Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

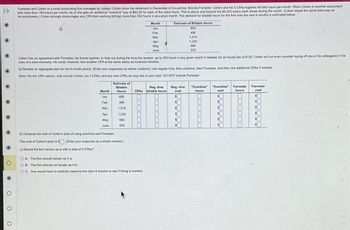

Transcribed Image Text:Forrester and Cohen is a small accounting firm managed by Joseph Cohen since the retirement in December of his partner, Brenda Forrester. Cohen and his 3 CPAs together bill 640 hours per month. When Cohen or another accountant

bills more than 160 hours per month, he or she gets an additional "overtime" pay of $62.50 for each of the extra hours. This is above and beyond the $5,000 salary each draws during the month. (Cohen draws the same base pay as

his employees.) Cohen strongly discourages any CPA from working (billing) more than 250 hours in any given month. The demand for billable hours for the firm over the next 6 months is estimated below.

Month

Jan.

Feb.

Mar

Apr.

Estimate of Billable Hours

600

490

1,010

1,220

660

570

O

May

June

Cohen has an agreement with Forrester, his former partner, to help out during the busy tax season, up to 250 hours in any given month if needed, for an hourly fee of $120. Cohen will not even consider laying off one of his colleagues in the

case of a slow economy. He could, however, hire another CPA at the same salary as business dictates.

a) Develop an aggregate plan for the 6-month period. (Enter your responses as whole numbers). Use regular time, then overtime, then Forrester, and then hire additional CPAs if needed.

O

O

Note: For the CPA column, only include Cohen, his 3 CPAs, and any new CPAs he may hire in your total. DO NOT include Forrester

Month

Estimate of

Billable

Hours

CPAs

Reg. time

billable hours

Reg. time

cost

"Overtime"

hours

Jan.

600

$

"Overtime"

cost

$

Forrester

hours

Forrester

cost

$

Feb

490

$

$

$

Mar.

1,010

$

$

$

Apr.

1,220

$

May

660

$

June

570

$

b) Compute the cost of Cohen's plan of using overtime and Forrester.

The cost of Cohen's plan is $

(Enter your response as a whole number.)

c) Should the firm remain as is with a total of 4 CPAs?

OA. The firm should remain as it is.

OB. The firm should not remain as it is.

OC. One would have to carefully examine the other 6 months to see if hiring is merited.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Similar questions

- It is January 1 of year 0, and Merck is trying to determine whether to continue development of a new drug. The following information is relevant. You can assume that all cash flows occur at the ends of the respective years. Clinical trials (the trials where the drug is tested on humans) are equally likely to be completed in year 1 or 2. There is an 80% chance that clinical trials will succeed. If these trials fail, the FDA will not allow the drug to be marketed. The cost of clinical trials is assumed to follow a triangular distribution with best case 100 million, most likely case 150 million, and worst case 250 million. Clinical trial costs are incurred at the end of the year clinical trials are completed. If clinical trials succeed, the drug will be sold for five years, earning a profit of 6 per unit sold. If clinical trials succeed, a plant will be built during the same year trials are completed. The cost of the plant is assumed to follow a triangular distribution with best case 1 billion, most likely case 1.5 billion, and worst case 2.5 billion. The plant cost will be depreciated on a straight-line basis during the five years of sales. Sales begin the year after successful clinical trials. Of course, if the clinical trials fail, there are no sales. During the first year of sales, Merck believe sales will be between 100 million and 200 million units. Sales of 140 million units are assumed to be three times as likely as sales of 120 million units, and sales of 160 million units are assumed to be twice as likely as sales of 120 million units. Merck assumes that for years 2 to 5 that the drug is on the market, the growth rate will be the same each year. The annual growth in sales will be between 5% and 15%. There is a 25% chance that the annual growth will be 7% or less, a 50% chance that it will be 9% or less, and a 75% chance that it will be 12% or less. Cash flows are discounted 15% per year, and the tax rate is 40%. Use simulation to model Mercks situation. Based on the simulation output, would you recommend that Merck continue developing? Explain your reasoning. What are the three key drivers of the projects NPV? (Hint: The way the uncertainty about the first year sales is stated suggests using the General distribution, implemented with the RISKGENERAL function. Similarly, the way the uncertainty about the annual growth rate is stated suggests using the Cumul distribution, implemented with the RISKCUMUL function. Look these functions up in @RISKs online help.)arrow_forwardAssume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.arrow_forwardA project does not necessarily have a unique IRR. (Refer to the previous problem for more information on IRR.) Show that a project with the following cash flows has two IRRs: year 1, 20; year 2, 82; year 3, 60; year 4, 2. (Note: It can be shown that if the cash flow of a project changes sign only once, the project is guaranteed to have a unique IRR.)arrow_forward

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning Foundations of Business - Standalone book (MindTa...MarketingISBN:9781285193946Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Foundations of Business - Standalone book (MindTa...MarketingISBN:9781285193946Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Foundations of Business (MindTap Course List)

Marketing

ISBN:9781337386920

Author:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:Cengage Learning

Foundations of Business - Standalone book (MindTa...

Marketing

ISBN:9781285193946

Author:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:Cengage Learning