Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

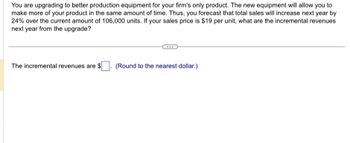

Transcribed Image Text:You are upgrading to better production equipment for your firm's only product. The new equipment will allow you to

make more of your product in the same amount of time. Thus, you forecast that total sales will increase next year by

24% over the current amount of 106,000 units. If your sales price is $19 per unit, what are the incremental revenues

next year from the upgrade?

The incremental revenues are $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.06 million per year. Your upfront setup costs to be ready to produce the part would be $7.97 million. Your discount rate for this contract is 8.1%. a. What is the IRR? b. The NPV is $5.05 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule?arrow_forwardYou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $86,000 immediately. If your cost of capital is 7.3%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? The minimum dollar amount is $. (Round to the nearest dollar)arrow_forwardA maker of mechanical systems can reduce product recalls by 25% if it purchases new packaging equipment. The cost of the new equipment is expected to be $40,000 four years from now. How much could the company afford to spend now, instead of 4 years from now, if it uses a minimum attractive rate of return of 12% per year?arrow_forward

- Your company is analyzing purchase of a machine costing $5,900 today. The investment promises to add $18,500 to sales one year from today, $14,500 two years from today, and $18,000 three years from today. Incremental cash costs should consume 75% of the incremental sales. The tax rate is 30% and the company’s financing rate is 8.2%. The investment cost is depreciated to zero over a 3-year straight-line schedule. What is the IRR for the project?arrow_forwardYou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $79,000 immediately. If your cost of capital is 7.2%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? The minimum dollar amount is $ (Round to the nearest dollar) COOarrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.02 million per year. Your upfront setup costs to be ready to produce the part would be $7.99 million. Your discount rate for this contract is 7.6%. a. What is the IRR? b. The NPV is $5.04 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.)arrow_forward

- You are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $86,000 immediately. If your cost of capital is 6.6%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV?arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.09 million per year. Your upfront setup costs to be ready to produce the part would be $7.92 million. Your discount rate for this contract is 8.3%. a. What is the IRR? b. The NPV is $5.13 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.) b. The NPV is $5.13 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? (Select from the drop-down menu.) The IRR rule with the NPV rule.arrow_forwardSuppose you were considering purchasing a $5000 machine today that would generate additional net profit of $2000 booked at the end of each year. Assuming you need a 15 percent return to justify the investment, would the investment be worth doing if you had only three years of payouts? Would your answer change if you had four years of $2000 payouts? Why or why not?arrow_forward

- A firm is considering a new inventory system that will cost $120,000. The system is expected to generate positive cash flows over the next four years in the amounts of $35,000 in year 1, $55,000 in year 2, $65,000 in year 3, and $40,000 in year 4. The firm’s required rate of return is 9%. What is the payback period of this project? 1.95 years 2.46 years 2.99 years 3.10 years Based on the information from Question 47. What is the net present value (NPV) of the project? $28,830.29 $30,929.26 $36,931.43 $39,905.28 Based on the information from Question 47, what is the internal rate of return (IRR) of this project? 14.03% 17.56% 19.26% 21.78% Based on the information from Question 47, what is the profitability index (PI) of this project? 0.87 1.11 1.31 1.83.arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.05 million per year. Your upfront setup costs to be ready to produce the part would be $7.92 million. Your discount rate for this contract is 7.5%. a. What is the IRR? b. The NPV is $5.21 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.)arrow_forwardDesk company has a product that it currently sales in the market for $50 per unit. Desk has develop in new feature that, if added to existing product, will allow Desk to receive a price of $65 per unit. The total cost of adding this new future is $44,000 and Desk expects to sell 2,800 units in the coming year. What is the net effect on the next-year's operating income of adding the feature to the product?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education