FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Refer to the original data. Instead of doing the major upgrade to the equipment, management is considering introducing a new advertising campaign that will increase fixed expenses by $30,000 per month. Management believes the new advertisements will increase monthly unit sales by 10%. In this case what would be imapact on operating income.

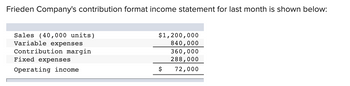

Transcribed Image Text:Frieden Company's contribution format income statement for last month is shown below:

Sales (40,000 units)

Variable expenses

$1,200,000

840,000

Contribution margin

360,000

Fixed expenses

288,000

Operating income

72,000

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A new product will cost $750,000 to design, test prototypes, and set up for production. Net revenue the first year is projected to be $225,000. Marketing is unsure whether future year revenues will (a) increase by $25,000 per year as the product’s advantages become more widely known or (b) decrease by 10% per year due to competition. A third pattern of increasing by $25,000 for one year and then decreasing by 10% per year has been suggested as being more realistic. The firm evaluates projects with a 12% interest rate, and it believes that this product will have a 5-year life. Calculate the present worth and rate of return for each scenario.arrow_forwardJordan Corporation is considering a new product that will be very popular for a couple of years and then slowly lose its commercial appeal. Sales are projected to be $90,000 in year one, $100,000 in year two, $60,000 in year three, $40,000 in year four, $20,000 in year five, and $10,000 in the final year six. Expenses are expected to be 40% of sales with net working capital requirements to be 15% of the following time period’s revenue. Equipment of $126,000 will be required for the launch of the product; this equipment can be depreciated straight-line over six years and will be worthless at the end of the project. The Tax Rate is 20% and the opportunity cost of capital is 14.5%. What is the Internal Rate of Return (rounded to two places)? Multiple Choice 32.61% None of the above 13.39% 18.32% 19.46%arrow_forwardThe ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $303,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $5.1 million, of which $900,000 of the purchase price would represent land value, and $4.2 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $540,000 per year for a term of…arrow_forward

- Beacon Company is considering automating its production facility. The initial investment in automation would be $7.52 million, and the equipment has a useful life of 6 years with a residual value of $1,100,000. The company will use straight- line depreciation. Beacon could expect a production increase of 47,000 units per year and a reduction of 20 percent in the labor cost per unit. Production and sales volume Sales revenue Variable costs Direct materials Direct labor Variable manufacturing overhead Total variable manufacturing costs Contribution margin Fixed manufacturing costs Net operating income Required: 1-a. Complete the following table showing the totals. Current (no automation) 81,000 Proposed (automation) 128,000 units units Per Unit $94 $ 17 30 9 56 $38 Total $ ? ? 1,240,000 ? Per Unit $94 $ 17 ? 9 ? $44 Total $ ? ? 2,200,000 ?arrow_forwardA manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forwardNonearrow_forward

- The Mechanical Components Division manager asks you to recommend a make/buy decision on a major automotive subassembly that is currently purchased externally for a total of $3.9 million this year. This cost is expected to continue rising at a rate of $300,000 per year. Your manager asks that both direct and indirect costs be included when in-house manufacturing (make alternative) is evaluated. New equipment will cost $3 million, have a salvage of $0.5 million and a life of 6 years. Estimates of materials, labor costs, and other direct costs are $1.5 million, per year. Typical indirect rates, bases, and expected usage are shown. Perform the AW evaluation at MARR = 12% per year over a 6-year study period. Show both hand and spreadsheet solutions. Department Basis Rate Expected Usage X Direct labor cost $2.40 per $ $450,000 Y Materials cost $0.50 per $ $850,000 Z Number of inspections $20 per inspection $4,500arrow_forwardPlease solve attached question normally, not using excel. thanks!arrow_forwardThank you for checking.arrow_forward

- Calculate the Margin Of Safety in units and in sales dollars? The President of Benoit is under pressure from shareholders to increase operating income by 50% in 2020. Management expects per unit data and total fixed costs to remain the same in 2020. Compute the number of units that would have to be sold in 2020 to reach the shareholders desired profit level. Is this a realistic goal? Assume that as a result of reorganizing the production process, the management of Benoit Manufacturing was able to reduce direct material cost per unit by $5 due to a change in the supplier of the raw material used in the production process. Variable manufacturing overhead per unit would also decrease by $3. The business is also considering paying additional annual commission of $36,400 to its sales team as part of the sales expansion effort, which should result in an increase in sales revenue. The head of the marketing department has indicated that the effort of the sales team should result in a…arrow_forwardThe plant manager of Orlando Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $275,000. The manager believes that the new investment will result in direct labor savings of $55,000 per year for 10 years. Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. What is the payback period on this project?fill in the blank 1 of 1 years b. What is the net present value, assuming a 10% rate of return? Use the table provided above. Round to the nearest whole dollar.Net present value fill in the blank 1 of 1$ c. What else should the manager consider in the analysis?arrow_forwardWhat is the reduction in Variable manufacturing costarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education