & Short Term Investments 17.46B 22.52B 24.17B 23.02B 57.46B Cash & Short Term Investments Growth - 28.99% 7.32% -4.75% 149.59% Cash Only 16.73B 21.11B 23.29B 20.89B 21.36B Short-Term Investments 726M 1.41B 883.2M 2.13B 36.1B Cash & ST Investments / Total Assets 23.96% 25.08% 16.06% 12.28% 27.26% Total Accounts Receivable 3.59B 4.02B 4.86B 5.91B 7.05B Total Accounts Receivable Growth - 11.86% 21.04% 21.46% 19.36% Accounts Receivables, Net 3.03B 3.39B 4.41B 5.37B 5.8B Accounts Receivables, Gross 3.61B 4.08B 5.09B 5.76B 6.46B Bad Debt/Doubtful Accounts (579.79M) (690.12M) (676.91M) (392.36M) (658.63M) Other Receivable 562.75M 630.06M 451.73M…arrow_forwardCalculate the 2020 current ratio using the following information: Balance Sheet Cash and Cash Equivalents Marketable Securities Accounts Receivable Total Current Assets Total Assets Current Liabilities Long Term Debt Shareholders Equity Income Statement Interest Expense Net Income Before Income Taxes 1.17 0.60 1.40 0.80 2020 5,000 15,000 10,000 40,000 70,000 50,000 10,000 10,000 7,500 45,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education