Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

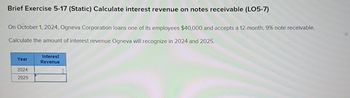

Transcribed Image Text:Brief Exercise 5-17 (Static) Calculate interest revenue on notes receivable (LO5-7)

On October 1, 2024, Ogneva Corporation loans one of its employees $40,000 and accepts a 12-month, 9% note receivable.

Calculate the amount of interest revenue Ogneva will recognize in 2024 and 2025.

Interest

Year

Revenue

2024

2025

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The difference between expected payoff under certainty and expected payoff under risk is the expected: O A. value of perfect information OB. rate of return OC. monetary value D.net present value O E. profitarrow_forwardThe buyer and seller are scheduled to close the sales transaction on Wednesday, June 14. The taxes for the year were $3,500 and were paid in arrears. How would this appear on a closing statement? O A credit and debit to the seller. O A credit to the buyer and a debit to the seller. O A credit to the seller and a debit to the buver. • A credit and debit to the buyer.arrow_forwardBUS 038 : Business Computations4. You buy goods on an invoice dated October 28, with terms of 2/20, n/45. What is the last day of the discount period? 5. You buy goods at a list price of $820. If you receive a trade discount of 25% and terms are “2/15, n/30,” what amount must you pay if you pay within the discount period? 6. You receive an invoice for $18,300 with terms of 5/15, n/60. If the supplier has a policy of allowing a cash discount for partial payments and you pay $11,500 within the discount period, calculate the amount of credit you will receive for this payment. Amount credited = Amount paid Complement of cash discount rate = $11,500arrow_forward

- Jessica's house sells for $235,000 and she pays a 6% real estate commission to the listing broker, Oscar. Oscar keeps 55% and gives the co-operating broker the balance of the sales commission. If Harry, the listing broker's agent, earns 65% of the commission that his broker receives, how much commission does Harry earn? O $5.689.25 (Dollars) O $4,124.25 (Dollars) O $5.040.75 (Dollars) O $9,165.00 (Dollars)arrow_forwardProblem 15-2 Calculating Interest [LO15-3] Calculate the annual interest and the semiannual interest payment for the following corporate bond issues with a face value of $1,000. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Annual Semiannual Annual Interest Interest Interest Rate Amount Payment 3.80% 4.50% 2.45% 3.00%arrow_forwardPLS HELP ASAParrow_forward

- Ruby obtained a loan of $90,000 towards the purchase of her new home. If the loan was 75% of the purchase price, how much did she pay for the home? O $125,000 (Dollars) O $115,000 (Dollars) O $145,000 (Dollars) O $120.000 (Dollars)arrow_forwardScenario analysis allows a firm to ask what - if type questions in capital budgeting. Question 22Select one: True Falsearrow_forwardA suburban office building in Fort Worth, Texas with 36,000 square feet was purchased for $4,500,000 at an 8% cap rate. Debt service for the first year was $305,000 of which $236,000 was interest and $69,000 was principal. Annual depreciation for tax purposes was $148,000. What was the property’s first year taxable income? a. $124,000 b. $212,000 c. - $24,000 d. $55,000arrow_forward

- On December 31, 2019, the unadjusted trial balance of Tarzwell Services showed the following balances: Accounts receivable Allowance for doubtful accounts Sales $200,000 1,000 Cr. 700,000 The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. The firm uses the allowance method to estimate bad-debt expense. Required a) Provide the entry for the write-off. b) If the firm uses the percent-of-sales allowance method for recording bad-debt expense, and has experienced an average 6% rate of non-collection based on sales, provide the entry to record bad-debt expense for 2019. c) Assume that after the firm recorded the $5,000 of write-offs, it determined that 18% of its remaining accounts receivable will be uncollectible under the aging method. Provide the entry to record bad-debt expense. Don't give answer in image formatarrow_forward3-44 CVP analysis. The Germa company produces two products, Spick and Span, on one machine. Spick and Span cannot be made simultaneously. There is no time required to adjust the machine when switching from one product to the other. One unit of Spick requires 2 machine hours to produce, whereas one unit of Span requires 4 hours. The normal occupation of the machine is 6,000 hours per year. The fixed costs of the machine are $120,000 annually. One unit of Spick needs 2 kg of material A, whereas one unit of Span requires 3 kg. The budgeted price for 1 kg of material A is $4. The sales costs consist only of fixed costs, which are budgeted at $40,000 a year. The allocated fixed sales costs per product are $20. 1. Calculate the cost per product for Spick and Span. The selling price for Spick is $70 and for Span it is $120. 2. Calculate the breakeven revenue when 50% of the units sold are Spick and 50% are Span. 3. When material shortage causes a bottleneck, which product should be produced…arrow_forwardWhen backing up the data base of the LIS, where should the backup disc/tape be stored? In the computer room in a sealed cabinet In a sperate room in the laboratory Outside the laboratory Not required.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON