Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

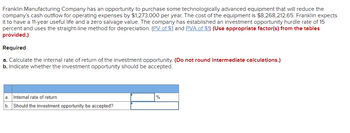

Transcribed Image Text:Franklin Manufacturing Company has an opportunity to purchase some technologically advanced equipment that will reduce the

company's cash outflow for operating expenses by $1,273,000 per year. The cost of the equipment is $8,268,212.65. Franklin expects

it to have a 11-year useful life and a zero salvage value. The company has established an investment opportunity hurdle rate of 15

percent and uses the straight-line method for depreciation. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables

provided.)

Required

a. Calculate the internal rate of return of the investment opportunity. (Do not round intermediate calculations.)

b. Indicate whether the investment opportunity should be accepted.

a Internal rate of return

b. Should the investment opportunity be accepted?

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Vaughn Company is considering a capital investment of $378,400 in additional productive facilities. The new machinery is expected to have a useful life of 6 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $18,920 and $86,000, respectively. Vaughn has an 7% cost of capital rate, which is the required rate of return on the investment. (a1) Compute the cash payback period. (Round answer to 2 decimal places, e.g. 2.25.) Your answer is correct. Cash payback period (a2) eTextbook and Media (b) Your answer is correct. Annual rate of return Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 2.25%.) eTextbook and Media 4.4 years Net present value $ 10 Attempts: 1 of 5 used % Attempts: 1 of 5 used Using the discounted cash flow technique, compute the net present value. (Round present value factor calculations to 5…arrow_forwardWalton Manufacturing Company has an opportunity to purchase some technologically advanced equipment that will reduce the company's cash outflow for operating expenses by $1,287,000 per year. The cost of the equipment is $5,187,854.53. Walton expects it to have a 9-year useful life and a zero salvage value. The company has established an investment opportunity hurdle rate of 19 percent and uses the straight-line method for depreciation. (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. W Required a. Calculate the internal rate of return of the investment opportunity. Note: Do not round intermediate calculations. b. Indicate whether the investment opportunity should be accepted. a. Internal rate of return b. Should the investment opportunity be accepted? Prev 1 of 15 「買買買 --- MacBook Air Next >arrow_forward1. Howell Petroleum is considering a new project that complements its existing business. The machine required for the project costs $3.82 million. The marketing department predicts that sales related to the project will be $2.52 million per year for the next four years, after which the firm expects to sell it for $500,000. The machine is a five-year class asset and will be depreciated down to zero over five years under the straight-line method. Cost of goods sold and operating expenses related to the project are predicted to be 25 percent of sales. Howell also needs to add net working capital of $200,000 immediately. The additional net working capital will be recovered in full at the end of the project’s life. The corporate tax rate is 35 percent. The required rate of return (or discount rate) for the project is 12.5 percent. Compute the NPV, IRR, and payback period of the project. The firm’s acceptable payback period is 3 years. Is this project acceptable to the firm?arrow_forward

- National Integrated Systems (NIS), a global provider of heating and air conditioning is planning a project whose data is provided below. The project’s equipment has a 3 year tax life after which its salvage value will be zero. The machinery will be depreciated on a straight line basis over three years. Revenues and other operating costs are expected to be constant over the project’s life. What is the project’s cash flow in Year 1? Equipment Cost = $130,000Depreciation rate = 33.33%Annual Sales Revenue= $120,000Operating Costs (ex Depreciation) = $50,000 Tax Rate = 35%arrow_forwardVaughn Company is considering a capital investment of $378,400 in additional productive facilities. The new machinery is expected to have a useful life of 6 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $18,920 and $86,000, respectively. Vaughn has an 7% cost of capital rate, which is the required rate of return on the investment. (a1) Compute the cash payback period. (Round answer to 2 decimal places, e.g. 2.25.) Your answer is correct. Cash payback period (a2) eTextbook and Media (b) Your answer is correct. Annual rate of return Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 2.25%.) eTextbook and Media Your answer is correct. 4.4 years Net present value $ 10 % Attempts: 1 of 5 used Using the discounted cash flow technique, compute the net present value. (Round present value factor calculations to…arrow_forwardPina Colada Company is considering a capital investment of $419,870 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value. Depreciation is computed by the straight-line method. During the life of the investment, annual net income and cash flows are expected to be $39,000 and $121,000, respectively. Pina Colada has a 12% cost of capital rate, which is the minimum acceptable rate of return on the investment. Click here to view PV tables. (a) Compute the annual rate of return. (Round answer to 1 decimal place, e.g. 15.5.) Annual rate of return. % Compute the cash payback period on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 15.25.) Cash payback period yearsarrow_forward

- Pique Corporation plans to purchase a new machine for $300,000. Management estimates that with the machine cash flows from sales will increase by $160,000 each year for the next 5 years. Expenses to generate the additional sales include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $70,000 per year. The firm uses straight-line depreciation with no terminal disposal value for all depreciable assets. The new machine has an expected salvage value of zero at the end of the project. Pique's combined income tax rate is 20%. Management requires a minimum after-tax rate of return of 8% on all investments.a. Calculate the Net Present Value (NPV) for this project.arrow_forwardProblem 8-08 A company had $16 of sales per share for the year that just ended. You expect the company to grow their sales at 7 percent for the next five years. After that, you expect the company to grow 4.25 percent in perpetuity. The company has a 15 percent ROE and you expect that to continue forever. The company's net margins are 5 percent and the cost of equity is 8 percent. Use the free cash flow to equity model to value this stock. Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardSunland is considering the purchase of equipment costing $147000. The equipment has a 12- year useful life, has an estimated salvage value of zero, and is expected to generate $29000 in annual cash flows. The company has a 10% required rate of return and uses the straight-line depreciation method. The accounting rate of return on this equipment is closest to 11.4%. 10.0%. 21.1%. 9.7%. O O O Oarrow_forward

- Most Company has an opportunity to invest in one of two new projects. Project Y requires a $320,000 investment for new machinery with a six-year life and no salvage value. Project Z requires a $320,000 investment for new machinery with a five-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. Project Y Project Z Sales $ 385,000 $ 308,000 Expenses Direct materials 53,900 38,500 Direct labor 77,000 46,200 Overhead including depreciation 138,600 138,600 Selling and administrative expenses 28,000 27,000 Total expenses 297,500 250,300 Pretax income 87,500 57,700 Income taxes (38%) 33,250 21,926 Net income $ 54,250 $ 35,774 Compute each project’s accounting rate of return.arrow_forwardThe Alabi corp is considering a project which requires an expenditure of $100,000 at t=0 intially, it will have additional revenue sales of $150k per year for the next to years (t=1 & t=2) with expenses of $30k per year for operating costs and general expenses attributed with the project but does not include depreciation of the intial expenditure of the $100k. The depreciation is straight line with zero salvage . Alabi weighted average cost of capital is 9.13% and taxed at 30%. What is the net present value for the project?arrow_forwardRockyford Company must replace some machinery that has zero book value and a current market value of $1,800. One possibility is to invest in new machinery costing $40,000. This new machinery would produce estimated annual pretax cash operating savings of $12,500. Assume the new machine will have a useful life of 4 years and depreciation of $10,000 each year for book and tax purposes. It will have no salvage value at the end of 4 years. The investment in this new machinery would require an additional $3,000 investment of net working capital. (Assume that when the old machine was purchased, the incremental net working capital required at the time was $0.) If Rockyford accepts this investment proposal, the disposal of the old machinery and the investment in the new one will occur on December 31 of this year. The cash flows from the investment are expected to occur over a four-year period. Rockyford is subject to a 40% income tax rate for all ordinary income and capital gains and has a 10%…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education