Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please give me answer general accounting

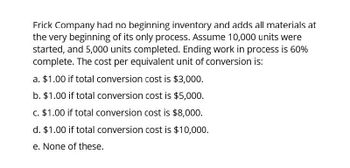

Transcribed Image Text:Frick Company had no beginning inventory and adds all materials at

the very beginning of its only process. Assume 10,000 units were

started, and 5,000 units completed. Ending work in process is 60%

complete. The cost per equivalent unit of conversion is:

a. $1.00 if total conversion cost is $3,000.

b. $1.00 if total conversion cost is $5,000.

c. $1.00 if total conversion cost is $8,000.

d. $1.00 if total conversion cost is $10,000.

e. None of these.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company has 1,500 units in ending work in process that are 30% complete after transferring out 10,000 units. All materials are added at the beginning of the process. If the cost per unit is $4 for materials and $7 for conversion, what is the cost of units transferred out and in ending work in process inventory using the weighted-average method?arrow_forwardA production department within a company received materials of $7,000 and conversion costs of $5,000 from the prior department. It added material of $78400 and conversion costs of $47000. The equivalent units are 5,000 for material and 4,000 for conversion. What is the unit cost for materials and conversion?arrow_forwardA company started a new product, and in the first month started 100,000 units. The ending work in process inventory was 20,000 units that were 100% complete with materials and 75% complete with conversion costs. There were 100,000 units to account for, and the equivalent units for materials was $6 per unit while the equivalent units for conversion was $8 per unit. What is the value of the inventory transferred out, using the weighted-average inventory method?arrow_forward

- The cost of direct materials transferred into the Rolling Department of Kraus Company is 3,000,000. The conversion cost for the period in the Rolling Department is 462,600. The total equivalent units for direct materials and conversion are 4,000 tons and 3,855 tons, respectively. Determine the direct materials and conversion costs per equivalent unit.arrow_forwardThere were 2,400 units in ending work in process inventory that were 100% complete with regard to material and 25% complete with regard to conversion costs. Ending work in process inventory had a cost of $9,000 and a per-unit material cost of $2. What was the conversion cost per unit using the weighted-average method?arrow_forwardThe packaging department began the month with 750 units that were 100% complete with regard to material and 25% complete with regard to conversion. It received 9,500 units from the processing department and ended the month with 500 units that were 100% complete with regard to materials and 75% complete with regard to conversion. With a $7 per unit material cost and a $4 per unit cost for conversion, what is the cost of the units transferred out and remaining in ending inventory?arrow_forward

- Using the weighted-average method, compute the equivalent units of production if the beginning inventory consisted of 20,000 units; 55,000 units were started in production; and 57,000 units were completed and transferred to finished goods inventory. For this process, materials are added at the beginning of the process, and the units are 35% complete with respect to conversion.arrow_forwardVexar manufactures nails. Manufacturing is a one-step process where the nails are forged. This is the information related to this years production: Â Ending inventory was 100% complete as to materials and 70% complete as to conversion, and the total materials cost is $115,080 and the total conversion cost is $72,072. Using the weighted-average method, what are the unit costs if the company transferred out 34,000 units? Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forwardThe following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- Using the weighted-average method, compute the equivalent units of production if the beginning inventory consisted of 20,000 units, 55,000 units were started in production, and 57,000 units were completed and transferred to finished goods inventory. For this process, materials are 70% complete and the Units are 30% complete with respect to conversion.arrow_forwardThe packaging department began the month with 500 units that were 100% complete with regard to material and 85% complete with regard to conversion. It received 9,500 units from the processing department and ended the month with 750 units that were 100% complete with regard to materials and 30% complete with regard to conversion. With a $5 per unit cost for conversion and a $5 per unit cost for materials, what is the cost of the units transferred out and remaining in ending inventory?arrow_forwardUsing the weighted-average method, compute the equivalent units of production for a new company that started 85,000 units into production and transferred 67,000 to the second department. Assume that beginning inventory was 0. Conversion is considered to occur evenly throughout the process, while materials are added at the beginning of the process. The ending inventory for Equivalent Units: Conversion is 9,000 units.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub