FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Solve this question. General accounting

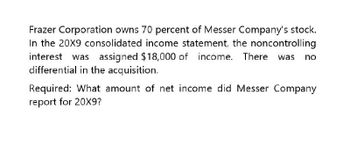

Transcribed Image Text:Frazer Corporation owns 70 percent of Messer Company's stock.

In the 20X9 consolidated income statement, the noncontrolling

interest was assigned $18,000 of income. There was no

differential in the acquisition.

Required: What amount of net income did Messer Company

report for 20X9?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The equity accounts of Jordan Company total $2,000,000. On 1/1/X1, Davidson Company purchased 60% of Jordan for $1,985,000. The fair values of net assets are equal to book values. What are goodwill and noncontrolling interests amounts?arrow_forwardGodoarrow_forwardummer Company holds assets with a fair value of $126,000 and a book value of $95,000 and liabilities with a book value and fair value of $24,000. Required: Compute the following amounts if Parade Corporation acquires 70 percent ownership of Summer: What amount did Parade pay for the shares if the fair value of the noncontrolling interest at acquisition is $45,600 and goodwill of $50,000 is reported? What balance will be assigned to the noncontrolling interest in the consolidated balance sheet if Parade pays $87,500 to acquire its ownership and goodwill of $23,000 is reported?arrow_forward

- Graham Limited acquired 90% of the share capital and reserves of Terry Limited for $170,000. Share capital was $ 100 000 and reserves amounted to $62 000. All assets and liabilities were recorded at fair value except equipment which was recorded at $30 000 below fair value. The company tax rate was 30%. The partial goodwill method is adopted by the group. The NCI share of equity at the date of acquisition was: Question 7Select one: a. $17 000 b. $19 200 c. $ 16 200 d. $18 30arrow_forwardYes Corporation reports net assets of P300,000 at book value. These net assets have an estimated fair value of P350,000. Parent Corporation buys 80% ownership of Sub for P300,000; there is a control premium of P10,000 included in the purchase price.Of the goodwill reported in the consolidated balance sheet (as of date of acquisition), how much is attributable to the non-controlling interest? 5,000 4,500 3,000 2,500arrow_forwardplease answer do not image.arrow_forward

- 1) Peter Inc. acquired 100% of the outstanding Inc. for $ Common Stock of Simran cash and shares of its own common stock ($1 par value), which was trading at $___ per share at the acquisition date. (a) Determine the Acquisition Cost. (b) Pass Journal Entry in the Book of Parent Company. [Assume your own figure in the blank spaces.].arrow_forwardOn December 31, 20X8, Paragraph Corporation acquired 80 percent of Sentence Company's common stock for $136,000. At the acquisition date, the book values and fair values of all of Sentence's assets and liabilities were equal. Paragraph uses the equity method in accounting for its investment. Balance sheet information provided by the companies at December 31, 20X8, immediately following the acquisition is as follows: Cash Accounts Receivable Inventory Fixed Assets (net) Investment in Sentence Co. Total Debits Accounts Payable Notes Payable Common Stock Retained Earnings Total Credits Assets Paragraph Corporation $ 74,000 120,000 180,000 Total Assets Liabilities and Stockholders' Equity 350,000 136,000 $860,000 Total Liabilities and Stockholders' Equity $ 65,000 350,000 150,000 295,000 $860,000 PARAGRAPH CORPORATION AND SUBSIDIARY Consolidated Balance Sheet December 31, 20X8 Required: Prepare a consolidated balance sheet for Paragraph at December 31, 20X8. Sentence Company $ 20,000…arrow_forwardProfessor Corporation acquired 70 percent of Scholar Corporation's common stock on December 31, 20X4, for $102,200. The fair value of the noncontrolling interest at that date was determined to be $43,800. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation Investment in Scholar Corporation Total Assets Accounts Payable Mortgage Payable Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Assets Cash Professor Scholar Corporation Corporation $50,300 Accounts receivable Inventory Land Buildings and equipment Less: Accumulated depreciation Investment in Scholar Corporation Total Assets Liabilities & Equity Accounts payable Mortgage payable Common stock Retained earnings NCI in Net assets of Scholar Corporation Total Liabilities & Equity 90,000 130,000 60,000 410,000 (150,000) 102,200 $ 692,500 $152,500 250,000…arrow_forward

- Please help mearrow_forwardPhelps Co. uses the sophisticated equity method to account for the 80% investment in its subsidiary Shore Corp. At the time of the acquisition, the fair values of the net asset required approximated their book values. Based upon the following information, what is consolidated net income? Phelps internally generated income: $250,000 Shore internally generated income: $ 50,000 Intercompany profit on Shore beginning inventory: $ 10,000 Intercompany profit on Shore ending inventory: $ 15,000 a. $300,000 b. $295,000 c. $286,000 d. $305,000arrow_forwardProblem Company owns 90 percent of Solution Dairy's stock. The balance sheets of the two companies immediately after the Solution acquisition showed the following amounts: Assets Cash & Receivables. Inventory Land Buildings & Equipment (net) Investment in Solution Dairy Total Assets Liabilities & Stockholders' Equity Current Payables Long-Term Liabilities Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Problem Company $ 132,000 211,000 74,000 409,000 259,200 $ 1,085,200 Solution Dairy $ 88,000 108,000 54,000 228,000 $ 478,000 $ 77,000 254,200 382,000 372,000 $ 30,000 180,000 66,000 202,000 $ 1,085,200 $ 478,000 The fair value of the noncontrolling interest at the date of acquisition was determined to be $28,800. The full amount of the increase over book value is assigned to land held by Solution. At the date of acquisition, Solution owed Problem $9,000 plus $1,100 accrued interest. Solution had recorded the accrued interest, but Problem had not Required: Prepare…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education